Two Great Chequing Accounts to Choose from

Enjoy a range of features and benefits, plus take advantage of our new bank account offer.

Everyday Benefits Included

with All RBC Canadian Chequing Accounts

RBC Right Account Guarantee

We will refund up to 3 months of account fees if you are not satisfied with your new account.24

J.D. Power 2024 Winner

RBC Ranks #1 in the J.D. Power 2024 Canada Online Banking Satisfaction Study.

RBC Right Account Guarantee

We will refund up to 3 months of account fees if you are not satisfied with your new account.24

J.D. Power 2024 Winner

RBC Ranks #1 in the J.D. Power 2024 Canada Online Banking Satisfaction Study.

How to get your Apple Watch Offer

Open an eligible RBC bank account1 by June 2, 2025.

Set up and complete two of the following by August 11, 2025:

Your payroll or pension as a direct deposit

Two pre-authorized monthly payments (PAPs)

Two bill payments to a service provider

Top Questions About Bank Account Offers

Please go to rbc.com/watchterms

Shortly after February 25, 2025 or after you complete the Qualifying Criteria (whichever is later), you will receive an email from RBC to the email address you have provided to us on account opening with a link to a secure website where you can select your device and confirm your shipment details. When selecting your device, the website will provide you with an estimated delivery time which will vary based on your selection.

Your Eligible Personal Banking Account must remain open and in good standing, and the Qualifying Criteria you performed to get the Apple Watch Reward (such as payroll/pension deposit, bill payment or pre-authorized payment) must remain in effect until at least June 2, 2026.

Switching to RBC from another bank is easy! Simply call 1-800-769-2561, visit a branch or choose your bank account and apply online. Please note that your account will need to be fully open before you can transfer money or pre-authorized payments from another financial institution to RBC.

RBC is one of Canada’s largest banks (as measured by market capitalization) and most trusted brands. We’re a proud member of Canada Deposit Insurance Corporation (CDIC) and offer a range of bank accounts, credit cards, loans, mortgages, investments and more to fit your needs.

A chequing account is meant for your everyday transactions, such as withdrawing cash from an ATM, paying a bill, depositing a paycheque, and paying for groceries. It has the advantage of providing easy access to your money.

Other Resources

RBC newcomers advantage provides no monthly fee banking solutions and other benefits

Answer a few questions to find the right RBC account for you

RBC Account Selector Tool

RBC newcomers advantage provides no monthly fee banking solutions and other benefits

RBC students accounts provides no monthly fee banking solutions and other benefits

Need More Help?

(Open 24/7)

Royal Bank of Canada may withdraw or amend this Offer at any time without notice. For full details including defined terms visit rbc.com/watchterms.

When you enrol your eligible RBC personal bank account into the RBC Value Program, you will be eligible to earn Avion points within the Avion Rewards Program as an Eligible Personal Banking Client, and any such points earned will be deposited into the Avion Rewards account tied to your enrolled account. Purchases from your account refers to using your RBC Client Card to pay for items at a merchant or service provider with the amount electronically debited directly from your enrolled account or using your RBC Virtual Visa Debit for purchases online. Avion points are governed by the Avion Rewards Terms and Conditions available on our website, or a copy may be provided to you by contacting us. For complete details on the Value Program, please see the Value Program Terms & Conditions.

By enrolling an eligible RBC personal bank account into the RBC Value Program, holding eligible additional RBC products (“Product Categories”, as more particularly described below), and completing certain activities from your enrolled account each month (as more particularly described below), you may be entitled to receive a partial or full rebate of your enrolled account’s standard Monthly Fee. Eligible Product Categories include RBC personal credit cards, personal investments, residential mortgages, and linked small business relationships. Multiple products in a single Product Category will be considered one Product Category. In addition to having eligible Product Categories, you must also perform any two (2) or more of the following specified account activities in the previous calendar month to or from your enrolled account: a monthly direct deposit, a monthly pre-authorized payment, or an eligible bill payment made at minimum once per month. An eligible bill payment means a bill payment completed through either RBC Online Banking, the RBC Mobile app, using an RBC ATM, or using Telephone Banking Services, and excludes any bill payment made: (i) in-person at an RBC Royal Bank branch with an RBC Advisor, (ii) to an RBC credit card account, or (iii) using an RBC Virtual Visa Debit® associated with your Enrolled Account. Conditions apply. For complete details, please see the Value Program Terms & Conditions.

To participate in this offer, you must have an RBC debit or credit card which is issued by Royal Bank of Canada (excluding RBC commercial credit cards) (“RBC Card”). RBC business clients will only be able to link up to two (2) business credit cards and one business debit card to a Petro-Points card. You must be enrolled in RBC Online Banking or the RBC Mobile app in order to link your RBC Card to your Petro-Points card. Card linking may take up to 2 business days to process before savings and bonus points can be applied to purchases. A linked RBC Card means an RBC Card linked to a Petro-Points Account. Your linked RBC Card acts as your Petro-Points card. You will automatically earn Petro-Points when you pay for qualifying purchases with your linked RBC Card at Petro-Canada locations and you do not need to swipe your Petro-Points card before you pay. You can redeem your Petro-Points at Petro-Canada using your linked RBC Card. Each time you use your linked RBC Card to purchase any grade of gasoline, or diesel, at a Petro-Canada location, you will save three cents ($0.03) per litre at the time of the transaction.

The following RBC bank accounts are eligible for the Value Program: RBC Day to Day Banking, RBC Advantage Banking (includes RBC Advantage Banking for students), RBC Signature No Limit Banking, RBC VIP Banking, RBC No Limit Banking (discontinued), RBC Student Banking (discontinued), RBC No Limit Banking for Students (discontinued), RBC Day to Day Savings, RBC Enhanced Savings and RBC High Interest eSavings.

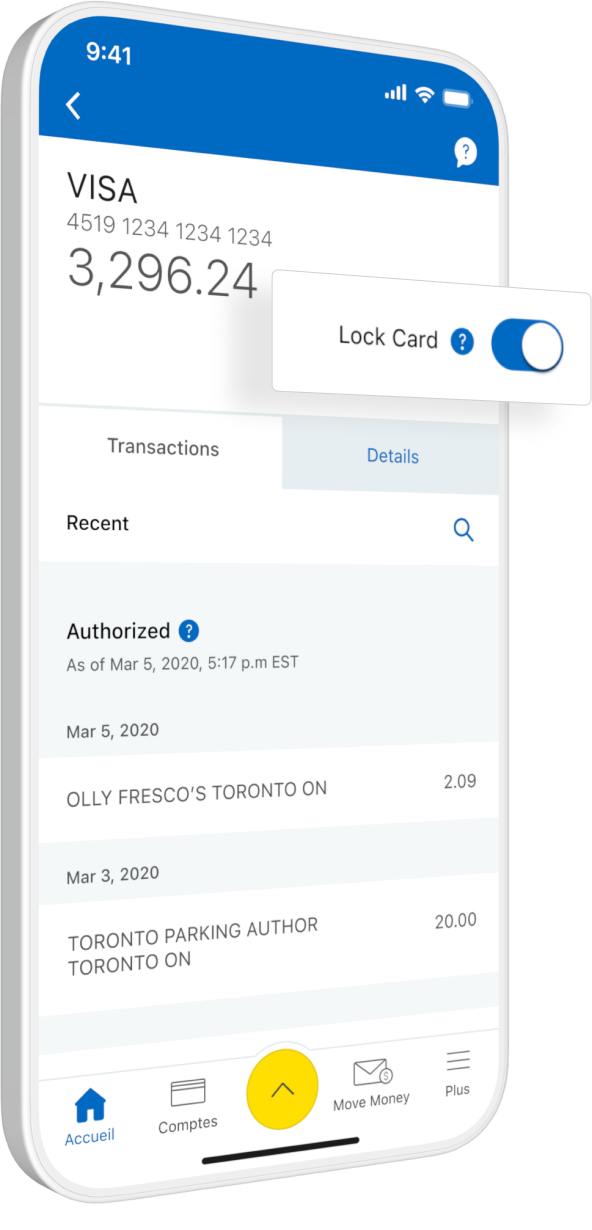

RBC Mobile is operated by Royal Bank of Canada, RBC Direct Investing Inc. and RBC Dominion Securities Inc.

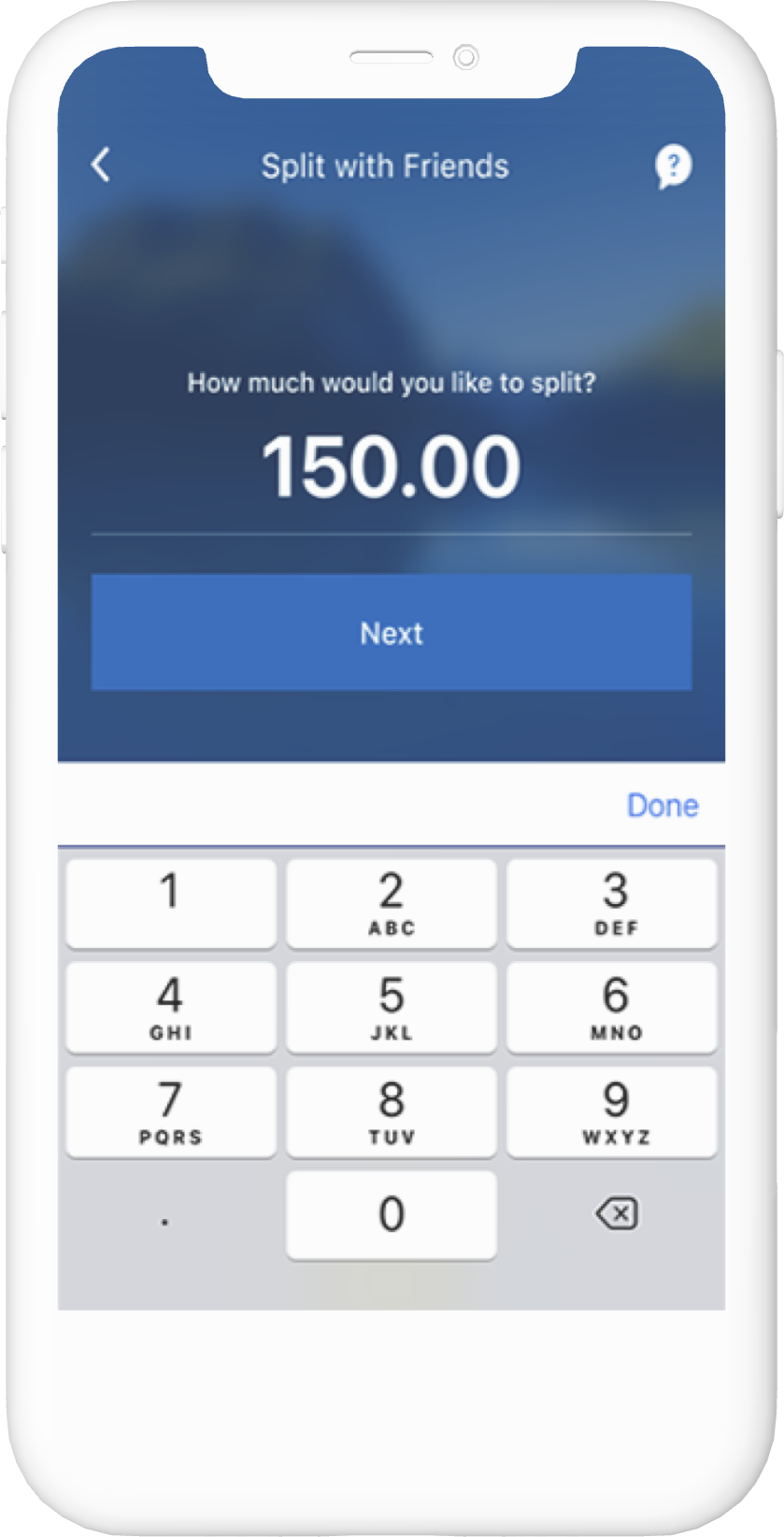

You can send up to 25 requests at a time up to $10,000 each to anyone banking in Canada with Request Money in the RBC Mobile app. Limits for fulfilling Request Money transactions vary by financial institution and recipient. Contact your recipient to ensure your request can be fulfilled. Any unfulfilled money request will expire after 30 calendar days.

The standard Monthly Fee for the RBC Signature No Limit Banking account is $16.95; however, you may be eligible to receive a partial rebate on your account's standard Monthly Fee if you meet the criteria applicable to rebates or discounts we offer, as described herein, and in the document entitled Personal Deposit Accounts Disclosures and Agreements.

As a sole or joint owner of an RBC Signature No Limit Banking (SNL) account and the primary cardholder of one of the eligible credit cards listed below, the annual fee of that eligible credit card will be fully or partially rebated (depending on the credit card you choose), every year, as long as your eligible card remains in good standing and you remain an SNL account owner. Additional cardholders (co-applicants and authorized users) do not qualify for the annual fee rebate, even if they are also owners of an SNL account. Only one credit card annual fee rebate per SNL account is allowed, which means that if you own a joint SNL account and each co-owner is also the primary cardholder of an eligible credit card, only the primary owner of the SNL account will be entitled to the credit card annual fee rebate. Other conditions and restrictions apply. Rebates that apply to eligible credit cards are: 1) $48 rebate ($4 applied monthly) (annual fee fully rebated) for: RBC ION+ Visa card, 2) $39 rebate (annual fee fully rebated) for: Signature® RBC Rewards Visa and WestJet RBC Mastercard cards, or 3) $35 rebate (annual fee partially rebated) for: RBC Avion Visa Infinite, RBC Avion Visa Infinite Privilege, RBC Avion Visa Platinum, RBC Rewards Visa Preferred, RBC US Dollar Visa Gold, RBC British Airways Visa Infinite and WestJet RBC World Elite Mastercard cards. If you already have an SNL account, the rebate will be applied at the time you open your eligible credit card account. If you open your SNL account after you have opened your eligible credit card account, the rebate will be applied at your next annual renewal and won't be applied retroactively. Other conditions and restrictions may apply. Royal Bank of Canada reserves the right to withdraw this offer at any time, even after acceptance by you.

There is a limit of 999 free Interac e-Transfer Transactions per Month per Account; for every Interac e-Transfer Transaction over the limit, you will be charged $1.

Interac e-Transfer Transactions expire 30 days after they are sent and cannot be claimed by the recipient after this time. You have 15 days after the Interac e-Transfer Transaction is sent to cancel without charge. A $5 Interac e-Transfer Transaction Reclaim Fee is charged when a recipient does not accept it before it expires and the sender does not cancel the transaction before the 15-day cancellation period.

The standard Monthly Fee for the RBC VIP Banking account is $30; however, you may be eligible to receive a partial rebate on your account's standard Monthly Fee if you meet the criteria applicable to rebates or discounts we offer, as described herein, and in the document entitled “Personal Deposit Accounts Disclosures and Agreements”.

The Monthly Fee is charged on the last day of the Month of your Account’s monthly cycle. If the last day is a non-Business Day, the fee is charged the previous Business Day. However, if the last day of your Account’s Monthly Cycle is a non-Business Day and falls at the beginning of the calendar month, then the Monthly Fee is collected the next Business Day.

In addition to the fee for making a Cross Border Debit, the purchase amount will be subject to foreign exchange rates at the time of the purchase. Transactions are converted to Canadian dollars at an exchange rate that is 2.5% over the Interbank Spot Rate as defined by Interac Corp.

On operating account only. $1 per cross border debit transaction on companion accounts. Not available on U.S. Personal Account. Foreign currency purchases paid by withdrawal from your Canadian dollar account are converted to Canadian dollars at an exchange rate 2.5% over the Interbank Spot Rate (as defined by Interac Corp.), effective at time of processing. Since exchange rates fluctuate, the rate applied will usually differ from the posted exchange rate at the time of your purchase.

Subject to credit approval. As a sole or joint owner of an RBC VIP Banking (VIP) account and the primary cardholder of one of the eligible credit cards listed below, the annual fee of that eligible credit card will be fully or partially rebated (as indicated below), every year, as long as your credit card remains in good standing and you remain a VIP account owner. Additional cardholders’ annual fee is also fully or partially rebated (as indicated below), every year, as long as your eligible credit card remains in good standing and you remain a VIP account owner. Only one credit card annual fee rebate per VIP account is allowed, which means that if you own a joint VIP account and each co-owner is also the primary cardholder of an eligible credit card, only the primary owner of the VIP account will be entitled to the credit card annual fee rebate. Other conditions and restrictions apply. Rebates that apply to eligible credit cards are: (i) partial rebate of $120 for the primary cardholder and $50 for the co-applicant on the annual fee of an RBC Avion Visa Infinite Privilege card, and (ii) annual fee fully rebated for the primary cardholder and the additional cardholders (co-applicant and authorized users) on any of the following cards: RBC Avion Visa Infinite, RBC Avion Visa Platinum, RBC Rewards Visa Preferred, RBC U.S. Dollar Visa Gold, RBC British Airways Visa Infinite, RBC ION+TM Visa ($4 applied monthly), RBC Cash Back Preferred World Elite Mastercard and WestJet RBC World Elite Mastercard. If you already have a VIP account, the rebate will be applied at the time you open your eligible credit card account. If you open your VIP account after you have opened your eligible credit card account, the rebate will be applied at your next annual renewal and won't be applied retroactively. Other conditions and restrictions may apply. Royal Bank of Canada reserves the right to withdraw this offer at any time, even after acceptance by you.

An ATM operator surcharge (also called convenience fee) may be charged by other ATM operators. The convenience fee is not a Royal Bank fee. It is added directly to the amount of your cash withdrawal. All clients who use non-RBC ATMs may be charged a convenience fee regardless of the type of Account they hold.

When you use your Client Card to make a withdrawal in a currency other than Canadian dollars at an ATM outside Canada displaying the PLUS system symbol, we will convert the amounts withdrawn and any associated charges imposed by any third party for the use of the ATM to Canadian dollars when we deduct the funds from your Account. We will convert these amounts to Canadian dollars no later than the date we post the transaction to your Account at our exchange rate, which is 2.5% over a benchmark rate set by Visa International, a subsidiary of Visa Inc., and which Royal Bank of Canada pays on the date of conversion. This rate may be different from the rate in effect on the date your ATM withdrawal occurred or on the date of the transaction.

With an RBC VIP Banking Client Card.

RBC VIP Banking account comes with a choice of up to two additional Canadian dollar deposit accounts, to be selected among the RBC Day to Day Banking, RBC Enhanced Savings and RBC Day to Day Savings accounts, and one additional U.S. dollar deposit account, limited to the U.S. Personal Account, with the monthly fees waived. Note: Due to system limitations all accounts must be opened by the client in the same geographic location or region to be recognized for this bundling feature. If you have questions, please speak to your branch.

ATM - RBC ATM Access fees waived. An ATM operator surcharge (also called convenience fee) may be charged by other ATM operators. The convenience fee is not a Royal Bank fee. It is added directly to the amount of your cash withdrawal. All clients who use non-RBC ATMs may be charged a convenience fee regardless of the type of account they hold. The number of waived fees per month are not cumulative, and if not used, may not be carried over into the next Monthly Cycle.

The RBC Offers program is available to clients with an RBC Royal Bank (i) debit card tied to a personal or business chequing account, and/or (ii) personal or business credit card, other than an RBC Commercial Visa or RBC US Dollar Visa card. Eligibility criteria for an RBC Offer: (a) is determined by RBC, (b) may vary depending on the offer, and (c) may be based on the client’s preferences and account status. Eligible clients will refer to the terms and conditions applicable to each specific RBC Offer for more details.

Additional service fees by any intermediary and receiving bank may apply. Must be enrolled in RBC Online Banking or the RBC Mobile app and have either a Canadian RBC Royal Bank chequing or savings account. Some restrictions may apply. Cannot send funds from a US dollar account, the RBC High Interest eSavings account, or Foreign Currency Accounts.

Eligible accounts include: RBC VIP Banking, RBC Signature No Limit Banking, RBC Advantage Banking, RBC Day to Day Banking account. You must close the account and apply for the refund or switch to another account within 4 months of account opening or upgrade. Offer limited to one account opening or upgrade per customer per calendar year. Offer may be withdrawn at any time without notice.

® / TM Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada.

‡ All other trademarks are the property of their respective owner(s).

Other Features Included in this Account

| Avion Pointslegal bug 1 | Enrol your account in the Value Program to get a minimum of 1 Avion point for every $10 you spend in-store and online using your enrolled account. |

| Interaclegal bug ‡ e-transferslegal bug 9,legal bug 10 | FREE |

| International Money Transfers | Pay no fee for U.S. and international money transferslegal bug 11 |

| Cross Border Debits | 5 cross-border debits per month, $1 each thereafterlegal bug 12 |

| Online, Mobile and Telephone Banking | FREE |

| eStatements | FREE |

| Monthly Paper Statements | $2.25 without cheque image, $2.50 with cheque image |

| Safe Deposit Boxlegal bug 2 | Up to $12/year discount on regular fees |

| Non-Sufficient Funds (NSF) Fee | 1 NSF fee rebated every calendar yearlegal bug 3 |

| Personalized Chequeslegal bug 4 | 1 book of cheques FREE, afterwards Fees Apply |

| Bank Draftslegal bug 5 | 6 FREE/year, $9.95 each thereafter |

| Right Account Guarantee® | If you’re not completely satisfied within the first 4 months, we’ll refund your monthly fees for up to 3 monthslegal bug 6. |

Optional Services

| Using a PLUS System ATM in Canada or the U.S.legal bug 7,legal bug 8 | $3 each |

| Using a PLUS System ATM Outside Canada or the U.S. | $5 each |

Other Features Included in this Account

| Avion Pointslegal bug 1 | Enrol your account in the Value Program to get a minimum of 1 Avion point for every $10 you spend in-store and online using your enrolled account. |

| Interaclegal bug ‡ e-transferslegal bug 10,legal bug 11 | FREE |

| International Money Transfers | Pay no fee for U.S. and international money transferslegal bug 12 |

| RBC ATMs | No RBC fee to use ATMs worldwidelegal bug 13,legal bug 14,legal bug 15 |

| Online, Mobile and Telephone Banking | FREE |

| eStatements or Monthly Paper Statements | FREE |

| Cross-Border Debitslegal bug 2,legal bug 3,legal bug 4 | FREE |

| Safe Deposit Boxlegal bug 5 | Up to $60/year discount on regular fees |

| Non-Sufficient Funds (NSF) Fee | 1 NSF fee rebated every calendar yearlegal bug 6 |

| Personalized Chequeslegal bug 7 | FREE, with RBC VIP Style |

| Bank Draftslegal bug 8 | 12 FREE/year, $9.95 each thereafter |

| Right Account Guarantee® | If you’re not completely satisfied within the first 4 months, we’ll refund your monthly fees for up to 3 months.legal bug 9 |