Published July 13, 2020 • 7 Min Read

Need cash to meet an immediate need, perhaps due to an unexpected job loss? You may be wondering whether it’s better to withdraw from your investments or take out a loan. What’s the best option to solve your cash crunch?

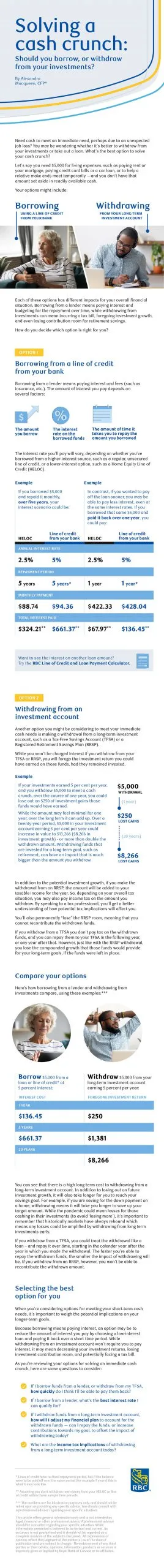

Let’s say you need $5,000 for living expenses, such as paying rent or your mortgage, paying credit card bills or a car loan, or to help a relative make ends meet temporarily —and you don’t have that amount set aside in readily available cash.

Your options might include borrowing, using line of credit from your bank, or withdrawing from your long-term investment account.

Each of these options has different impacts for your overall financial situation. Borrowing from a lender means paying interest and budgeting for the repayment over time, while withdrawing from investments can mean incurring a tax bill, foregoing investment growth, and even losing contribution room for retirement savings.

How Do You Decide Which Option Is Right for You?

Option 1: Borrowing from a line of credit from your bank

Borrowing from a lender means paying interest and fees (such as insurance, etc.). The amount of interest you pay depends on several factors: the amount you borrow, the interest rate on the borrowed funds, and the amount of time it takes you to repay the amount you borrowed.

The interest rate you’ll pay will vary, depending on whether you’ve borrowed from a higher-interest source, such as a regular, unsecured line of credit, or a lower-interest option, such as a Home Equity Line of Credit (HELOC).

For example, if you borrowed $5,000 and repaid it monthly, over five years, your interest scenario could be:

| Lending source | HELOC | Line of credit from your bank |

| Annual interest rate | 2.5% | 5% |

| Repayment period | 5 years | 5 years** |

| Monthly payment | $88.74 | $94.36 |

| Total interest paid | $324.21* | $661.37* |

The numbers are for illustrative purposes only, and should not be relied upon as providing any specific advice. You should consult with a professional advisor regarding your specific situation.

*Assuming you don’t withdraw new money from your HELOC or line of credit within this 5 year time period.

**Lines of credit have no fixed repayment period, but if the balance were to be paid off over the same period (for example 5 years) this is what it may look like.

In contrast, if you wanted to pay off the loan sooner, you may be able to pay less interest, even at the same interest rates. If you borrowed that same $5,000 and paid it back over one year, you could pay:

| Lending source | HELOC | Line of credit from your bank |

| Annual interest rate | 2.5% | 5% |

| Repayment period | 1 years | 1 years** |

| Monthly payment | $422.33 | $428.04 |

| Total interest paid | $67.97* | $136.45* |

Option 2: Withdrawing from an investment account

Another option you might be considering to meet your immediate cash needs is making a withdrawal from a long-term investment account, such as a Tax-Free Savings Account (TFSA) or a Registered Retirement Savings Plan (RRSP).

While you won’t be charged interest if you withdraw from your TFSA or RRSP, you will forego the investment return you could have earned on those funds, had they remained invested.

For example, if your investments earned 5 per cent per year, and you withdraw $5,000 to meet a cash crunch, over the course of one year, you could lose out on $250 of investment gains those funds would have earned.

While the amount may feel minimal for one year, over the long term it can add up. Over a twenty-year period, $5,000 in your investment account earning 5 per cent per year could increase in value to $13,266 ($8,266 in investment growth) – or more than double the withdrawn amount. Withdrawing funds that are invested for a long-term goal, such as retirement, can have an impact that is much bigger than the amount you withdraw.

In addition to the potential investment growth, if you make the withdrawal from an RRSP, the amount will be added to your taxable income for the year. So, depending on your overall tax situation, you may also pay income tax on the amount you withdraw. By speaking to a tax expert, you’ll get a better understanding of how potential tax implications will affect you.

You’ll also permanently “lose” the RRSP room, meaning that you cannot recontribute the withdrawn funds.

If you withdraw from a TFSA you don’t pay tax on the withdrawn funds, and you can repay them to your TFSA in the following year, or any year after that. However, just like with the RRSP withdrawal, you lose the compounded growth that those funds would provide for your long-term goals, if the funds were left in place.

Here’s how borrowing from a lender and withdrawing from investments compare, using these examples:

| Borrow $5,000 from a loan or line of credit at 5 percent interest: |

|

| Withdraw $5,000 from your long-term investment account earning 5 percent per year: |

|

The numbers are for illustrative purposes only, and should not be relied upon as providing any specific advice. You should consult with a professional advisor regarding your specific situation.

You can see that there is a high long-term cost to withdrawing from a long-term investment account. In addition to losing out on future investment growth, it will also take longer for you to reach your savings goal. For example, if you are saving for the down payment on a home, withdrawing means it will take you longer to save up your target amount. While the pandemic could mean losses for those cashing in their investments (to avoid ‘losing more’), it’s important to remember that historically markets have always rebound which means any losses could be amplified by withdrawing from long term investments early.

If you withdraw from a TFSA, you could treat the withdrawal like a loan – and repay it over time, starting in the calendar year after the year in which you made the withdrawal. The faster you’re able to repay the withdrawn funds, the smaller the impact of withdrawing will be. If you withdraw from an RRSP, however, you won’t be able to recontribute the withdrawn amount.

Choosing the Best Option for You

When you’re considering options for meeting your short-term cash needs, it’s important to weigh the potential implications on your longer-term goals.

Because borrowing means paying interest, an option may be to reduce the amount of interest you pay by choosing a low-interest loan and paying it back over a short time period. While withdrawing from an investment account won’t require you to pay interest, it may mean decreasing your investment returns, losing investment contribution room, and potentially facing a tax bill.

As you’re reviewing your options for solving an immediate cash crunch, here are some questions to consider:

- If I borrow funds from a lender, or withdraw from my TFSA, how quickly do I think I’ll be able to pay them back?

- If I borrow from a lender, what’s the best interest rate I can qualify for?

- If I withdraw funds from a long-term investment account, how will I adjust my financial plan to account for the withdrawn funds — can I repay the funds, or increase contributions towards my goal, to offset the impact of withdrawing today?

- What are the income tax implications of withdrawing from a long-term investment account today?

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. Information available on the RBC Direct Investing website is intended for access by residents of Canada only, and should not be accessed from any jurisdiction outside Canada.

Share This Article