Published March 20, 2025 • 6 Min Read

TLDR

-

Market volatility can cause investors stress, and understandably so, as the markets make dramatic moves in response to current events.

-

However, in many cases, the best reaction is no reaction—research shows that investors who stick to their long-term plans tend to fare better.

-

Maintaining discipline, diversifying and rebalancing your portfolio, using time to your advantage and continuing to invest can all help mitigate the impact of a volatile market.

-

Understanding more about your reactions to market moves can also help.

While market volatility is an expected part of investing, dramatic market shifts can certainly lead to some sleepless nights. Geopolitical events, inflationary pressures, and economic news can all cause financial markets to swing, sometimes significantly.

For investors, the urge to react is strong—and understandably so. Yet, history shows time and again that you’re more likely to achieve your long-term investment goals if you have a plan and stick with it. This means weathering market fluctuations and playing the long game, even during uncertain times.

Though it can be challenging, staying the course is critical. Veering from a carefully thought-out plan can negatively impact your portfolio’s long-term performance and progress toward your financial goals.

What is volatility?

Volatility is defined as the price movement of an investment. The more the price changes, the greater the volatility. All investments include some level of volatility, though it varies by asset class. For instance, cash is typically less volatile than equities, which experience more frequent and wide-ranging swings. Some of the most volatile asset classes include cryptocurrency, commodities and real estate.

What does a highly volatile market look like?

As previously noted, markets may go through periods of volatility in response to geopolitical, economic or other events. A highly volatile market is characterized by:

-

Erratic market movements. Equity markets may be hitting record highs and lows within short time periods.

-

Hard-to-predict price changes. Individual equities may also reach new highs and lows, and stocks may be trading far outside their typical price range.

-

A high volume of trading activity. In volatile markets, investors buy and sell at high rates, and there’s often an imbalance of trade orders, ultimately impacting prices.

How can market volatility impact your investments?

Generally, the more volatile the market conditions, the more risk investors face. A volatile market can increase the potential of portfolio losses, especially if you’re heavily invested in impacted equities or sectors. It can also increase your downside risk as portfolio allocations shift with the swinging market. That said, some investors can find opportunities in volatile markets, such as buying equities at lower prices.

Strategies to manage your investments in a volatile market

Here are five strategies to help you mitigate the effects of a volatile market and feel more confident about reaching your long-term goals.

1. Maintain discipline

Making significant portfolio changes, such as moving in and out of the markets in response to global or economic events, can have a negative impact on achieving your financial goals. The old investment adage: Time in the market is more important than timing the market is especially applicable in periods of high volatility. Because it’s impossible to “time the market” (know the best time to buy or sell an investment), staying invested can help smooth the impact of a rough market. Learn more about why it’s best to stay invested.

2. Diversify your portfolio

Diversification, where you hold a mix of investments, has long been considered the golden rule of investing. It remains key to helping you navigate market swings and reduce your overall risk. Learn why it’s essential to spread your investments across different asset classes and even regions.

3. Regularly rebalance

Market swings – even smaller ones – can often cause a shift in the mix of investments you hold in your portfolio (also known as portfolio drift). This can lead to a different mix of investments than you originally intended. For example, if 40 per cent of your portfolio is invested in equities that grow by 10 per cent each year, that changes the overall mix of your portfolio. It will a higher proportion invested in equities, which may not align with your broader approach.

If you are a self-directed investor, at RBC Direct Investing, for example, you probably keep an eye on drift within your portfolio. At RBC InvestEase, portfolios are automatically rebalanced. Learn more about the impact of portfolio drift or book an appointment with MyAdvisor or RBC Online Banking to discuss the rebalancing process.

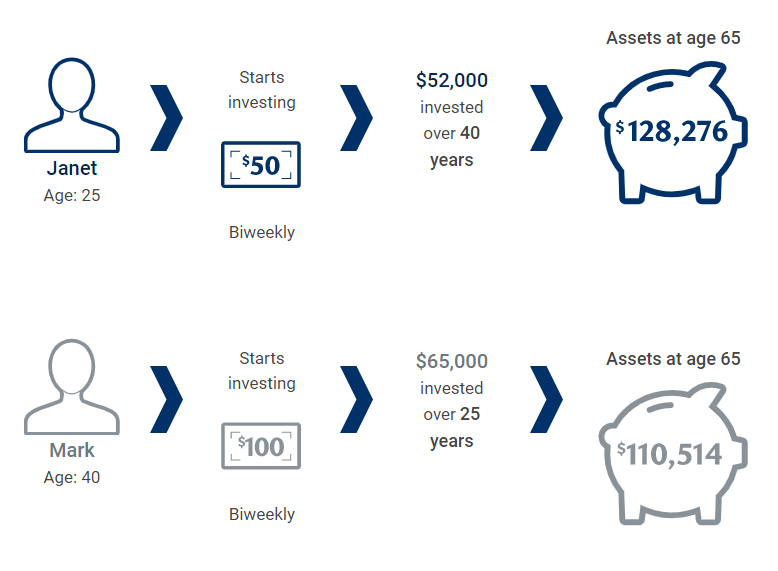

4. Use time to your advantage

One investing rule of thumb is to start as early as possible. That’s because time is one of the most powerful elements in your investment plan.

The above example is for illustrative purposes only and not indicative of any investment. Account value in this example assumes a 4% annual return. Source: RBC Global Asset Management Inc.

Learn about the power of compounding and how regular savings can really add up.

5. Invest regularly

Investing a fixed amount on a regular basis helps keep your investment plan on track through all types of market conditions. See the example below to get a sense of how regular investments can add up over time.

Assumes a 5% Annualized rate of return. Source: RBC Global Asset Management Inc. The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the mutual fund or returns on investment in the mutual fund.

Learn more about how dollar-cost averaging works and why it’s important to pay yourself first.

How to keep emotions in check during market volatility

A volatile market can lead to heightened emotions. But you don’t want to let fear—or, conversely, excitement—drive short-term decisions that are misaligned with your long-term goals. To ensure that your feelings don’t impact your investments, consider:

-

Sticking to your long-term plan. Stay the course, even when the waters get choppy, and trust that the plan you decided on is still the right path.

-

Checking how often you look at your portfolio. If frequent updates are causing you stress, consider reducing how frequently you check your portfolio so you’re not caught up in short-term market moves.

-

Understand feelings about losses. The concept of loss aversion states that experiencing losses hurts more than experiencing gains of an equal value. Remember this context as you navigate near-term uncertainty.

Market volatility can make for a bumpy ride in the short term. But by keeping your long-term strategy in mind, you can avoid reactive decisions and stay focused on your future. Have additional questions about market volatility? Schedule an appointment with an RBC advisor today.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article