Published October 29, 2024 • 8 Min Read

TLDR

-

Learn how to build a down payment to purchase your first home.

-

Explore using funds from your home country and gifts from relatives to boost your savings.

-

Leverage RRSP, TFSA and FHSA accounts to grow your savings tax-free.

-

Build your credit score to secure a mortgage with better terms and lower interest rates.

Homeownership is one of the most meaningful ways we plant roots in a community and declare we are here to stay. For many newcomers, buying their first home in Canada is when they finally feel truly at home in their new country. But it takes a lot of planning and saving to bring this dream to fruition. In this article, you will learn how to save for a down payment — and financially prepare to buy your own home in Canada.

Buying a home in Canada

To achieve your goal of owning a home, you first need to understand Canada’s real estate market. You also need to understand how home financing works in Canada, including the processes, guidelines and options available for buying a home.

What is a mortgage?

A mortgage is a loan from a bank or a lender specifically for the purpose of buying property. It enables a potential buyer to purchase a home or a property without having to pay the full amount by themselves. You’ll still need to pay a down payment of at least five to twenty per cent, depending on the purchase price of the house and your repayment plan. Following that, you repay the principal plus interest of the mortgage, in installments over its amortization period (15 to 30 years).

In Canada, mortgages can have a variable interest rate, which fluctuates depending on the prime lending rate, or a fixed rate, which is applicable for a pre-defined time period (called a term), which can range from 6 months to five years.

Learn more about RBC mortgage options for newcomers to Canada

What is a down payment?

You will need to have a down payment to secure a mortgage. This is the upfront cash investment that is required to buy a home. It is a percentage of the overall cost of the property. The larger your down payment, the smaller the mortgage amount you will pay interest on — and the sooner you can pay off your mortgage.

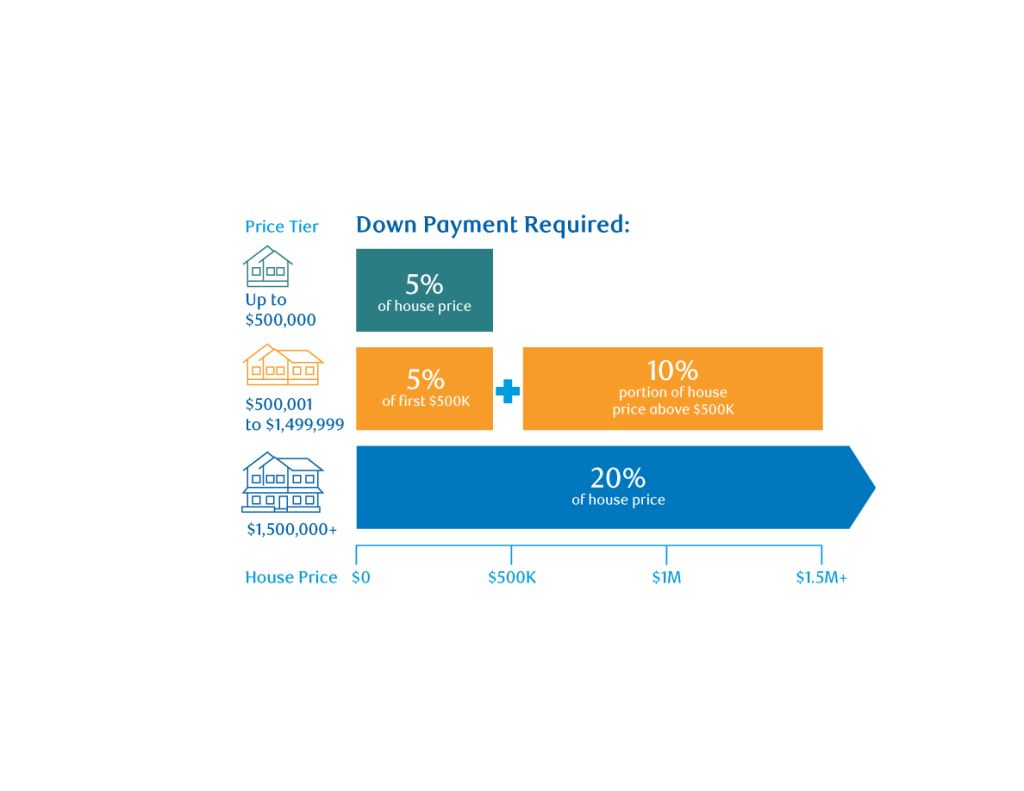

What is the minimum down payment in Canada?

The minimum down payment in Canada depends on the property’s price. For homes priced at $500,000 or less, the required minimum down payment is 5% of the property’s price. For homes priced above $500,000 but below $1 million, you must pay 5% on the first $500,000 and then 10% on the amount above $500,000. For homes priced at $1 million or more, you must pay 20% of the home’s price as a down payment.

For example: If you purchase a home for $450,000, your down payment is 5% of $450,000, which is $22,500. If you buy a home that costs $700,000, your down payment is 5% of $500,000 ($25,000) and 10% of the remaining $200,000 ($20,000) for a total of $45,000. If you purchase a home that costs $1 million, your down payment is 20%, which is $200,000.

How newcomers can save for a down payment to buy a home in Canada

Saving for a down payment does not have to be complicated. Once you’ve estimated roughly how much you’ll need to provide as a down payment to purchase the type of home you plan on buying, with the right tools and a consistent action plan, you can achieve a down payment faster than you think.

Budgeting to save for your down payment

The first step in saving for a down payment is to create a budget that aligns with your income and expenses. A clear understanding of your financial situation helps you set realistic savings goals.

-

Pay your goals first: Many financial advisers suggest setting up automatic transfers to a dedicated savings or investment account as soon as you get paid. This is known as “paying yourself first.” It ensures you prioritise savings before you spend on other things.

-

Insights from NOMI: RBC clients can use the Nomi Find and Save feature to track and analyse their spending, and get personalised budget recommendations. By analysing your financial habits, NOMI can help you identify areas where you can cut back and save more towards your goal of home ownership.

-

Saving for your future in Canada: Some newcomers provide financial support to loved ones back home, leaving fewer funds available for their Canadian savings goals. Having open conversations with your family can help manage their expectations of support while also allowing you to put some of your savings towards a down payment on your future home.

-

Speak with a financial adviser: Everyone’s financial situation is different, and a financial adviser can help you develop a customised savings plan. They can review your budget, recommend savings strategies, and ensure you’re on the right track to achieve your down payment goals.

You can schedule an appointment with an RBC Financial Advisor to make a customized savings plan based on your unique situation and goal.

Bring funds from overseas

Some newcomers to Canada have funds from accounts and investments in their home country. If you have assets abroad, you can use them to support your down payment in Canada. However, be aware of Canadian tax rules and regulations that apply to funds transferred from overseas. A financial adviser or an accountant can provide information to help you navigate cross-border financial regulations.

-

Selling overseas property: If you’ve sold property in another country, consult a financial adviser to understand the tax implications in Canada. You may need to report the funds to Canadian tax authorities.

-

Gifts from relatives: Family members might want to help you with a financial gift for your down payment. If this is so, it’s essential to follow Canadian rules regarding gifts and ensure all documentation is in order. Lenders may ask for proof of the gift to verify that it is not a loan.

Grow your savings by investing

Once you have decided to start your homeownership journey, look for practical ways to save towards this goal. Consider strategic investments instead of letting your savings sit in a regular bank account. Here are a few tax-efficient ways to save:

-

Open a First Home Savings Account (FHSA): A First Home Savings Account (FHSA) is a registered account designed specifically for first-time homebuyers. You can contribute up to $8,000 each year tax-free, (up to a total of $40,000), making it an excellent option to grow your savings for the purpose of a down payment.

-

Leverage RRSP and TFSA: Contributing to a Registered Retirement Savings Plan (RRSP) or a Tax-Free Savings Account (TFSA) allows your savings to grow tax-free. When you are ready to purchase a home, you can withdraw funds to put towards a down payment without paying tax. Some rules apply, so be sure to take these into account when making your plan.

Build your credit score

In Canada, your credit score is like your financial reputation. It informs lenders of your ability to manage your personal finances and used by banks and other lenders to determine whether or not they are willing to lend you funds, and at what rates.

As a newcomer, you will likely be building your credit score from scratch, so be sure to learn about and follow credit best practices to build up a strong credit score, which will make you eligible for a mortgage at an advantageous rate.

An excellent start to building your credit profile is to get a Canadian credit card and demonstrate you can use this credit responsibly by making timely payments and keeping a relatively low balance. Over time, this will help you build a positive credit history.

Learn how to choose the right credit card as a newcomer to Canada

A good credit score not only makes it easier to qualify for a mortgage but can also help you secure a lower interest rate, which saves you money in the long run.

Build the foundation for homeownership in Canada

Saving for a down payment to buy your first home in Canada can seem challenging, but it’s achievable with the right strategies and tools. By budgeting carefully, bringing in overseas funds and growing your savings through investments, you can build the foundation for homeownership in Canada.

For more helpful advice on easing the process of buying your first home in Canada, please visit the RBC Newcomer Hub. With the right planning and resources, your dream of owning a home in Canada can be a reality sooner than you think!

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article