Are You Ready to Invest Your Money?

Here’s what you need to know…

Your Investment Options

If you have a registered account, you may have funded it by putting cash in a Savings Deposit. While a Savings Deposit is a good place to hold your money while you decide on the investments you want (or if you need your funds in the next year or so) your money will have the opportunity to grow faster if it’s invested outside of a Savings Deposit.

Here’s an overview of your investment options at RBC Royal Bank:

Mutual Funds and Portfolio Solutions

- Ideal if you want to benefit from the expertise of a professional money manager

- Offers an easy way to achieve a diverse and balanced investment portfolio

- Can offer more growth potential than a Savings Deposit or GIC

Guaranteed Investment Certificates (GICs)

- Ideal if you want a secure investment that guarantees 100% of your original investment

- Offers competitive rates that are guaranteed for the full term of your investment

- Can offer more growth potential than a Savings Deposit

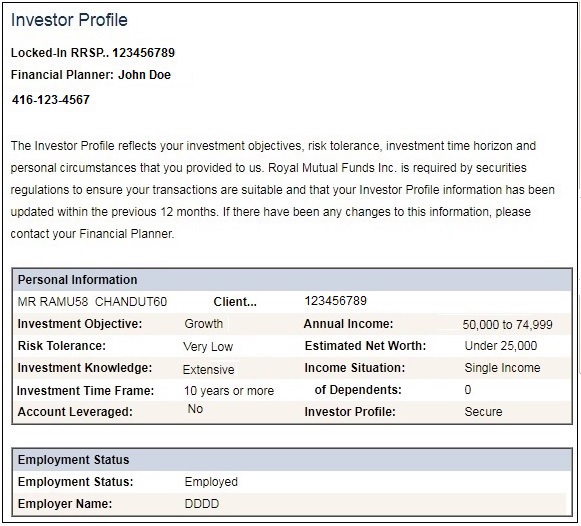

Investor Profile—What It Is and Why You Need One

Your Investor Profile contains valuable information about you and your investment preferences. Creating one helps you understand your goals, appetite for risk and investing timeframe. Once you have completed your Investor Profile, you’ll be able to buy mutual funds and portfolio solutions that are suitable for you and make changes to these investments on your own or with an advisor.

View a sample Investor ProfileHere's how to create, update and view your Investor Profile:

Create or Update Your Profile

Before you can purchase mutual funds or portfolio solutions, you must have an Investor Profile that’s been created or updated in the last 12 months.

To create or update your Investor Profile:

Call 1-800-463-3863 (toll-free) Visit your local branchTip: Save time at the branch! Call 1-800-769-2511 to book an appointment.

View Your Profile Online

To view your Investor Profile:

Sign in to Online Banking.

From the Accounts Summary page, click on the investment account with the profile you want to view.

Select “Account Investor Profile” from the menu on the left.

If you haven’t reviewed and confirmed your profile in the last 12 months, or if there have been any changes, please call 1-800-769-2511 and select "Investments".

Tips for Making the Most of Your Money

Want to get more out of your savings and investments? Here are a few tips…

Put Your Savings into More than One Type of Investment

When it comes to choosing investments, it’s important to think about why you’re investing and how long you have to save. For example, the investments you might use to save for a vacation would probably be different than the investments you would use to save for retirement.

If you’re not sure where to put your money right now, an RBC advisor can help you make the right choice.

Invest in a Registered Plan

If you’re not already saving within a registered plan, you could be missing out on opportunities to lower your taxes. At RBC, you can save for the future using a wide range of registered plans:

A TFSA is a registered account you can use to save for a major purchase or goal—a new car, a dream vacation or retirement (contribution limits apply). Investment earnings and withdrawals are tax-free.

An RRSP is a personal savings plan that lets you save for your retirement on a tax-sheltered basis, and the contributions can be deducted from your income!

A RRIF is like an extension of your RRSP, but instead of putting money in, you withdraw from it to use throughout retirement.

An RESP is a tax-sheltered plan that helps you save for a child’s post-secondary education.

An RDSP is a registered savings plan that helps eligible Canadians with disabilities and their families save for long-term financial needs.

Max Out Contributions to Your Registered Plans

If your budget allows for it, contribute the maximum amount to your TFSA and RRSP every year to take advantage of the unique tax benefits of these plans.

TFSA contribution limitsRRSP contribution limits

Plan Ahead When Withdrawing Investments

Be careful when withdrawing (or redeeming) investments from certain registered and non-registered accounts as some withdrawals can be taxed and counted as income. Before you tap into your investments, talk to an RBC advisor about the impact on your bottom line.

Check in with an Advisor

It’s a good idea to talk with an RBC advisor anytime you have a life event, like a new job, a change in your income, a new baby, marriage or divorce. Life events like these can affect your financial goals, so it’s important to make sure your investment plan is current.