Published February 1, 2023 • 6 Min Read

This article was originally published on RBC Global Asset Management.

Recession is one of those terms you hear a lot in tough economic times. Yet what exactly does it mean?

The most common definition is two quarters in a row of declining Gross Domestic Product (GDP). GDP is a measure of the value of all the goods and services a country produces and sells in a specific time period. Think of the food you buy, the work you do, every time you get a haircut, order in a meal or take a vacation. Or the equipment a business buys, the staff they hire and what they sell – all these things and more are part of GDP.

Yet even when a country sees a drop in GDP across two quarters, it’s not always considered a true recession. This was the case in the U.S. in 2022. Why?

What makes a recession? A deeper dive

In practice, the experts look at more than GDP to assess what’s going on in the economy. For example, they consider:

Real income

This number measures how much people earn, adjusted for inflation. It’s not just the pay you receive. It’s about how far your money goes. When real income drops, you can’t afford to buy as much. When this happens to a lot of people, demand for goods and services falls.

Employment

Combined with real income, this number gives us a clearer picture of the financial health of the consumer. Are they working and earning money they can spend? This is important since consumer spending makes up 65-70% of GDP.

Industrial production

This number can help us determine if a recession is starting. When companies see demand is falling, they may cut back their production. This lowers GDP – which in turn drives the economy closer to recession.

Wholesale and retail sales

These numbers can be used to assess the spending of consumers.

These indicators work together to help us understand the business cycle – including the stage that’s called a recession. Economists look at all these things and more to understand the expansion and contraction in economic activity over time.

Are we heading into a recession in 2023? What might that look like?

Economic activity began to slow in late 2022 while interest rates continued to rise. However, there’s no indication yet that a recession has arrived. Employment remains strong. Consumers and businesses are sitting on healthy cash balances. Industrial production is rising.

While it’s likely we may experience a recession in 2023, our Chief Economist Eric Lascelles believes that employment may remain stronger than in previous recessions. This could lead to a shorter, shallow recession. A smaller trough would then set off the next wave of recovery and growth in the economy.

How does a recession fit into the business cycle?

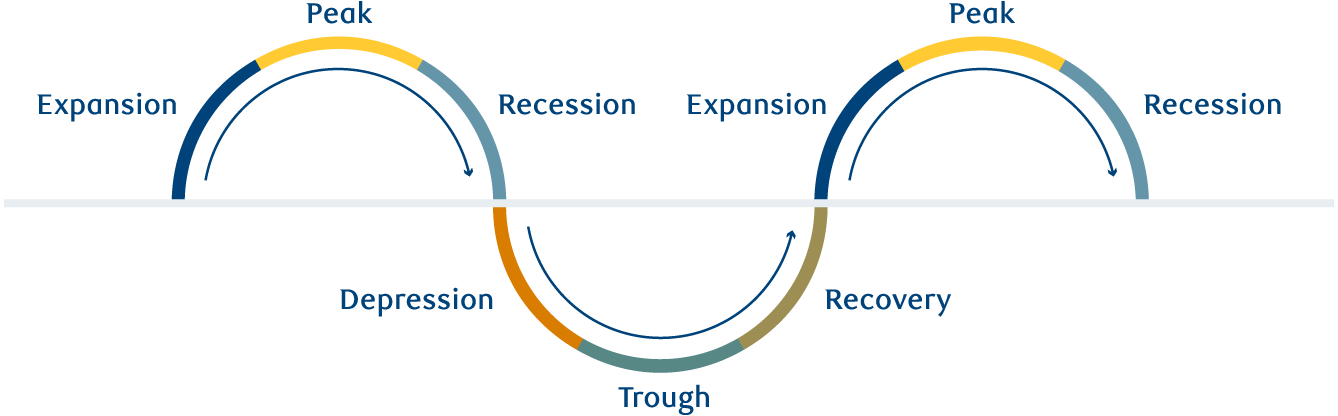

Think of the business cycle as a natural cycle, like the four seasons – although often stretched out over years, rather than months. Roughly speaking, the business cycle is marked by six different stages as shown below. How long each stage lasts and its impact varies from one cycle to the next.

Source: RBC GAM

Each stage of the cycle reflects a different level of economic activity. By the time the business cycle passes through expansion and into the “peak,” we often see areas of the economy beginning to overheat. This happens when the economy starts to run at a pace that it can’t sustain. There simply isn’t enough supply to meet all the demand. This often fuels inflation, as scarce supply can drive prices up.

In response, central banks like the Bank of Canada or U.S. Federal Reserve may raise interest rates. This is called tightening monetary policy. It’s designed to slow consumer spending and bring economic activity back into balance.

What typically follows is a recession, as tighter conditions often reduce demand for goods and services. As consumers spend less, this impacts how much companies produce, their willingness and capacity to hire, and ultimately leads to a general slowdown in economic activity.

Do all recessions follow the same path?

No. The causes of a recession tend to affect its length and depth. For example, there was a recession in 2020 at the height of the COVID-19 pandemic. It was exceptionally deep, due to the widespread lockdowns. But it didn’t last long in many countries due to the actions of government and central banks, and the rapid reopening of economies.

The recession that happened with the 2008 financial crisis was different. It was caused when excess borrowing met with rising interest rates. This added to other issues in the housing market as people began to default on their mortgages. The resulting credit crisis spread globally and took years to resolve. Compared to typical recessions, the 2008 financial crisis was both exceptionally deep and long.

Whatever lies ahead for the economy, we know that business cycles will continue to come and go. So will recessions. They are an uncomfortable part of the business cycle.

How do recessions affect investors?

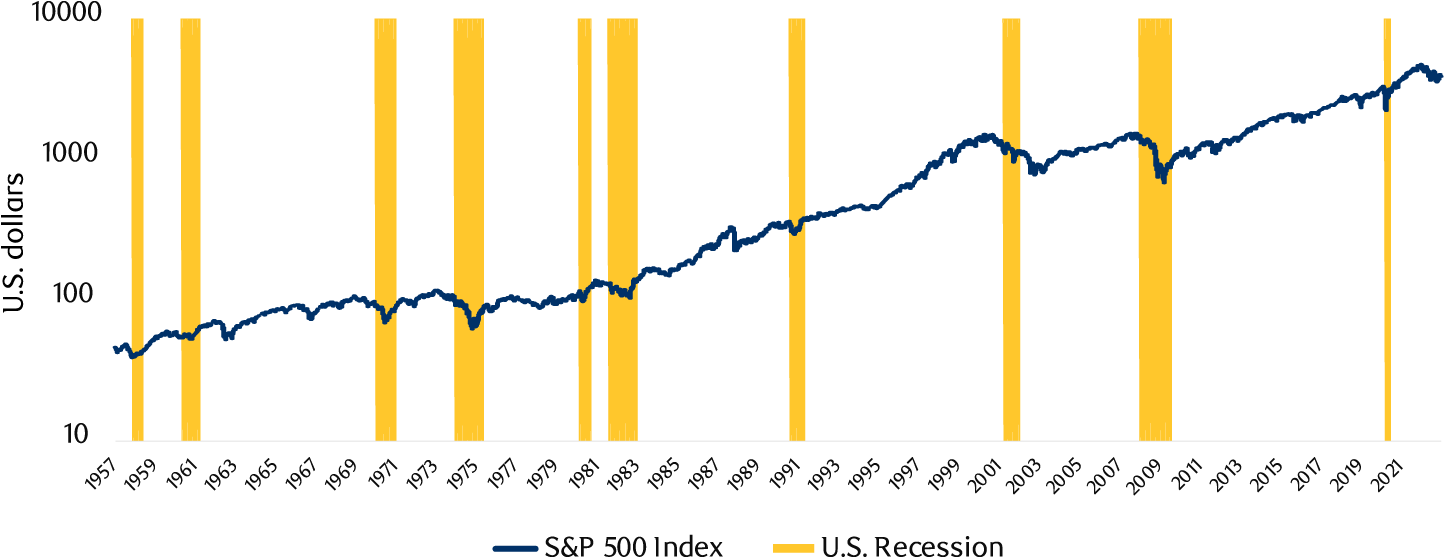

Recessions and bear markets tend to go hand in hand. Investors will often feel short-term pain. But recessions don’t usually disrupt investors over the long term. As you can see in the chart below, historically markets have risen over time.

U.S. recessions and equity bear markets go hand in hand

Source: RBC GAM, Bloomberg. For the period of January 1, 1957 to December 15, 2022. Shown on a logarithmic scale. This graph does not reflect transaction costs, investment management fees or taxes. If such costs and fees were reflected, returns would be lower. An investment cannot be made directly into an index.

To sum it up, the economy and businesses are constantly adapting to changing conditions. Sometimes that process is painful. But if recessions are painful, they are typically very short. Over the years included in the chart above, the economy was in recession for a total amount of time equivalent to 9.1 years. That’s less than 15% of the time.

That’s good news for investors who stay in the market for the long term – whether we’re in a recession now or not.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article