Effortless Payments Every Single Time

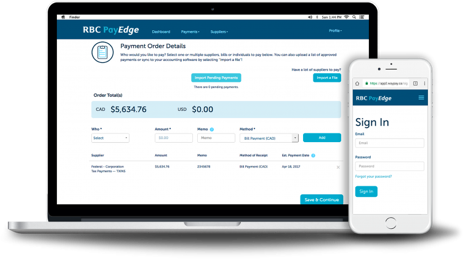

RBC PayEdge is an innovative platform that automates payments to suppliers by integrating with your accounts payable system. Enabling seamless payment and reconciliation, businesses of all sizes can save time and money, whether or not they’re an RBC banking client. With funds easily accessed from any Canadian bank account or credit card, RBC PayEdge makes it easy to pay suppliers anywhere.

Effortless Payments Every Single Time

RBC PayEdge is an innovative platform that automates payments to suppliers by integrating with your accounts payable system. Enabling seamless payment and reconciliation, businesses of all sizes can save time and money, whether or not they’re an RBC banking client. With funds easily accessed from any Canadian bank account or credit card, RBC PayEdge makes it easy to pay suppliers anywhere.

Book a Demo for RBC PayEdge (opens in new window)

Why Choose RBC PayEdge?

Fast & Easy Payments

Combine multiple funding sources from any Canadian bank or credit union and credit card to make supplier payments, with same day or next day payment options.

Every Bank. Every Credit Union and Credit Cards.

Unlock new funding sources and pay suppliers in more ways by connecting multiple bank accounts or credit cards from any Canadian financial institution to make payments.

Empower Your Suppliers

Provide your suppliers with better remittance information and increase adoption of electronic payments. Our supplier database contains hundreds of thousands of suppliers, with each one’s preferred electronic payment type.

Pay Suppliers Globally

No matter where you need to send money to your suppliers, RBC PayEdge makes foreign exchange and global payments easy with access to over 130 countries in more than 100 currencies.

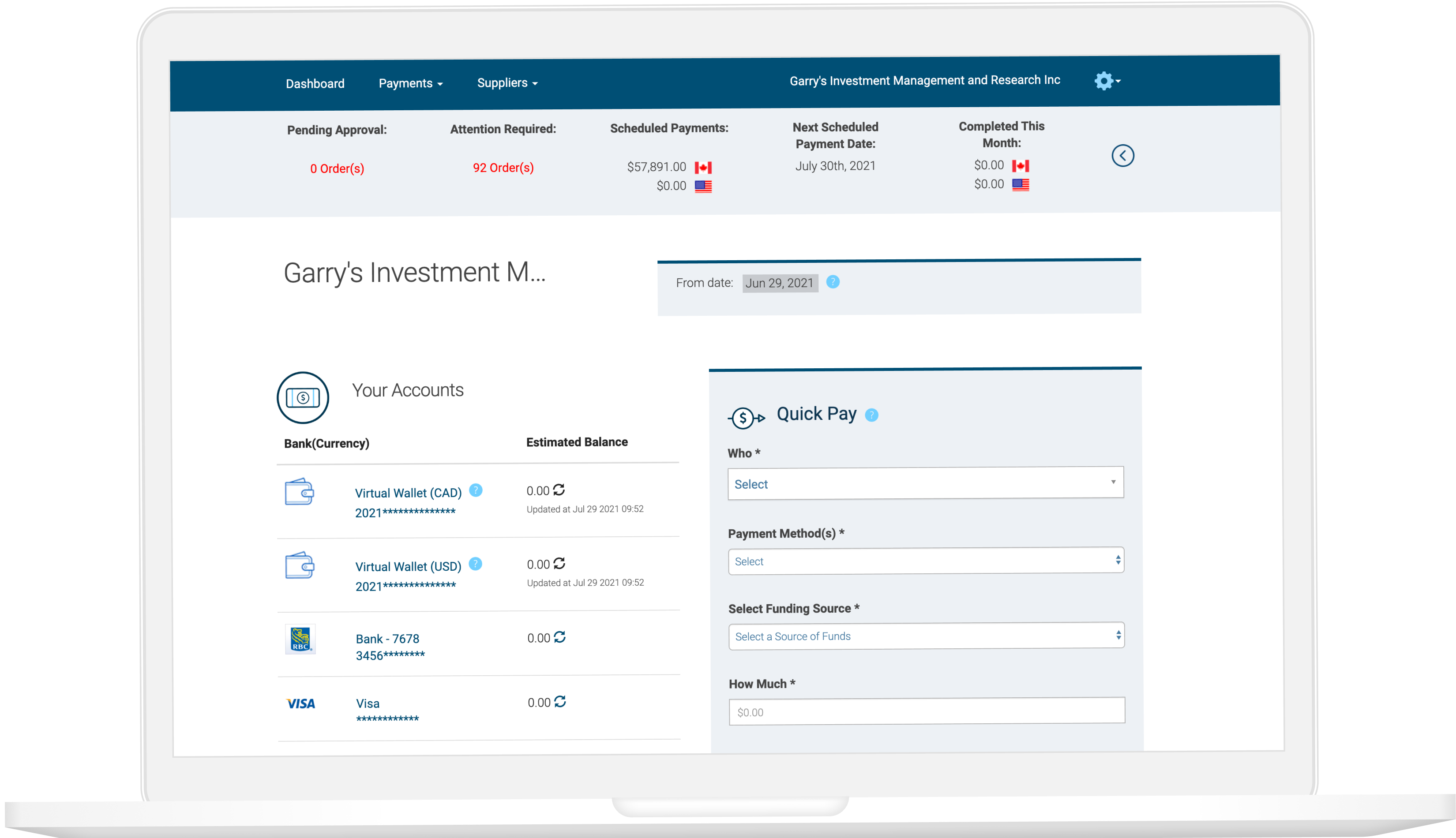

RBC PayEdge Works For You

Refine your workflow and free up precious time spent on manual processes and reconciliation by automating tedious repetitive tasks. Pay your entire list of suppliers with ease.

Integrated For Business

With seamless integration by connecting to QuickBooks, Sage, Xero and others, RBC PayEdge delivers more efficiency by bringing your payments workflow into one place. Businesses can also connect through API’s and Secure File Transfer Protocol (SFTP) for easy integration.

Easily Fund Your Payments

With RBC PayEdge, you can use your credit card and bank accounts to fund almost any business expense, including paying suppliers who don’t accept credit cards.

Optimize What You Already Have

Optimize your cash flow and give yourself extra time to pay your invoice by making the most of your credit card billing cycle.

Increase Your Payment Flexibility

Even when a supplier doesn’t accept credit cards, you can take advantage of your available credit and pay your suppliers how they want to be paid.

Maximize Rewards and Incentives

Do you have credit card perks? You could earn points or rewards1 every time you pay a supplier by using your existing credit card through RBC PayEdge.

Optimize Your Working Capital

Discover ultimate flexibility in cash management by aggregating funds from all your sources to make payments. And because you can fund with any combination of bank account or credit card, you can manage payments in the way that works best for you.

RBC PayEdgeTM

Get Started with RBC PayEdge

Still Have a Few Questions?

Request a Demo

Get Started with RBC PayEdge

Still Have a Few Questions?

Request a Demo

Resources

How to add an agent or business as a supplier/payee

How to make a commission/ business payment