Investments can go up and down in value. So, investing your money comes with some degree of risk. Learn more about your risk tolerance, how to use risk to your advantage, and the concept of risk and reward.

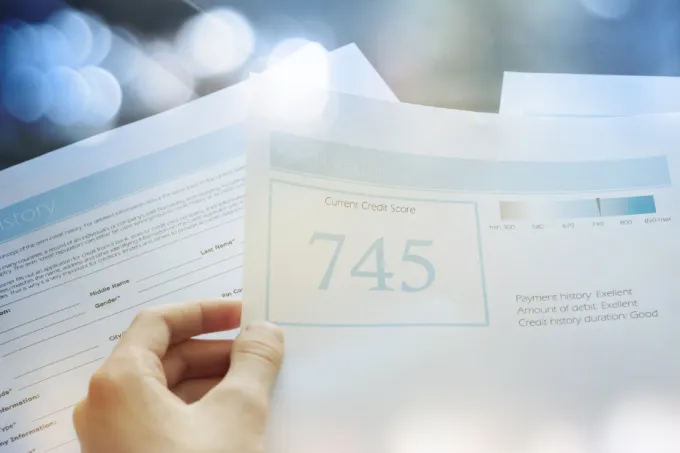

From approvals to interest rates. It's important to understand the significant role your credit score plays when borrowing money.

What to know when buying fixed income.

How much do you need to retire? The million-dollar myth is out. Instead, focus on your individual needs to determine your savings goal.

Let's bust four common myths about Will and estate planning so you can leave a legacy that is uniquely yours.

More From Understanding Risk

We all have biases when it comes to money. Behavioural economics tells us what they are and how to avoid them.

This is why having a variety of investments in your portfolio better prepares you to ride out ups and downs.

RESPs are savings plans that allow your contributions to grow tax free. Here's how to use them.