No Monthly Fee for a YearLegal Disclaimer1

Here’s a bank account offer designed to help you save money.

Open an RBC Day to Day Banking account online through a self-serve channel either through the RBC Mobile App, RBC public site rbcroyalbank.com or RBC Online Banking by June 2, 2025 and pay no monthly fee for 12 months.Legal Disclaimer1

The Essentials

RBC Day to Day Banking account

12 Free Debits

per Month,

$1.25 each thereafter

Free InteracLegal Disclaimer‡ e-transfersLegal Disclaimer2,Legal Disclaimer3

to send and receive money quickly and easily

Earn Avion

pointsLegal Disclaimer4

on eligible debit purchases when your account is enrolled in the Value Program

12 Free Debits

per Month, $1.25 each thereafter

Free InteracLegal Disclaimer‡ e-transfersLegal Disclaimer2,Legal Disclaimer3

to send and receive money quickly and easily

Earn Avion pointsLegal Disclaimer4

on eligible debit purchases when your account is enrolled in the Value Program

J.D. Power 2024 Winner

RBC Ranks #1 in the J.D. Power 2024 Canada Online Banking Satisfaction and Mobile App Satisfaction Studies.

J.D. Power 2024 Winner

RBC Ranks #1 in the J.D. Power 2024 Canada Online Banking Satisfaction Study.

Top Bank Account

Questions

Please visit rbc.com/nofeeterms.

The RBC Day to Day Banking account isn’t normally a no-monthly-fee account, but with this limited time offer you pay no monthly fee for 12 monthsLegal Disclaimer 1. Keep in mind, other bank fees may apply, such as overdraft fees, bank draft fees and cheque fees, depending on how you use your account.

No – this offer does not affect any of the service fees related to the operation of any of our personal deposit accounts, credit card accounts and business banking accounts, which continue to apply.

To qualify for this offer you must:

- Be an “Eligible Personal Client” as defined in the Terms and Conditions for this offer

- Open a new RBC Day to Day Banking account as a primary owner before June 2, 2025 through a digital channel

- Be the age of majority as defined in your province of residence prior to June 2, 2025

The offer is available to Canadian residents who:

- have never had a Personal Banking account (chequing account) with RBC nor qualified for any of our offers related to opening a Personal Banking Account at any time during the Promotional Period or in the five year period before the start of the Promotional Period.

See the full Terms and Conditions for details.

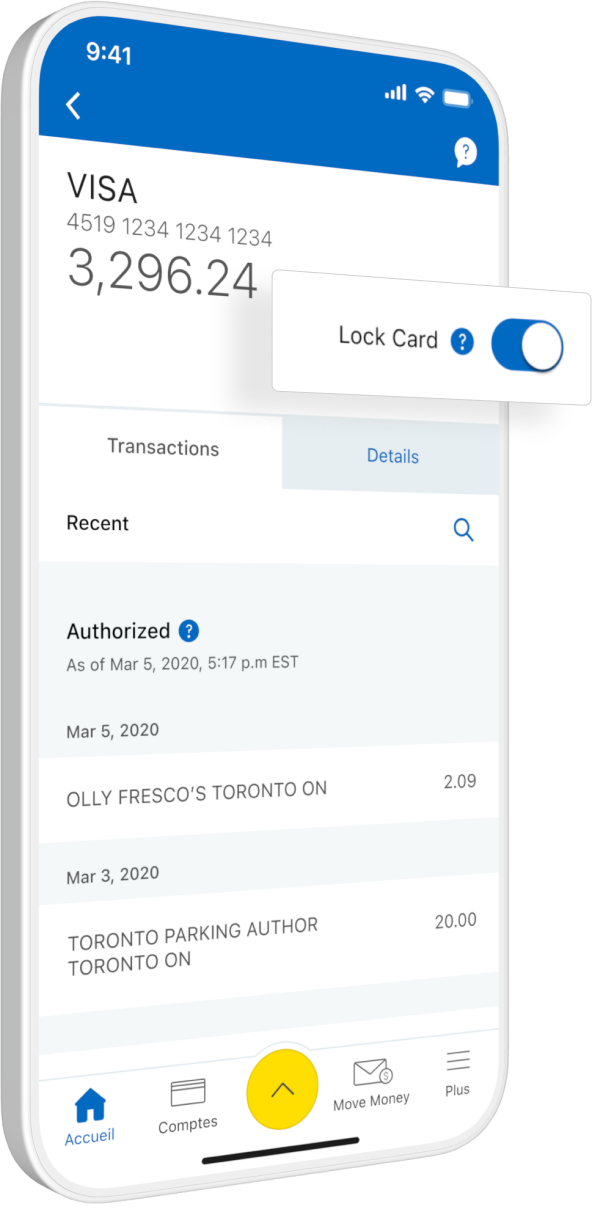

There are a few ways you can open a personal bank account at RBC. To take advantage of this offer, however, you must open your account online, through online banking or in the RBC MobileLegal Disclaimer 7 app.

If you want to open your account another way (and not receive this offer), you can:- Visit a branch

- Call 1-800-769-2511 (lines are open 24/7)

Please contact your branch or our Advice Centre at 1-800-769-2511 no later than July 24, 2025 if you have not received your monthly fee waiver. Any notice received after this date will not be accepted and you will be deemed not to have qualified for this Promotional Offer.

If you see a monthly fee charge on your first statement, please don’t worry. You’ll be credited on your next month’s statement.

No. Only one offer is available per client, no matter how many eligible accounts you may open during the offer period.

If you switch from the RBC Day to Day Banking Account to another personal banking account during the offer period, the monthly fee for the new Day to Day Banking Account will not be waived and the monthly fee for the new personal banking account will apply from the day of the switch forward.

No. This offer is only for clients who have never had a Personal Banking Account nor qualified for any of our offers related to opening a Personal Banking Account at any time during the Promotional Period or in the five year period before the start of the Promotional Period. Account switches do not qualify for this offer.

After your 12 months of this offer, the Day to Day Banking account comes with a $ 4 monthly feeLegal Disclaimer 9,Legal Disclaimer 14. However, if you qualify for the RBC Value Program and enroll in it, your monthly fee will be rebated, meaning you will pay $0 monthly fee for this account. To qualify for the rebate under the Value Program you must:

- Have two other RBC products, such as a personal credit card, personal investment, residential mortgage or small business account

- Complete at least 2 out of 3 regular account activities, such as pre-authorized payment, direct deposit or eligible bill paymentLegal Disclaimer 10

RBC is one of Canada’s largest banks (as measured by market capitalization) and most trusted brands. We’re a proud member of Canada Deposit Insurance Corporation (CDIC) and offer a range of bank accounts, credit cards, loans, mortgages, investments and more to fit your needs.

Learn more about RBC.A chequing account is meant for your everyday transactions, such as withdrawing cash from an ATM, paying a bill, depositing a pay cheque, and paying for groceries. It has the advantage of providing easy access to your money.

RBC Vantage is the way we describe all of the powerful benefits you can get just by having an eligible RBC bank account. There is no additional cost to enjoy these benefits—and you don’t need a minimum balance.

Here are just a few ways you can take advantage of these benefits:

- Earn Avion points with an eligible bank account by enrolling your account in the Value Program and making debit purchases in-store or online using your enrolled account.Legal Disclaimer 4

- Save on monthly fee when you enrol your account in the Value Program, have 2 or more additional eligible RBC product categories, and complete at least 2 out of 3 regular account activities (a pre-authorized payment, direct deposit or bill payment) with your enrolled account each month.Legal Disclaimer 10

- Save 3¢/L on gas at Petro-Canada with every fill-up using your linked RBC card.Legal Disclaimer 6

- Load available offers to your eligible RBC debit card and start getting rewarded with offers from popular brands.Legal Disclaimer 11

If you are opening a new account, you can enrol it in the Value Program at the same time you open the account. If you open an account online, simply enrol in the Value Program when you are invited to do so.

If you already have an eligible bank account, an RBC advisor can enrol your account in the Value Program for you. Please book an appointment, call 1-800-769-2511 or visit a branch.

Avion Rewards gives you the opportunity to earn Avion points in many ways and the flexibility to redeem them for nearly endless options—travel the world, buy merchandise and gift cards from some of your favourite brands, pay down bills, invest in your future and much more.

There are several ways to earn points. For example, you can earn points when you make debit purchases with an eligible RBC bank accountLegal Disclaimer 2 that is enrolled in the Value Program or when you make purchases with an Avion Rewards credit card.

Avion Rewards also gives you access to discounts, bonus points, special offers and savings you’ll only find at Canada’s largest bank-owned loyalty program.

Learn more about Avion Rewards.Other Resources

Are you a Newcomer to Canada?

Are you a Newcomer to Canada?

Enjoy no-monthly-fee banking for a yearLegal Disclaimer 12 with the RBC Newcomer Advantage

Are you a full-time StudentLegal Disclaimer 13?

Are you a full-time StudentLegal Disclaimer 13?

Enjoy special student offers, including no-monthly-fee banking on an RBC Advantage Banking account for students

Need More Help?

(Open 24/7)

There is a limit of 999 free Interac‡ e-Transfer Transactions per Month per Account; for every Interac‡ e-Transfer Transaction over the limit, you will be charged $1.

Interac‡ e-Transfer Transactions expire 30 days after they are sent and cannot be claimed by the recipient after this time. You have 15 days after the Interac‡ e-Transfer Transaction is sent to cancel without charge. A $5 Interac‡ e-Transfer Transaction Reclaim Fee is charged when a recipient does not accept it before it expires and the sender does not cancel the transaction before the 15-day cancellation period.

When you enrol your eligible RBC personal bank account into the RBC Value Program, you will be eligible to earn Avion points within the Avion Rewards Program as an Eligible Personal Banking Client, and any such points earned will be deposited into the Avion Rewards account tied to your enrolled account. Purchases from your account refers to using your RBC Client Card to pay for items at a merchant or service provider with the amount electronically debited directly from your enrolled account or using your RBC Virtual Visa Debit for purchases online. Avion points are governed by the Avion Rewards Terms and Conditions available on our website, or a copy may be provided to you by contacting us. For complete details on the Value Program, please see the (pdf opens in a new window)Value Program Terms & Conditions.

The following RBC bank accounts are eligible for the Value Program: RBC Day to Day Banking, RBC Advantage Banking (includes RBC Advantage Banking for students), RBC Signature No Limit Banking, RBC VIP Banking, RBC No Limit Banking (discontinued), RBC Student Banking (discontinued), RBC No Limit Banking for Students (discontinued), RBC Day to Day Savings, RBC Enhanced Savings and RBC High Interest eSavings.

To participate in this offer, you must have an RBC debit or credit card which is issued by Royal Bank of Canada (excluding RBC commercial credit cards) (“RBC Card”). RBC business clients will only be able to link up to two (2) business credit cards and one business debit card to a Petro-Points card. You must be enrolled in RBC Online Banking or the RBC Mobile app in order to link your RBC Card to your Petro-Points card. Card linking may take up to 2 business days to process before savings and bonus points can be applied to purchases. A linked RBC Card means an RBC Card linked to a Petro-Points Account. Your linked RBC Card acts as your Petro-Points card. You will automatically earn Petro-Points when you pay for qualifying purchases with your linked RBC Card at Petro-Canada locations and you do not need to swipe your Petro-Points card before you pay. You can redeem your Petro-Points at Petro-Canada using your linked RBC Card. Each time you use your linked RBC Card to purchase any grade of gasoline, or diesel, at a Petro-Canada location, you will save three cents ($0.03) per litre at the time of the transaction.

RBC Mobile is operated by Royal Bank of Canada, RBC Direct Investing Inc. and RBC Dominion Securities Inc.

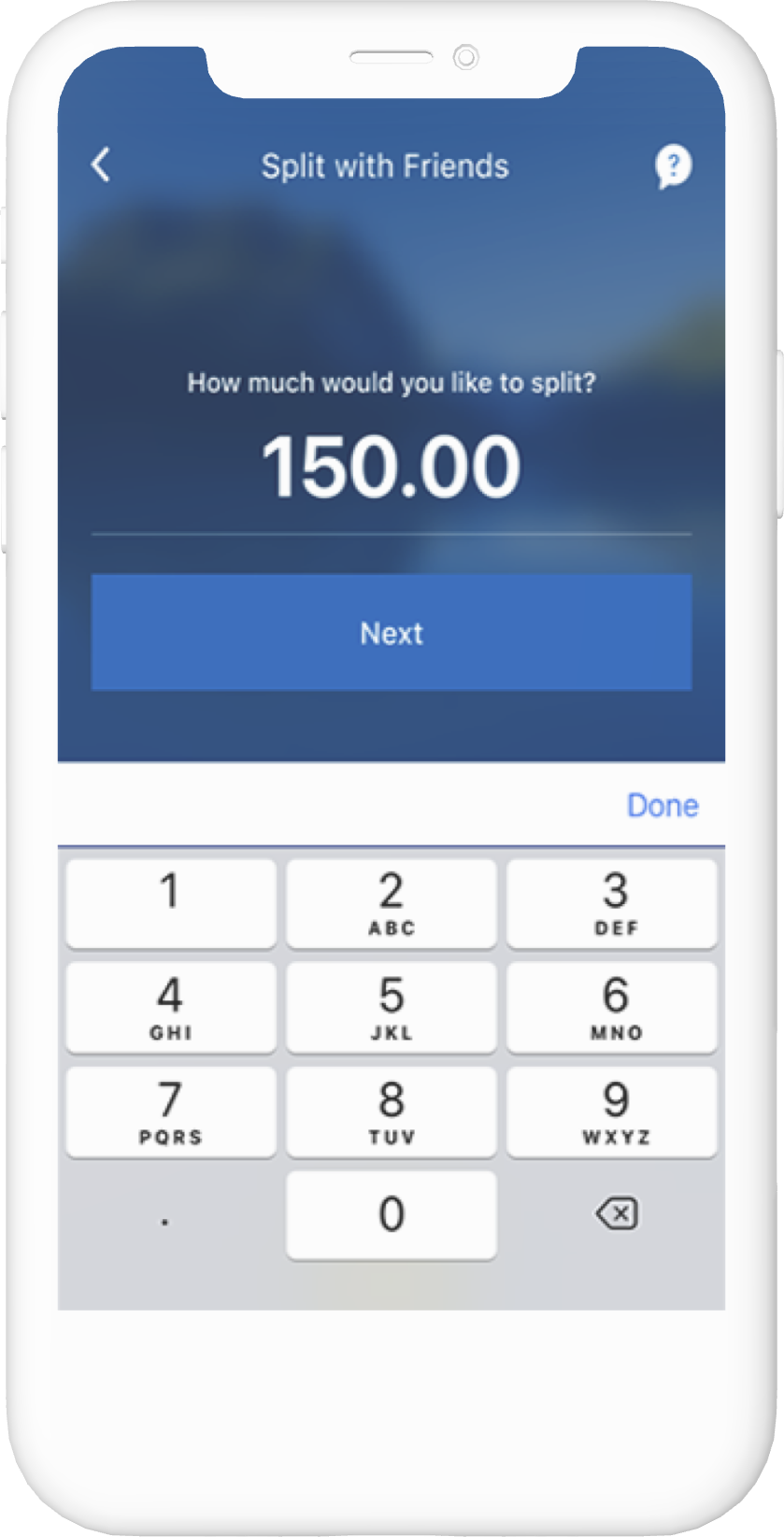

You can send up to 25 requests at a time up to $10,000 each to anyone banking in Canada with Request Money in the RBC Mobile app. Limits for fulfilling Request Money transactions vary by financial institution and recipient. Contact your recipient to ensure your request can be fulfilled. Any unfulfilled money request will expire after 30 calendar days.

The Monthly Fee is charged on the last day of the Month of your Account’s monthly cycle. If the last day is a non-Business Day, the fee is charged the previous Business Day. However, if the last day of your Account’s Monthly Cycle is a non-Business Day and falls at the beginning of the calendar month, then the Monthly Fee is collected the next Business Day.

By enrolling an eligible RBC personal bank account into the RBC Value Program, holding eligible additional RBC products (“Product Categories”, as more particularly described below), and completing certain activities from your enrolled account each month (as more particularly described below), you may be entitled to receive a partial or full rebate of your enrolled account’s standard Monthly Fee. Eligible Product Categories include RBC personal credit cards, personal investments, residential mortgages, and linked small business relationships. Multiple products in a single Product Category will be considered one Product Category. In addition to having eligible Product Categories, you must also perform any two (2) or more of the following specified account activities in the previous calendar month to or from your enrolled account: a monthly direct deposit, a monthly pre-authorized payment, or an eligible bill payment made at minimum once per month. An eligible bill payment means a bill payment completed through either RBC Online Banking, the RBC Mobile app, using an RBC ATM, or using Telephone Banking Services, and excludes any bill payment made: (i) in-person at an RBC Royal Bank branch with an RBC Advisor, (ii) to an RBC credit card account, or (iii) using an RBC Virtual Visa Debit® associated with your Enrolled Account. Conditions apply. For complete details, please see the (pdf opens in a new window)Value Program Terms & Conditions.

The RBC Offers program is available to clients with an RBC Royal Bank (i) debit card tied to a personal or business chequing account, and/or (ii) personal or business credit card, other than an RBC Commercial Visa or RBC US Dollar Visa card. Eligibility criteria for an RBC Offer: (a) is determined by RBC, (b) may vary depending on the offer, and (c) may be based on the client’s preferences and account status. Eligible clients will refer to the terms and conditions applicable to each specific RBC Offer for more details.

Monthly fee will be waived for the first twelve months upon account opening of the RBC Advantage Banking account or RBC VIP Banking account. Thereafter the monthly fee will be charged: monthly fee of $11.95 for the RBC Advantage Banking account or monthly fee of $30.00 for the RBC VIP Banking account. For RBC VIP Banking account, $10,000 CAD must be deposited into the account within 20 days of account opening to qualify for the promotional offer, and offer expires October 31, 2025. Other account transaction fees may apply. Monthly fee waiver for the first twelve months may be replaced with any in-market offer that applies to the RBC Advantage Banking or RBC VIP Banking account. Available only to newcomers; please see the eligibility requirements in note 15. Offer may be withdrawn or amended at any time without notice. See complete (pdf opens in a new window)terms and conditions that apply to this promotional offer.

To be considered a full-time student, you must attend a primary or secondary school OR be enrolled in a program at the post-secondary level at a college, university or other educational institution (whether in Canada or not). If you are a post-secondary student, you must take at least 60% of the usual course load for the program in which you are enrolled in any particular semester. Proof of enrollment may be requested at our discretion.

Fee subject to change at any time, see the RBC Day to Day Banking account page for current fees.

Available only to (i) Newcomers to Canada who arrived within the last 5 years and (ii) for non-credit card accounts with RBC. Must show proof of entry into Canada and provide supporting documents such as landing papers or permanent resident card. Other conditions apply. See branch for details. This offer may be withdrawn at any time and is subject to change without notice.

® / TM Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada.

‡ All other trademarks are the property of their respective owner(s).