Published July 24, 2023 • 5 Min Read

Investing in fixed income can often be an afterthought.

In the investment world, bonds are typically overshadowed by riskier assets like stocks. You rarely see bond indexes flicker across your TV screen. Plus, there can be some head-scratching math: Why do bond prices fall when yields rise?

Fixed income securities such as bonds may seem dull. But their power shouldn’t be underestimated. With recession fears lingering and bond returns looking attractive again, the asset diversification they provide to investors has garnered renewed attention.

If you’re looking to add fixed income to your portfolio, here are four things to know.

What’s fixed income?

Fixed income is an umbrella term for a variety of investment securities which pay the investor a fixed interest amount on a fixed schedule until their maturity date. When you buy a bond, you lend your money to entities like governments and corporations, which promise to pay your principal back – plus interest.

Typically considered lower-risk, fixed income has historically moved in the opposite direction of stocks, providing downside protection within an investor’s portfolio.

What are the benefits of fixed income?

Fixed income investments provide benefits aside from portfolio diversification. Knowing how much you’ll earn through the certainty of bonds can take some of the stress out of planning your down payment, your child’s education savings or retirement income.

But it’s not just about regular income. “Fixed income can serve many purposes for investors,” says Brigitte Felx, a senior regional manager at RBC Global Asset Management. “It provides a predictable source of income, helps preserve capital and adds diversification to a portfolio as they usually tend not to move in the same direction as other asset classes,” she says.

Indeed, a well-balanced portfolio includes allocations to both equities and fixed income, aligned to an investor’s risk profile. A properly diversified fixed income allocation, such as a mutual fund or exchange-traded fund (ETF), can help an investor smooth out their long-term investing experience to help them meet their financial goals.

What impacts bonds?

Bond investors watch interest rates closely. That’s because when rates rise, bond prices fall.

Suppose you’ve bought a five-year bond for $1,000. With a five per cent coupon rate, the bond will earn $250 in income if held to maturity. Say, a year from now, interest rates go up to eight per cent, meaning a new five-year, $1,000 bond would generate $400 in income. Since bonds are traded, your existing bond would become less attractive in the marketplace; not a big worry if you held it to maturity, but you’d be faced with lower prices if you wanted to sell.

Why now?

According to data from New York University, between 1918 and 2022, bonds and stocks almost always moved in opposite directions. In an unusual development, bonds and stocks declined in tandem in 2022, driven by a combination of factors like inflation and successive interest rate hikes. A simultaneous drop in both asset classes is rare.

Today, fixed income appears to have turned a corner.

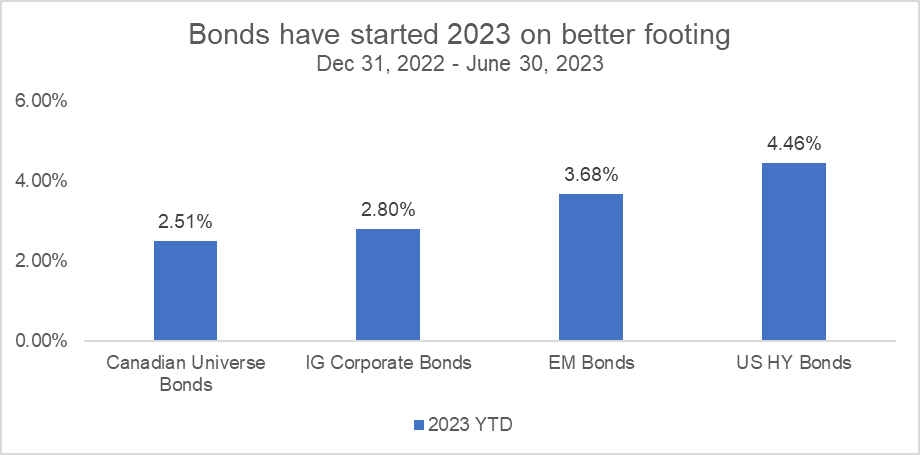

Based on market data compiled by RBC Global Asset Management, fixed-income securities were back on investors’ radars in mid-October 2022 and it appears bonds have been on better footing for the first half of 2023. (The chart below shows year-to-date returns of various bonds).

Source: Morningstar Direct, Bloomberg. US HY Bonds = ICE BofA US High Yield TR Index, Canadian Universe Bonds = FTSE Canada Universe Bond Index, Investment Grade (IG) Corporate Bonds = ICE BofA US Corporate TR Index, Emerging Market (EM) Bonds = JPM EMBI Global Diversified TR Index. Returns are in Canadian dollars. The graph does not reflect transaction costs, investment management fees or taxes. If such costs and fees were reflected, returns would be lower. Past performance is not a guarantee of future results. An investment cannot be made directly into an index.

Know what’s right for you

There are a few things you should consider before investing in fixed income.

“What are your goals and what’s the income level you hope to achieve? Most importantly, what is your time horizon and risk tolerance?” Felx says. She adds that you should consider the full suite of fixed income products available to you, including mutual funds and ETFs.

More broadly, Felx says it’s important to focus on the long term.

“It’s important to tune out the headline noise. Long-term investing involves defining your goals and putting a strategy in place that fits your situation and tolerance for risk,” she says. “Markets may be choppy now, but over time, investing in fixed income solutions can be a good way to ensure your portfolio remains resilient and on track to achieve your goals.”

Financial planning services and investment advice are provided by Royal Mutual Funds Inc. (RMFI). RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article