How to View and Manage Your Investments

There are several ways to access and manage your investments at RBC. Here are your options:

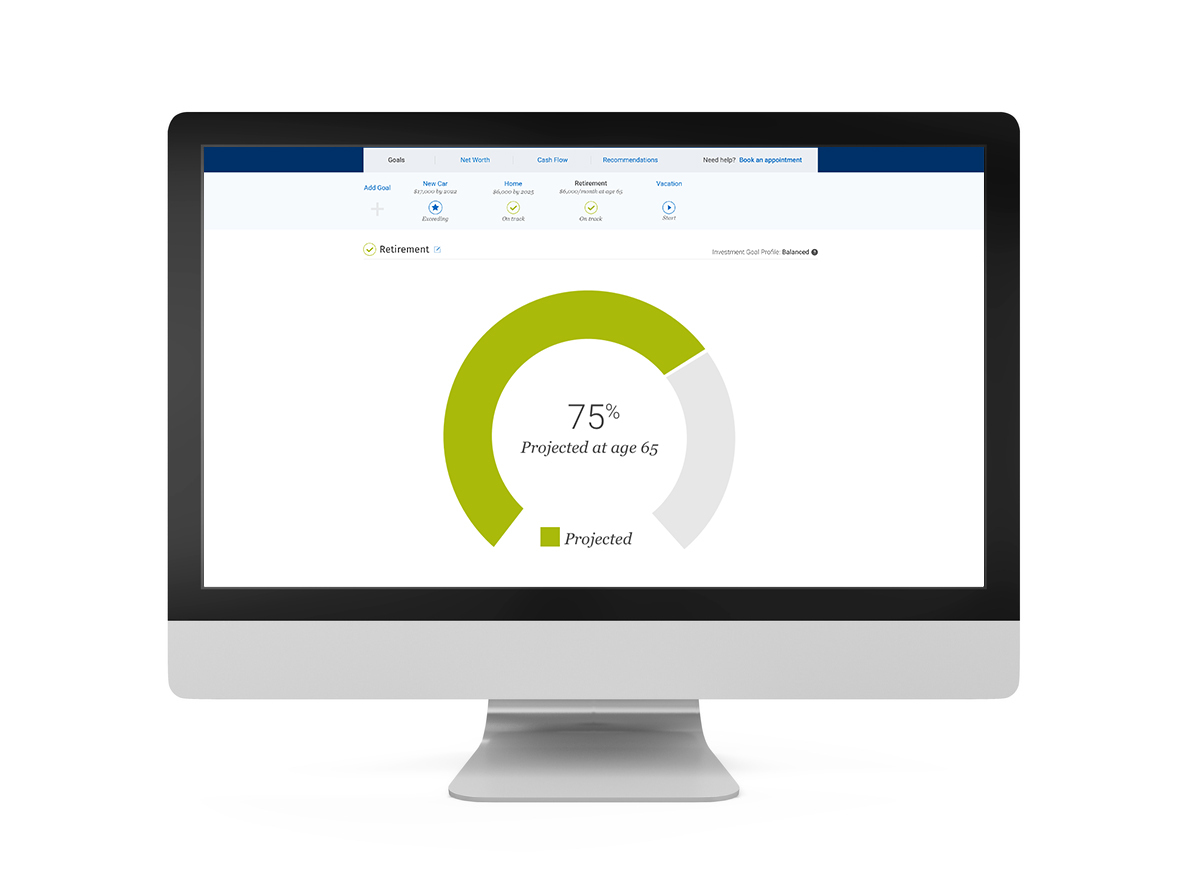

MyAdvisor

Available through RBC Online Banking, MyAdvisor is a powerful service that can help you stay on top of your money and reach your savings goals sooner.

Since MyAdvisor can show all of your savings and investments (even those outside RBC) it gives you a comprehensive look at your net worth, cash flow and how you’re progressing towards your goals. Plus, it’s completely free and exclusive to RBC!

Sign in to RBC Online Banking to access MyAdvisor:

Getting started with MyAdvisor takes just a few minutes!

- Sign in to RBC Online Banking.

Not yet enrolled in Online Banking? Enrol Now. - Answer a few easy questions to build your savings plan.

- Book a 1-1 financial review with a live advisor and meet by phone, video or in person.

Online Banking

RBC Online Banking is another secure and easy way to view and manage your investments.

- Get a snapshot of all your accounts and the investments you hold

- View transaction histories (contributions, earnings, withdrawals, etc.)

- See how your investments are performing

- Access and manage investment statements and other types of statements

- Set up pre-authorized contributions or make a single contribution

- View your Investor Profile(s)

- Make withdrawals

- And much more…

To view and manage your investments now:

From the Accounts Summary page, click the investment account you want.

Mobile Banking

View your investment balances right from your phone with the secure RBC Mobile app1.

Download the app now:

NOMI Find & Save, available exclusively through the RBC Mobile app, learns your transaction patterns, finds those extra dollars that it thinks you won’t miss, and then sets them aside for you automatically. NOMI finds and you save—it’s that simple!

Learn about NOMIInvestment Statements

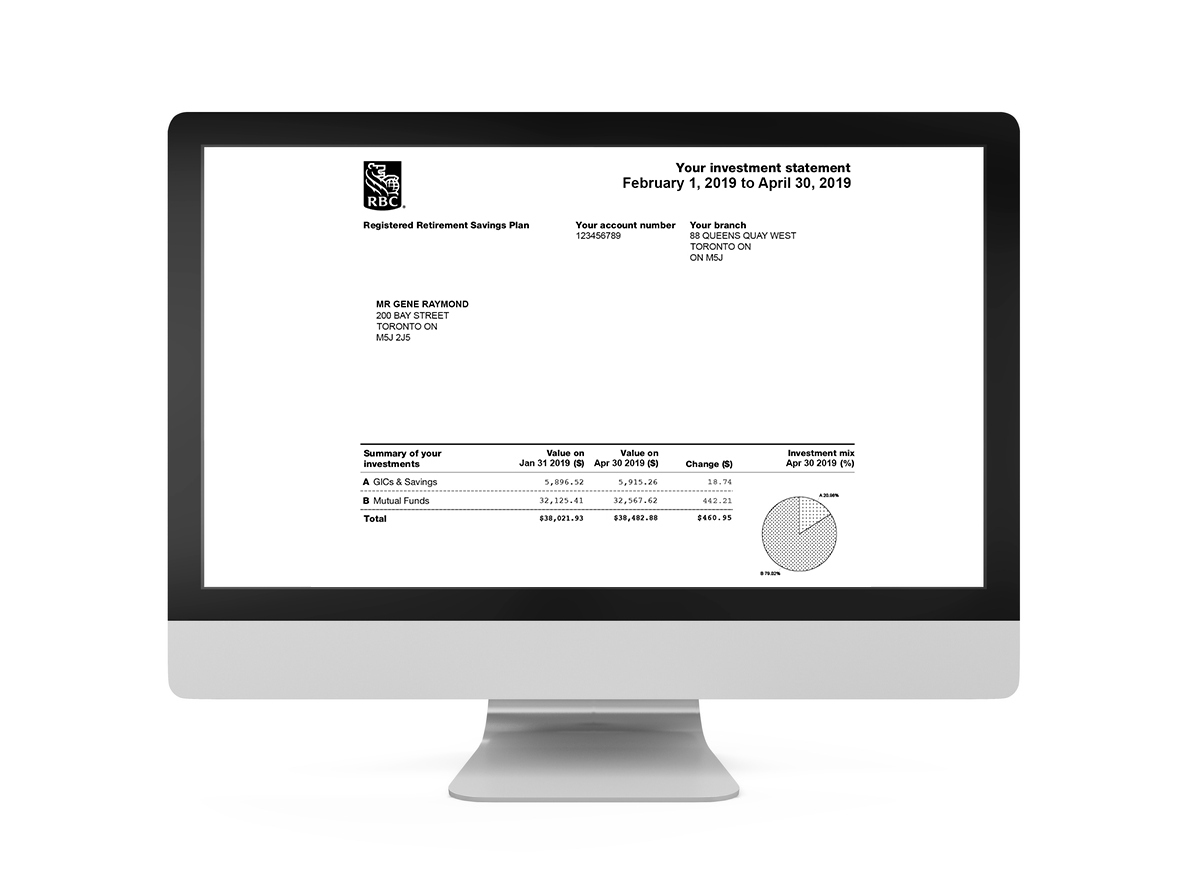

Another way to keep track of how you’re doing is through your investment statement, which shows how your money is invested.

If you have RBC Online Banking, you can view your statements (as well as confirmations, regulatory documents and eSignatures) online:

- Sign in to Online Banking.

- From the Accounts Summary page, click the “Statements/Documents” link in the top menu.

- On the View eDocuments tab, choose the account you want to view statements for from the Accounts drop-down menu.

- Click Go.

- From the eDocument Type menu, choose the statement or document you want.

Tip: You can also go into your local branch to get a copy of your statements.

You can choose to receive your statements electronically or by mail:

- Sign in to Online Banking.

- From the Accounts Summary page, click the “Statements/Documents” link in the top menu.

On the Manage Documents tab, use the Select drop-down menu to change your statement preference for any of your accounts.

Our Guarantee to You

With the RBC Digital Banking Security Guarantee 2, you’re fully protected against any transactions you didn’t make or approve.

Read More about Our Guarantee to You