Articles with the Tag “Home Ownership”

-

Bank of Canada Rates Hold Steady: What You Could Do to Adjust Your Mortgage Payment

Interest rate uncertainty has been top of mind for many Canadians. Staying up to date on the interest rate environment can help you make informed mortgage decisions.

-

Another Bank of Canada Rate Cut May Pull More First-Time Home Buyers Off the Sidelines

On March 12 the BoC reduced its benchmark rate to 2.75%, its seventh straight cut. This reduction coupled with recent changes to mortgage rules, may entice more first-time home buyers to the spring market. Here’s how an FHSA could help.

-

Actions to Help Protect Your Home from Extreme Weather Events [Infographics]

Infographics on ways to help safeguard your home from extreme heat, flooding, and wildfires.

-

Mortgage Rates Going Up or Down? What the U.S. Fed Rate Cuts Mean for You

In December, the U.S. Federal Reserve lowered its overnight rate by 25 basis points, marking its third consecutive rate cut. But mortgage rates in the U.S. haven’t followed suit. In fact, rates have gone up – not down – since the Fed began lowering rates in September. Why? Here we look at what really affects…

-

Bank of Canada Interest Rate Announcement and New Mortgage Rules: What it Means for Homebuyers and Owners

The latest interest rate announcement, which revealed a reduction of 25 basis points, continues to signal good news for both current and prospective buyers — in the last year, rates have come down from 5% to 3%.

-

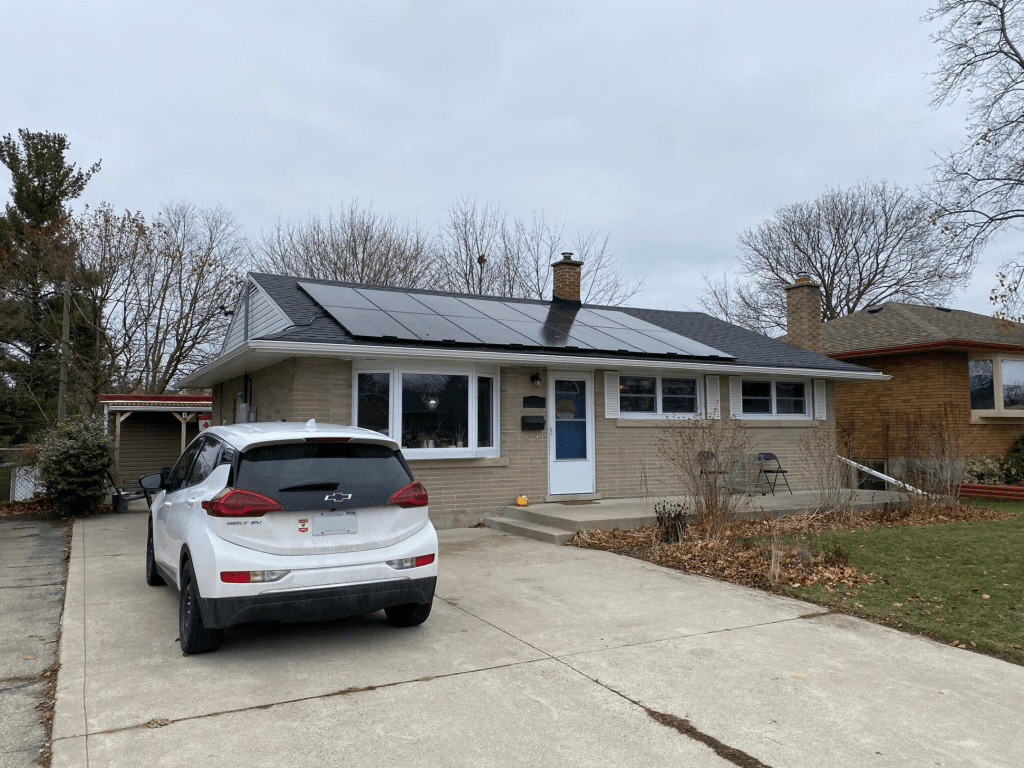

Switching to a Heat Pump: One Homeowner’s Experience

We spoke to Joseph Tanel about what it was like to buy and install a heat pump in his Cambridge, Ontario home. He discusses why he did it and shares advice for homeowners considering it.

-

Mortgage 101: Tackle Your Down Payment and Other New Home Costs

Saving for a down payment is one of the biggest steps to buying a home. Here are some tips to help build your savings.

-

Another Bank of Canada Rate Cut and New Mortgage Rules

In its December 11 announcement, the BoC reduced its benchmark rate to 3.25%. This reduction complements upcoming new mortgage rules, designed to help reduce the barriers that exist for first-time homebuyers and renewers.

-

Understanding the Bank of Canada’s Monetary Policy Report: What It Means for Everyday Canadians

The Bank of Canada’s (BoC) latest Monetary Policy Report provides a comprehensive look at how its monetary policy is shaping critical aspects of the Canadian economy including inflation, employment, economic growth, and consumer spending. Here are some of the key highlights of the report and what they mean for Canadians:

-

Investing in the U.S.: How to Set Yourself Up for Financial Success

Discover ways to invest in your U.S. lifestyle and make the most of financial opportunities south of the border.