There are many ways to borrow money. Learn how to match your goals with the loans and lines of credit that are right for you.

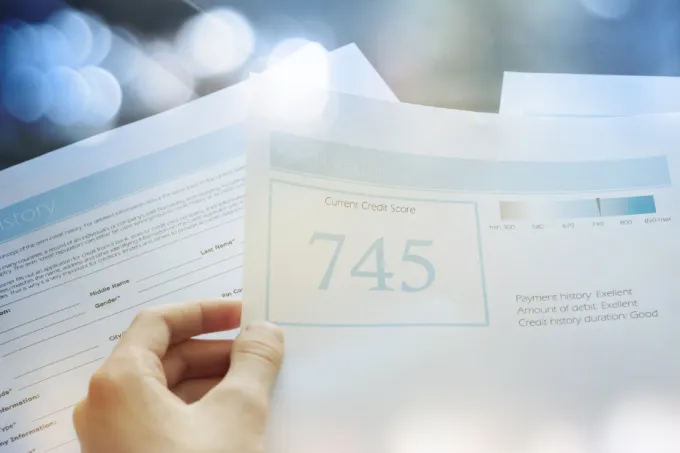

From approvals to interest rates. It's important to understand the significant role your credit score plays when borrowing money.

Understand how credit works in Canada to help you build your financial future.

Helpful strategies for paying down your debt, no matter what your financial situation is.

Understanding the different types of borrowing options can help you determine if one is right for you.

More From Understanding Loans

Learn how to get the most out of your line of credit.

A line of credit can be a powerful financial tool, if used properly.

A clear guide to student loans, grants, and credit options to help you pay for post-secondary education in Canada.

Thinking about making a big purchase? Understand the basics of borrowing and how the loan process works.

Debt can feel overwhelming and a heavy burden to carry. Debt consolidation may be the right financial strategy to help lighten your load.

The best way to conquer a big task is to break it into smaller ones. Follow these steps to build an efficient and effective repayment plan.