There are many ways to borrow money. Learn how to match your goals with the loans and lines of credit that are right for you.

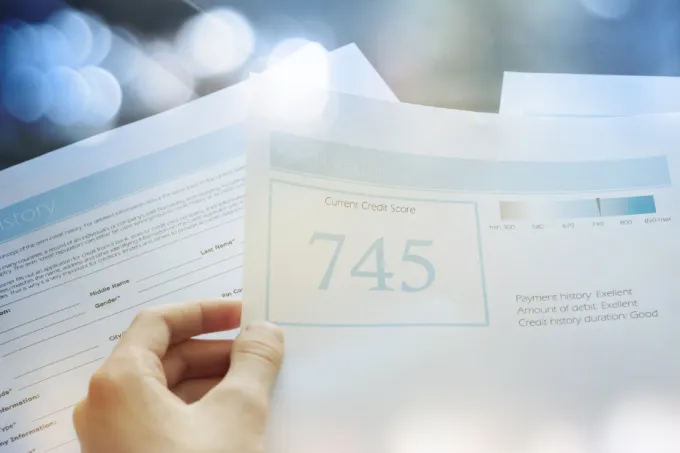

From approvals to interest rates. It's important to understand the significant role your credit score plays when borrowing money.

Understand how credit works in Canada to help you build your financial future.

Helpful strategies for paying down your debt, no matter what your financial situation is.

Canadians now have three major registered investments accounts to choose from. Here’s how to determine which ones best meet your needs.

More From Understanding Loans

Should you pay down debt or save? With the right debt management strategy, it's possible to do both to reach your financial goals.

Buying a home is a happy choice for many families, but it’s a big investment. Learn how optional mortgage protection insurance can help safeguard…

From approvals to interest rates. It's important to understand the significant role your credit score plays when borrowing money.

A glossary of commonly used for mortgages (and applications) to help you find one that fits your needs and lifestyle.

Skipping a mortgage payment can offer immediate financial relief. But is it the right move for you? RBC Advisors share the pros and cons.

A home equity line of credit may be a way for you to access U.S. cash from your U.S. property.