A chequing account with everyday benefits

With RBC Vantage, you can enjoy additional benefits at no extra cost and with no minimum balance required when you open an eligible RBC bank account.

Unlimited Debit Transactions

Unlimited Debit Transactions

Use your account as often as you want! With unlimited debit transactions in Canada, you can buy, send, withdraw and transfer without having to keep track of your transactions.

Up to $48 rebate

on annual credit card fees

As a Signature No Limit account holder, you get up to a $48 rebate on the annual fee of an eligible credit card.9

RBC ION+ Visa

Right Account Guarantee

If you're not 100% satisfied within the first 4 months, we'll refund up to 3 months of monthly fees.legal disclaimer 10 That's our Right Account Guarantee.

Security Guarantee

Trust your money is safe. Your account is CDIC-insured for up to $100,000 and protected against unauthorized transactions with our Security Guarantee.legal disclaimer 11

Account Fees

Monthly Fee

$16.95/month

with the Value Program Rebatelegal disclaimer 13

as low as $5/month

After the Seniorslegal disclaimer 12 Rebate

$12.95/month

Save with the Value Program Rebatelegal disclaimer 13

Get more from your everyday banking when you enrol any of your eligible RBC bank accountslegal disclaimer 23 in the Value Program. The more product categories you have, the more you earn and save.

Bank Account

RBC Signature No Limit Banking

$16.95/monthlegal disclaimer 2

Your Savings and Rewards

Monthly Feelegal disclaimer 2

$16.95

after rebate*,legal disclaimer 13

*For each enrolled account, you must also complete at least 2 out of 3 regular account activities (pre-authorized payment, direct deposit or eligible bill payment) each month to receive the monthly fee rebate.

More Chequing Account Features

Avion Pointslegal disclaimer 14

Earn a minimum of 1 point per $10 spent

Once eligible account is enrolled in the Value Program

International Money Transfers

Pay no fee for U.S. and international money transferslegal disclaimer 37

Non-Sufficient Funds (NSF) Fee

1 NSF fee rebated every calendar yearlegal disclaimer 15

Personalized Chequeslegal disclaimer 16,legal disclaimer 17

1 book of cheques FREE

Afterwards fees apply

Bank Draftslegal disclaimer 18

6 FREE/year

$9.95 thereafter

Right Account Guarantee®

If you’re not completely satisfied within the first 4 months, we’ll refund your monthly fees for up to 3 months.legal disclaimer 10

Safe Deposit Boxlegal disclaimer 19

Up to $12/year discount on regular fees

Paper Statements

$2.25/monthlegal disclaimer 20 without cheque image, $2.50/monthlegal disclaimer 21 with cheque image

Using a PLUS System ATM in Canada or the U.S.legal disclaimer 7

$3 each

Using a PLUS System ATM Outside Canada or the U.S.legal disclaimer 7,legal disclaimer 22

$5 each

Not sure which chequing account is right for you?

Help Me Choose The Best Chequing Account For Me

Help Me Choose The Best Chequing Account For Me

Answer a few questions and we’ll suggest the chequing accounts that best match your needs.

Compare Chequing Account Features

Compare Chequing Account Features

See our range of accounts and compare the features that are important to you.

Speak to an Advisor

Speak to an Advisor

Book a virtual appointment with an advisor: 1-800-769-2561 (Open 24/7).

Unlock More From Your Everyday Banking

With RBC Vantage, you can unlock rewards, savings, insights and more with any eligible bank account. legal disclaimer 23 Only at RBC.

Avion Points

Now you can get rewarded for the things you do every day. Earn Avion points on your online and in-store debit purchases.legal disclaimer 14

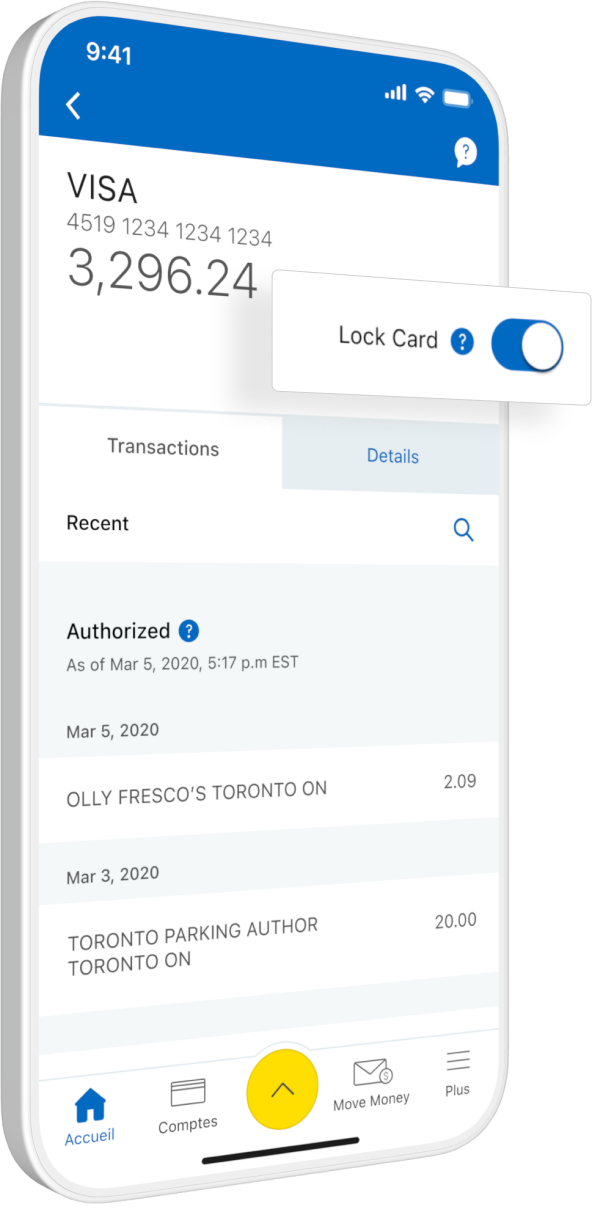

Card Lock

Easily lock a misplaced debit or credit card in the RBC Mobilelegal disclaimer 24 app. Unlock it just as fast.

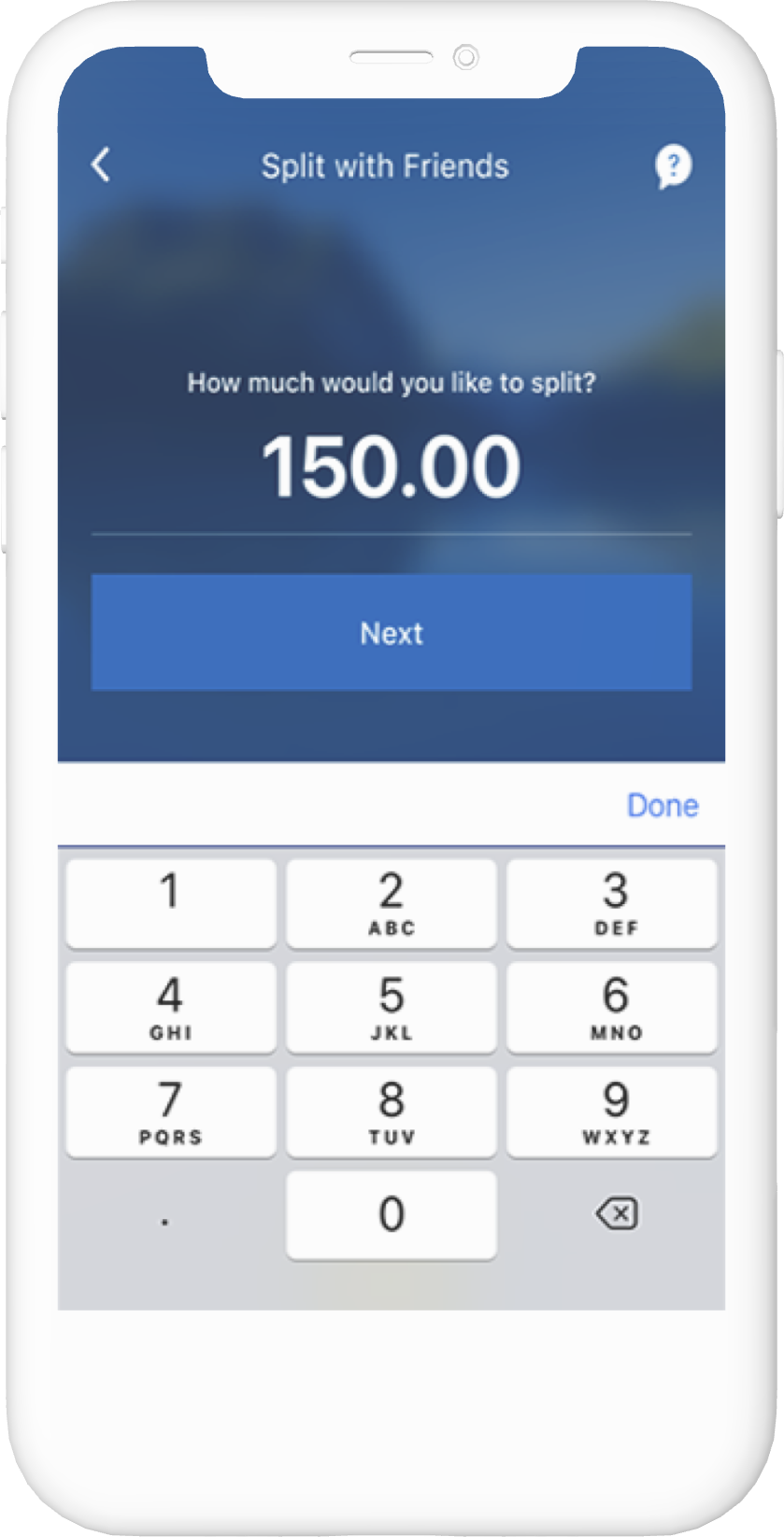

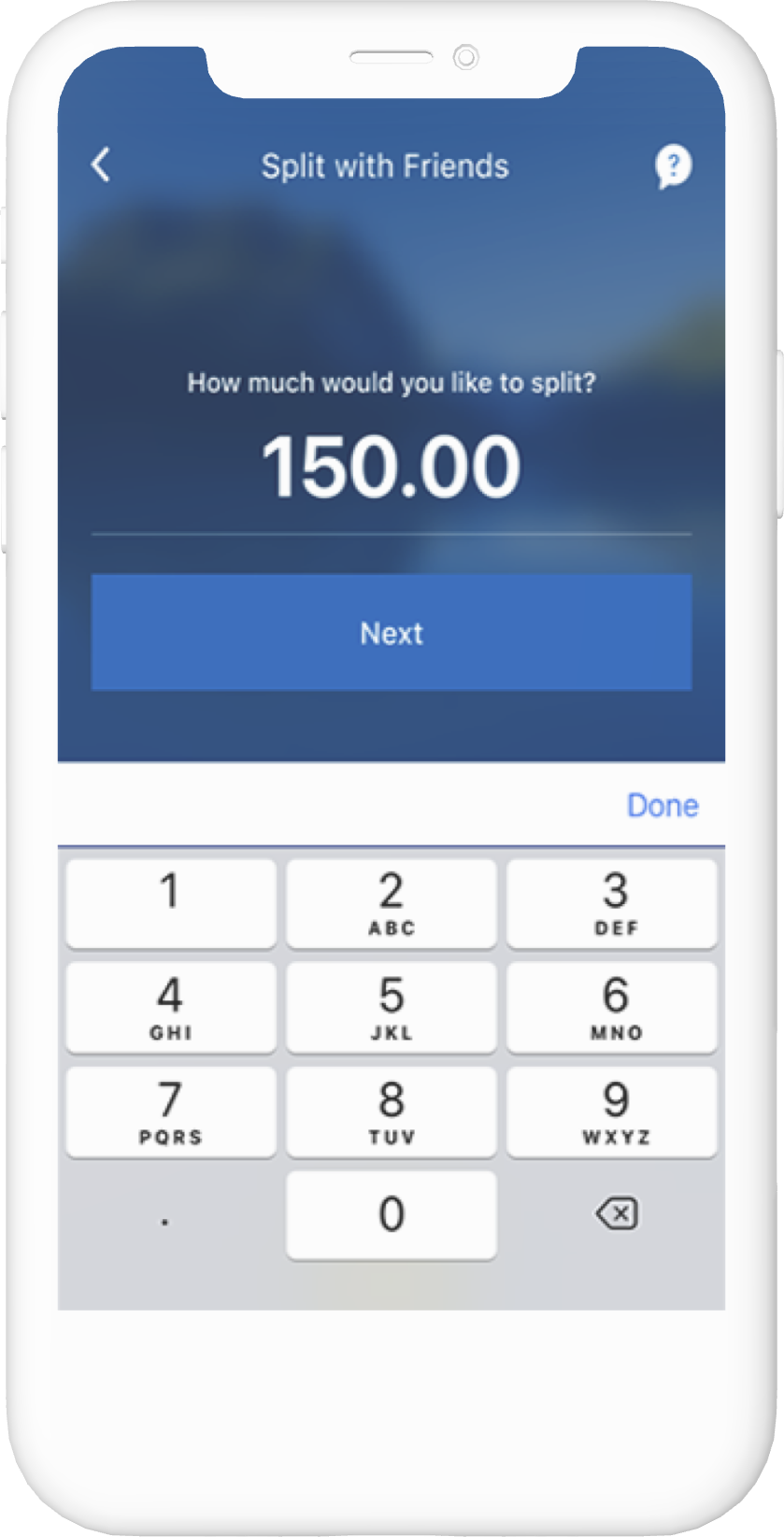

Split with Friends

A fast and simple way to manage shared expenses with your social circle.legal disclaimer 25

Unlock More From Your Everyday Banking

With RBC Vantage, you can unlock rewards, savings, insights and more with any eligible bank account. legal disclaimer 23 Only at RBC.

Avion Points

Now you can get rewarded for the things you do every day. Earn Avion points on your online and in-store debit purchases.legal disclaimer 14

Card Lock

Easily lock a misplaced debit or credit card in the RBC Mobile legal disclaimer 24 app. Unlock it just as fast.

Split with Friends

A fast and simple way to manage shared expenses with your social circle.legal disclaimer 25

Top Bank Account Questions

Top Bank Account Questions

RBC Signature No Limit Banking is a chequing account that gives you unlimited debits in Canada, valuable savings and other powerful benefits. Plus, there is no minimum balance needed to open an account.

A chequing account from RBC unlocks powerful benefits including rewards, savings, insights and more through RBC Vantage. With an RBC chequing account, you can make free Interac‡ e-Transfer transactions4,5, save 3¢/L on gas6 at Petro-Canada and more. You can also earn Avion points on debitlegal disclaimer 14 if you enrol your eligible RBC bank account in the Value Program, have other eligible RBC products and do simple activities like direct deposit13.

Explore our chequing accounts.

No, you can only receive one monthly fee rebate per bank account. For example, you cannot receive both the Value Program Rebate13 and the Seniors Rebate12 on the same account in the same month. We automatically apply to your account the highest value rebate you are eligible for each month.

If you have multiple bank accounts, you could receive a different monthly fee rebate for each account, as long as you meet the eligibility requirements to receive each of the rebates.

No, RBC Vantage isn’t a bank account—it describes all of the powerful benefits you get with any eligible RBC bank account.

RBC Royal Bank offers a variety of personal banking credit cards including:

- Cash Back

- Rewards

- Travel

- Low Interest Rate

- Student

- No Annual Fee

- Prepaid

We also have Commercial Banking and Small Business credit cards. Learn more about Personal Banking RBC Credit Cards or RBC Business Credit Cards.

You may be able to pay as low as $0 per month for RBC Day to Day Banking or RBC Advantage Banking if you enrol your account in the Value Program, you have other eligible RBC products and you do simple activities like direct depositlegal disclaimer 13. In addition, there are several other ways you may be able to pay as low as $0 per month for a chequing account at RBC. For example:

- Eligible full-time studentslegal disclaimer 30 pay $0 per month for RBC Advantage Banking for students31

- Eligible seniors12 pay $0 per month for RBC Day to Day Banking

- Eligible newcomers to Canada28 pay $0 per month for RBC Advantage Banking for one year

- RDSP beneficiarieslegal disclaimer 26 pay $0 per month for RBC Day to Day Banking

Avion Rewards gives you the opportunity to earn Avion points in many ways and the flexibility to redeem them for nearly endless options—travel the world, buy merchandise and gift cards from some of your favourite brands, pay down bills, invest in your future and much more.

There are several ways to earn points. For example, you can earn points when you make debit purchases with an eligible RBC bank accountlegal disclaimer 14 that is enrolled in the Value Program or when you make purchases with an Avion Rewards credit card.

Avion Rewards also gives you access to discounts, bonus points, special offers and savings you’ll only find at Canada’s largest bank-owned loyalty program.

Learn more about Avion Rewards.

If you are opening a new account, you can enrol it in the Value Program at the same time you open the account. If you open an account online, simply enrol in the Value Program when you are invited to do so.

If you already have an eligible bank account, an RBC advisor can enrol your account in the Value Program for you. Please book an appointment, call 1-800-769-2511 or visit a branch.

RBC Online and Mobile Banking24 maintain the highest security standards.

Every time you access your account, you’re protected with the latest security and encryption features. These, along with timed automatic logouts, ensure the safety and privacy of your personal information.

We also offer our RBC Online Banking Security Guarantee+ to protect you against unauthorized transactions.

There are some simple steps you can take to ensure the security of your information and the protection of your privacy:

- Protect your password. It's your key to accessing your accounts. Don't reveal it to anyone.

- Memorize your password. Never write it down or store it on your smartphone.

- Don’t choose passwords that include your name, telephone number, address or birthday or those of any close friend or relative.

- Never share your device passcode or leave your smartphone unattended while using the RBC Mobile app.

- Ensure that you download the app created by Royal Bank of Canada. Just to be safe, you can go to our site at www.rbcroyalbank.com/mobileapps, select your device and you will be directed to our app on the appropriate store.

Please visit our Privacy and Security page for more detailed information.

+ For a definition of an unauthorized transaction and for full details regarding the protections and limitations of the RBC Online Banking Security Guarantee, please see your Electronic Access Agreement. This guarantee is given by Royal Bank of Canada in connection with its Online Banking service.

NOMI Find & Save is a free service that makes savings simple and effortless. It's a smart, predictive and personalized savings solution that looks for pockets of money in your cash flow to automatically save.

NOMI Find & Save will move money from your source Chequing account up to three times per week. Since NOMI Find & Save understands your transaction behaviours, it will not set aside more savings than you can afford. There is no need for you to add money directly. NOMI Find & Save finds and saves the money for you. What's more, deposit interest is calculated daily and paid monthly on the balance saved and held in your NOMI Find & Save.

In addition, NOMI Find & Save identifies upcoming cheques and pre-authorized payments in excess of your source account balance and automatically moves money into the source account to avoid fees.

To enrol, simply sign in to RBC Mobile, tap "More" and then tap "Find & Save". If you are eligible, you will be presented with the Getting Started page. You will receive push notifications alerting you every time money is saved to help balance savings and day to day banking. If push notifications for your RBC Mobile app have been disabled, they can be re-enabled at any time through device settings. Alerts will also be sent to your Alerts Inbox within the RBC Mobile app.

You can access your money in NOMI Find & Save anytime by going to your NOMI Find & Save details and selecting Transfer Money. From there you will be able to transfer any amount available in NOMI Find & Save back into any eligible chequing or savings account. You can do this from within the RBC Mobile app or through RBC Online Banking.

Royal Bank of Canada may withdraw or amend this Offer at any time without notice. For full details including defined terms visit rbc.com/watchterms.

- transactions that occur after you notify us that you believe that any of your Passwords may have become known by someone, or that you noticed unusual, suspicious or fraudulent activity on any of your Accounts;

- transactions where it can be shown that you have been a victim of fraud, theft or have been coerced by trickery, force or intimidation, so long as you report the incident to us immediately and cooperate and assist us fully in any investigation;

- transactions resulting from negligent conduct by us, our employees or Third-Party Service Providers;

- Interac‡ Online Payment transactions resulting from negligent conduct by any Third Party participating in Interac‡ Online Payment; and

- any failure, error, malfunction, or technical problem of our system or equipment or that of any Third-Party Service Provider or any Third Party participating in Interac‡ Online Payment.

- you do not comply with any of your obligations under this Agreement or you do not comply with any instructions we may provide to you in connection with Digital Banking or Mobile Payments;

- you engage in any fraudulent, criminal or dishonest acts related to Digital Banking or Mobile Payments;

- you access Digital Banking or Mobile Payments via a Device that you know or reasonably should know contains software that has the ability to reveal or otherwise compromise any of your Passwords, Personal Verification Questions or an e-Transfer Question and Answer;

- you carry out the transaction, including if the transaction is a result of any mistake, error, omission, inaccuracy or other inadequacy of, or contained in any data or information that you give to us;

- you share any of your Passwords or Personal Verification Questions; class="vertical-or" or

- you consent to, contribute to or authorize a transaction in any way.