Open an Eligible RBC Chequing Account and Get the New Apple Watch Series 10legal bug 1

Offer Ends June 2, 2025. Conditions apply.

A chequing account, also known as a transaction account, is an account you use for your everyday transactions, such as withdrawing money from an ATM, depositing paycheques, paying bills, and making one-time purchases with a debit card. You can access your chequing account at an ATM, in a branch, or online on the bank website or mobile applegal disclaimer 27.

We offer a variety of chequing accounts in Canada, and knowing more about you can help us suggest the chequing account that’s right for you. Choose the button that best describes what you’re looking for.

If you're not 100% satisfied within the first 4 months, we'll refund up to 3 months of monthly fees.legal disclaimer 16 That's our Right Account Guarantee.

Trust your money is safe. Your account is CDIC-insured for up to $100,000 and protected against unauthorized transactions with our Security Guarantee.legal disclaimer 17

Answer a few questions and we’ll suggest the chequing accounts that best match your needs.

See our range of accounts and compare the features that are important to you.

Book a virtual appointment with an advisor: 1-800-769-2561 (Open 24/7).

With RBC Vantage, you can unlock rewards, savings, insights and more with any eligible bank account. legal disclaimer 18 Only at RBC.

Now you can get rewarded for the things you do every day. Earn Avion points on your online and in-store debit purchases.legal disclaimer 19

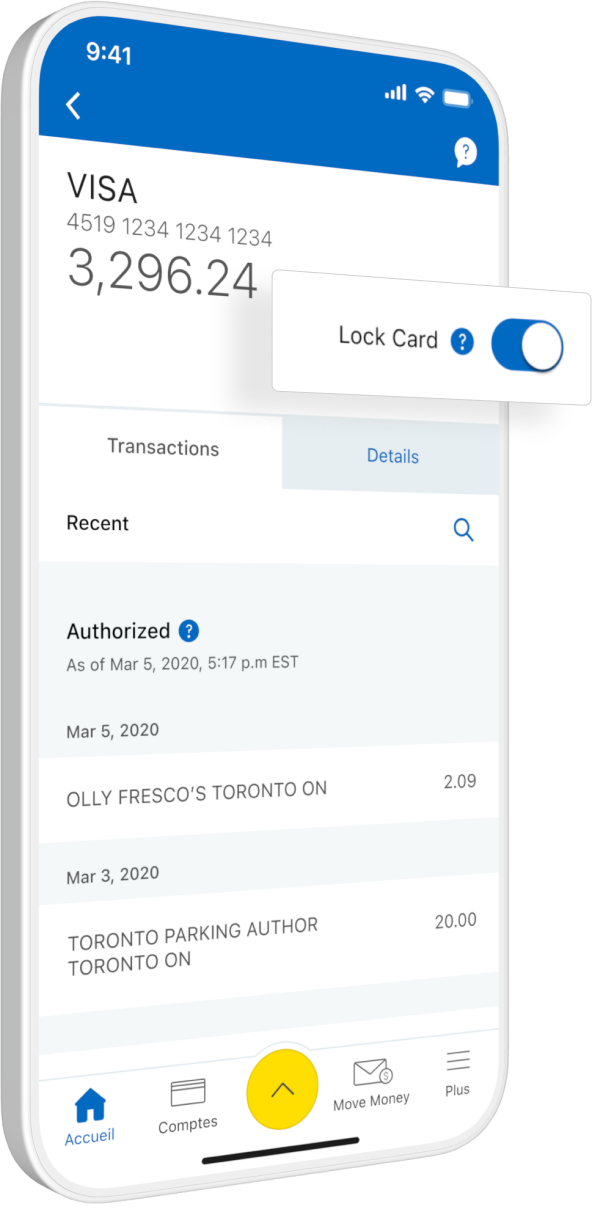

Easily lock a misplaced debit or credit card in the RBC Mobilelegal disclaimer 21app. Unlock it just as fast.

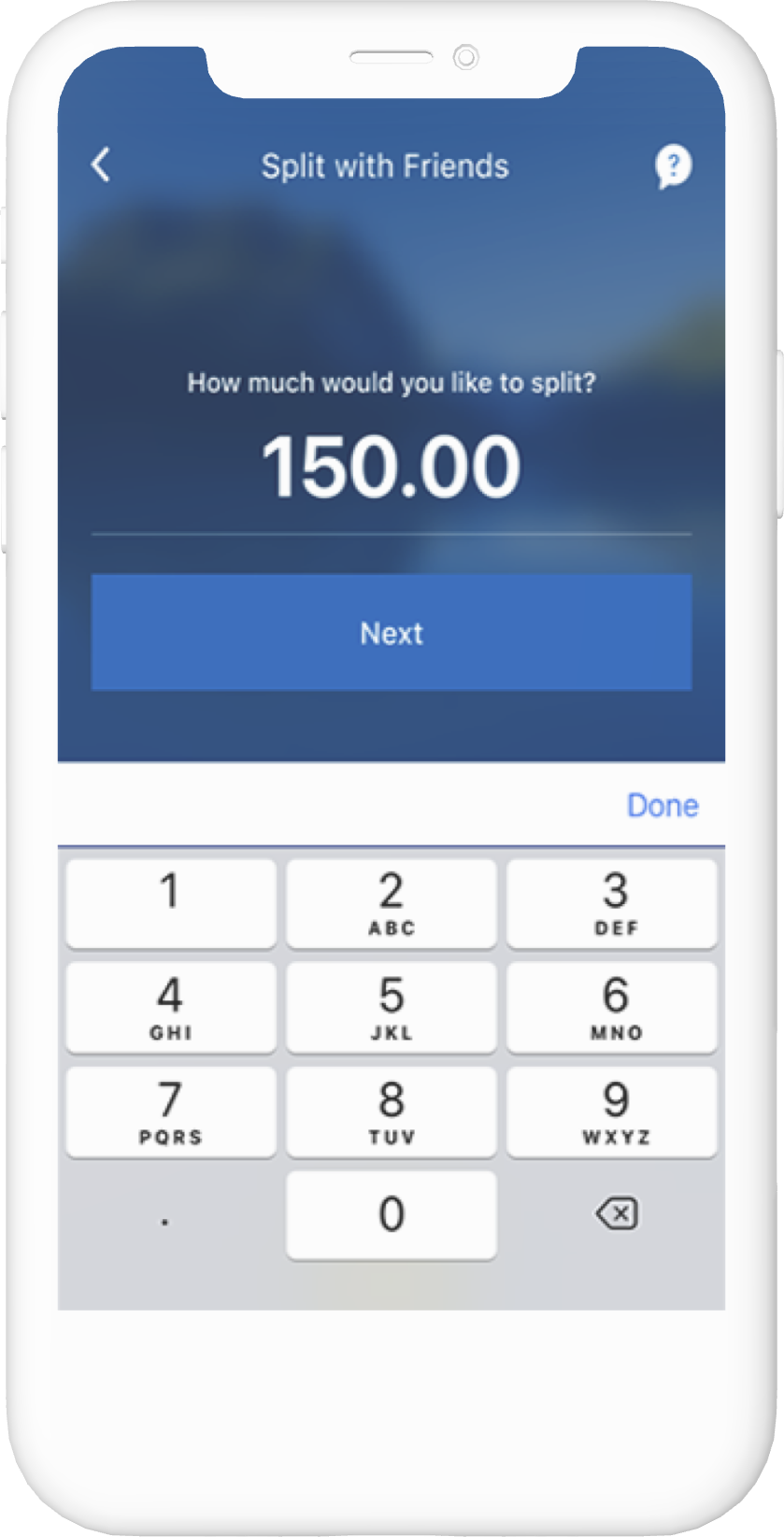

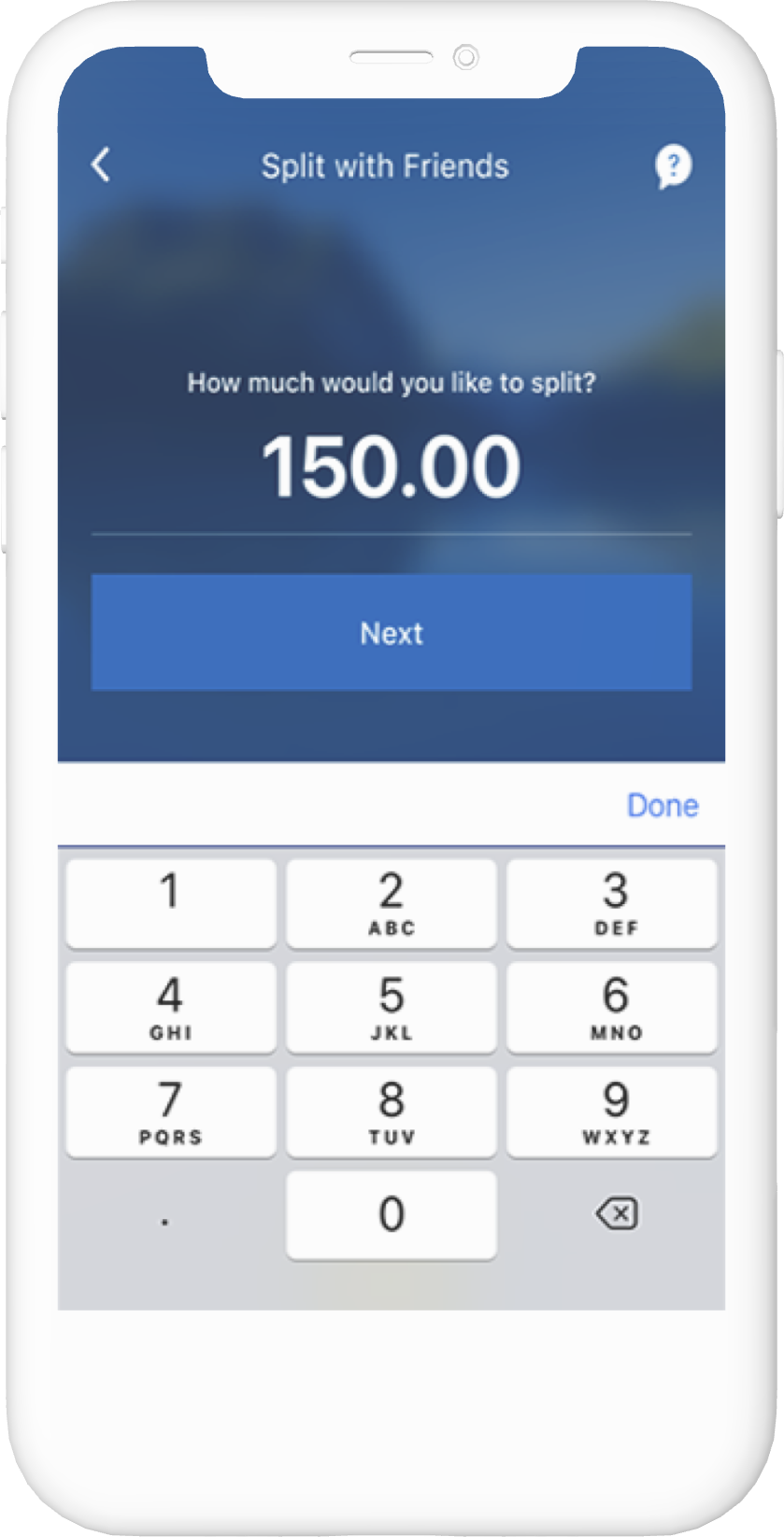

A fast and simple way to manage shared expenses with your social circle.legal disclaimer 22

With RBC Vantage, you can unlock rewards, savings, insights and more with any eligible bank account. legal disclaimer 18 Only at RBC.

Now you can get rewarded for the things you do every day. Earn Avion points on your online and in-store debit purchases.legal disclaimer 19

Easily lock a misplaced debit or credit card in the RBC Mobilelegal disclaimer 21 app. Unlock it just as fast.

A fast and simple way to manage shared expenses with your social circle.legal disclaimer 22

Keep track of the benefits you get with an eligible RBC bank account using the RBC Mobile app.legal disclaimer 21

Keep track of the benefits you get with an eligible RBC bank account using the RBC Mobile app.legal disclaimer 21

Providing a rolling forecast of your payments & deposits for the next 7 days, NOMI helps you stay on top of your money.

Providing a rolling forecast of your payments & deposits for the next 7 days, NOMI helps you stay on top of your money.

A chequing account is meant for your everyday transactions, such as withdrawing cash from an ATM, paying a bill, depositing a pay cheque, and paying for groceries. It has the advantage of providing easy access to your money. You typically earn no or low interest on the money you store in a chequing account.

A savings account is where you can set aside money for your short-term and long-term financial goals, such as saving for a trip, a wedding, or buying a house. You can also use it to build up an emergency fund for unexpected expenses like car repairs. Savings accounts typically earn a higher interest on your money compared to Chequing accounts, meaning you can use them to grow your money over time. For that reason, they’re not usually used for everyday expense like paying bills.

RBC Vantage is the way we describe all of the powerful benefits you can get just by having an eligible RBC bank account. There is no additional cost to enjoy these benefits—and you don’t need a minimum balance.

Here are just a few ways you can take advantage of these benefits:

The following RBC bank accounts are eligible to be enrolled in the Value Program:

Learn more about the Value Program or explore bank accounts now.

No, you can only receive one monthly fee rebate per bank account. For example, you cannot receive both the Value Program Rebate10 and the Seniors Rebate2 on the same account in the same month. We automatically apply to your account the highest value rebate you are eligible for each month.

If you have multiple bank accounts, you could receive a different monthly fee rebate for each account, as long as you meet the eligibility requirements to receive each of the rebates.

Whether you bank or invest through the RBC Royal Bank Online Banking service, or the RBC Mobile app, you're covered by an Online Banking Security Guarantee. If an unauthorized transaction is conducted through your RBC Royal Bank, RBC Direct Investing or RBC Dominion Securities accounts on RBC Mobile, you'll be reimbursed 100% for any resulting losses to those accounts.

For a definition of an unauthorized transaction and for full details regarding the protections and limitations of the RBC Online Banking Security Guarantee, please see your Electronic Access Agreement. This guarantee is given by Royal Bank of Canada in connection with its Online Banking service.

Avion Rewards gives you the opportunity to earn Avion points in many ways and the flexibility to redeem them for nearly endless options—travel the world, buy merchandise and gift cards from some of your favourite brands, pay down bills, invest in your future and much more.

There are several ways to earn points. For example, you can earn points when you make debit purchases with an eligible RBC bank accountlegal disclaimer 19 that is enrolled in the Value Program or when you make purchases with an Avion Rewards credit card.

Avion Rewards also gives you access to discounts, bonus points, special offers and savings you’ll only find at Canada’s largest bank-owned loyalty program.

Learn more about Avion Rewards.

Yes. To deposit a cheque in RBC Mobile, simply:

Offers is our way of helping you do more when you choose to pay with your RBC Royal Bank personal or business chequing account or credit card. It allows you to take advantage of a wide range of offers to help you save money and earn bonus Avion points on your shopping, travel, dining and more.

Simply sign in to RBC Royal Bank Online Banking and from the top of your Accounts Summary page, select the Offers for You link to browse your offers. You can also get your offers from the Avion Rewards app.

RBC Royal Bank personal and business savings accounts are not eligible at this time.

Get more from your everyday banking when you enrol any of your eligible RBC bank accountslegal bug 4 in the Value Program. The more product categories you have, the more you earn and save.

Bank Account

$16.95/monthlegal bug 2

Your Savings and Rewards

after rebate*, legal bug 1

*For each enrolled account, you must also complete at least 2 out of 3 regular account activities (pre-authorized payment, direct deposit or eligible bill payment) each month to receive the monthly fee rebate.

By enrolling an eligible RBC personal bank account into the RBC Value Program, holding eligible additional RBC products (“Product Categories”, as more particularly described below), and completing certain activities from your enrolled account each month (as more particularly described below), you may be entitled to receive a partial or full rebate of your enrolled account’s standard Monthly Fee. Eligible Product Categories include RBC personal credit cards, personal investments, residential mortgages, and linked small business relationships. Multiple products in a single Product Category will be considered one Product Category. In addition to having eligible Product Categories, you must also perform any two (2) or more of the following specified account activities in the previous calendar month to or from your enrolled account: a monthly direct deposit, a monthly pre-authorized payment, or an eligible bill payment made at minimum once per month. An eligible bill payment means a bill payment completed through either RBC Online Banking, the RBC Mobile app, using an RBC ATM, or using Telephone Banking Services, and excludes any bill payment made: (i) in-person at an RBC Royal Bank branch with an RBC Advisor, (ii) to an RBC credit card account, or (iii) using an RBC Virtual Visa Debit® associated with your Enrolled Account. Conditions apply. For complete details, please see the Value Program Terms & Conditions.

The Monthly Fee is charged on the last day of the Month of your Account’s monthly cycle. If the last day is a non-Business Day, the fee is charged the previous Business Day. However, if the last day of your Account’s Monthly Cycle is a non-Business Day and falls at the beginning of the calendar month, then the Monthly Fee is collected the next Business Day.

When you enrol your eligible RBC personal bank account into the RBC Value Program, you will be eligible to earn Avion points within the Avion Rewards Program as an Eligible Personal Banking Client, and any such points earned will be deposited into the Avion Rewards account tied to your enrolled account. Purchases from your account refers to using your RBC Client Card to pay for items at a merchant or service provider with the amount electronically debited directly from your enrolled account or using your RBC Virtual Visa Debit for purchases online. Avion points are governed by the Avion Rewards Terms and Conditions available on our website, or a copy may be provided to you by contacting us. For complete details on the Value Program, please see the Value Program Terms & Conditions.

The following RBC bank accounts are eligible for the Value Program: RBC Day to Day Banking, RBC Advantage Banking (includes RBC Advantage Banking for students), RBC Signature No Limit Banking, RBC VIP Banking, RBC No Limit Banking (discontinued), RBC Student Banking (discontinued), RBC No Limit Banking for Students (discontinued), RBC Day to Day Savings, RBC Enhanced Savings and RBC High Interest eSavings.

Get more from your everyday banking when you enrol any of your eligible RBC bank accountslegal bug 4 in the Value Program. The more product categories you have, the more you earn and save.

Bank Account

$11.95/monthlegal bug 2

Your Savings and Rewards

after rebate*, legal bug 1

*For each enrolled account, you must also complete at least 2 out of 3 regular account activities (pre-authorized payment, direct deposit or eligible bill payment) each month to receive the monthly fee rebate.

By enrolling an eligible RBC personal bank account into the RBC Value Program, holding eligible additional RBC products (“Product Categories”, as more particularly described below), and completing certain activities from your enrolled account each month (as more particularly described below), you may be entitled to receive a partial or full rebate of your enrolled account’s standard Monthly Fee. Eligible Product Categories include RBC personal credit cards, personal investments, residential mortgages, and linked small business relationships. Multiple products in a single Product Category will be considered one Product Category. In addition to having eligible Product Categories, you must also perform any two (2) or more of the following specified account activities in the previous calendar month to or from your enrolled account: a monthly direct deposit, a monthly pre-authorized payment, or an eligible bill payment made at minimum once per month. An eligible bill payment means a bill payment completed through either RBC Online Banking, the RBC Mobile app, using an RBC ATM, or using Telephone Banking Services, and excludes any bill payment made: (i) in-person at an RBC Royal Bank branch with an RBC Advisor, (ii) to an RBC credit card account, or (iii) using an RBC Virtual Visa Debit® associated with your Enrolled Account. Conditions apply. For complete details, please see the Value Program Terms & Conditions.

The Monthly Fee is charged on the last day of the Month of your Account’s monthly cycle. If the last day is a non-Business Day, the fee is charged the previous Business Day. However, if the last day of your Account’s Monthly Cycle is a non-Business Day and falls at the beginning of the calendar month, then the Monthly Fee is collected the next Business Day.

When you enrol your eligible RBC personal bank account into the RBC Value Program, you will be eligible to earn Avion points within the Avion Rewards Program as an Eligible Personal Banking Client, and any such points earned will be deposited into the Avion Rewards account tied to your enrolled account. Purchases from your account refers to using your RBC Client Card to pay for items at a merchant or service provider with the amount electronically debited directly from your enrolled account or using your RBC Virtual Visa Debit for purchases online. Avion points are governed by the Avion Rewards Terms and Conditions available on our website, or a copy may be provided to you by contacting us. For complete details on the Value Program, please see the Value Program Terms & Conditions.

The following RBC bank accounts are eligible for the Value Program: RBC Day to Day Banking, RBC Advantage Banking (includes RBC Advantage Banking for students), RBC Signature No Limit Banking, RBC VIP Banking, RBC No Limit Banking (discontinued), RBC Student Banking (discontinued), RBC No Limit Banking for Students (discontinued), RBC Day to Day Savings, RBC Enhanced Savings and RBC High Interest eSavings.

Get more from your everyday banking when you enrol any of your eligible RBC bank accountslegal bug 4 in the Value Program. The more product categories you have, the more you earn and save.

Bank Account

$30/monthlegal bug 2

Your Savings and Rewards

after rebate*, legal bug 1

*For each enrolled account, you must also complete at least 2 out of 3 regular account activities (pre-authorized payment, direct deposit or eligible bill payment) each month to receive the monthly fee rebate.

By enrolling an eligible RBC personal bank account into the RBC Value Program, holding eligible additional RBC products (“Product Categories”, as more particularly described below), and completing certain activities from your enrolled account each month (as more particularly described below), you may be entitled to receive a partial or full rebate of your enrolled account’s standard Monthly Fee. Eligible Product Categories include RBC personal credit cards, personal investments, residential mortgages, and linked small business relationships. Multiple products in a single Product Category will be considered one Product Category. In addition to having eligible Product Categories, you must also perform any two (2) or more of the following specified account activities in the previous calendar month to or from your enrolled account: a monthly direct deposit, a monthly pre-authorized payment, or an eligible bill payment made at minimum once per month. An eligible bill payment means a bill payment completed through either RBC Online Banking, the RBC Mobile app, using an RBC ATM, or using Telephone Banking Services, and excludes any bill payment made: (i) in-person at an RBC Royal Bank branch with an RBC Advisor, (ii) to an RBC credit card account, or (iii) using an RBC Virtual Visa Debit® associated with your Enrolled Account. Conditions apply. For complete details, please see the Value Program Terms & Conditions.

The Monthly Fee is charged on the last day of the Month of your Account’s monthly cycle. If the last day is a non-Business Day, the fee is charged the previous Business Day. However, if the last day of your Account’s Monthly Cycle is a non-Business Day and falls at the beginning of the calendar month, then the Monthly Fee is collected the next Business Day.

When you enrol your eligible RBC personal bank account into the RBC Value Program, you will be eligible to earn Avion points within the Avion Rewards Program as an Eligible Personal Banking Client, and any such points earned will be deposited into the Avion Rewards account tied to your enrolled account. Purchases from your account refers to using your RBC Client Card to pay for items at a merchant or service provider with the amount electronically debited directly from your enrolled account or using your RBC Virtual Visa Debit for purchases online. Avion points are governed by the Avion Rewards Terms and Conditions available on our website, or a copy may be provided to you by contacting us. For complete details on the Value Program, please see the Value Program Terms & Conditions.

The following RBC bank accounts are eligible for the Value Program: RBC Day to Day Banking, RBC Advantage Banking (includes RBC Advantage Banking for students), RBC Signature No Limit Banking, RBC VIP Banking, RBC No Limit Banking (discontinued), RBC Student Banking (discontinued), RBC No Limit Banking for Students (discontinued), RBC Day to Day Savings, RBC Enhanced Savings and RBC High Interest eSavings.

Get more from your everyday banking when you enrol any of your eligible RBC bank accountslegal bug 4 in the Value Program. The more product categories you have, the more you earn and save.

Bank Account

$4/monthlegal bug 2

Your Savings and Rewards

after rebate*, legal bug 1

*For each enrolled account, you must also complete at least 2 out of 3 regular account activities (pre-authorized payment, direct deposit or eligible bill payment) each month to receive the monthly fee rebate.

By enrolling an eligible RBC personal bank account into the RBC Value Program, holding eligible additional RBC products (“Product Categories”, as more particularly described below), and completing certain activities from your enrolled account each month (as more particularly described below), you may be entitled to receive a partial or full rebate of your enrolled account’s standard Monthly Fee. Eligible Product Categories include RBC personal credit cards, personal investments, residential mortgages, and linked small business relationships. Multiple products in a single Product Category will be considered one Product Category. In addition to having eligible Product Categories, you must also perform any two (2) or more of the following specified account activities in the previous calendar month to or from your enrolled account: a monthly direct deposit, a monthly pre-authorized payment, or an eligible bill payment made at minimum once per month. An eligible bill payment means a bill payment completed through either RBC Online Banking, the RBC Mobile app, using an RBC ATM, or using Telephone Banking Services, and excludes any bill payment made: (i) in-person at an RBC Royal Bank branch with an RBC Advisor, (ii) to an RBC credit card account, or (iii) using an RBC Virtual Visa Debit® associated with your Enrolled Account. Conditions apply. For complete details, please see the Value Program Terms & Conditions.

The Monthly Fee is charged on the last day of the Month of your Account’s monthly cycle. If the last day is a non-Business Day, the fee is charged the previous Business Day. However, if the last day of your Account’s Monthly Cycle is a non-Business Day and falls at the beginning of the calendar month, then the Monthly Fee is collected the next Business Day.

When you enrol your eligible RBC personal bank account into the RBC Value Program, you will be eligible to earn Avion points within the Avion Rewards Program as an Eligible Personal Banking Client, and any such points earned will be deposited into the Avion Rewards account tied to your enrolled account. Purchases from your account refers to using your RBC Client Card to pay for items at a merchant or service provider with the amount electronically debited directly from your enrolled account or using your RBC Virtual Visa Debit for purchases online. Avion points are governed by the Avion Rewards Terms and Conditions available on our website, or a copy may be provided to you by contacting us. For complete details on the Value Program, please see the Value Program Terms & Conditions.

The following RBC bank accounts are eligible for the Value Program: RBC Day to Day Banking, RBC Advantage Banking (includes RBC Advantage Banking for students), RBC Signature No Limit Banking, RBC VIP Banking, RBC No Limit Banking (discontinued), RBC Student Banking (discontinued), RBC No Limit Banking for Students (discontinued), RBC Day to Day Savings, RBC Enhanced Savings and RBC High Interest eSavings.