Published September 1, 2023 • 3 Min Read

This article was produced with files from RBC Global Asset Management.

We all hope to retire with enough money to enjoy a secure and enjoyable retirement. For some, that might mean heading south each winter; for others, spending more time with family. How you spend your retirement is a personal decision. But the question is, how do you save enough to comfortably retire on your own terms? The short answer: consistency.

Set it and forget it

A regular investment plan allows you to choose when, how often and how much you contribute to your investments throughout the year. This helps ensure that your savings goals remain a priority throughout the entire year, and not only during certain periods – like the yearly RRSP contribution deadline that causes a flurry of last-minute transfers. Setting up a pre-authorized contribution plan, also known as a PAC, let’s you automate your investments so you don’t have to think about it regularly. Frequent contributions from your PAC can really add up. Even more so if you gradually increase the amount you contribute each year.

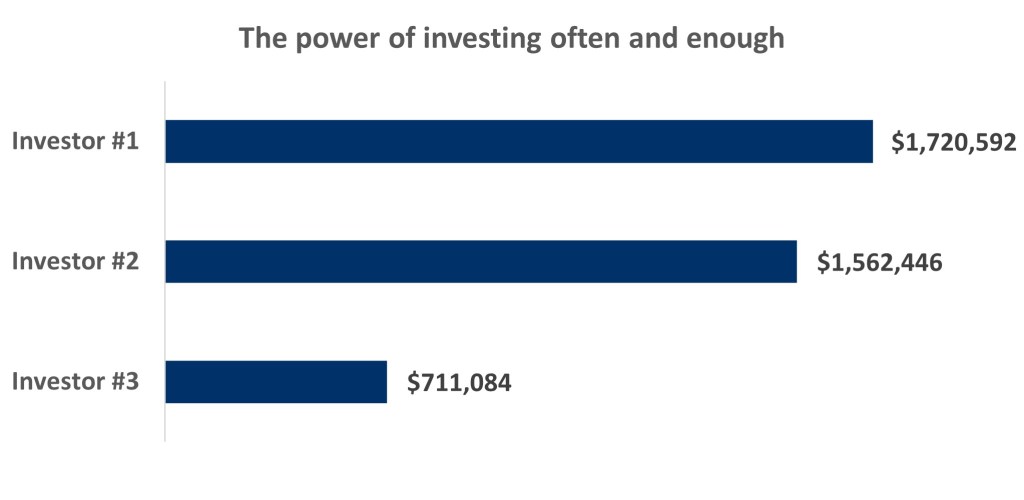

Let’s explore this further and examine how different choices investors make can change the amount of wealth that accumulates over time.

Here are three hypothetical investors who invest in markets at the end of each month. They all started a PAC in January 1990 and each investor takes a different approach.

-

Investor #1: Invests $250 each month and increases this amount by $250 every 5 years.

-

Investor # 2: Invests $250 each month and increases this amount by $250 every 5 years until they reach a $1000 contribution per month.

-

Investor # 3: Invests $250 each month but decides not to increase their contributions throughout the period.

Source: RBC GAM, Morningstar. Performance based on hypothetical investments in the S&P 500 Total Return Index USD. For the period of January 1, 1990 to June 30, 2023. Investor #1: Invests $250 each month and increases this amount by $250 every 5 years. Investor # 2: Invests $250 each month and increases this amount by $250 every 5 years until they reach a $1000 contribution per month. Investor # 3: Invests $250 each month. The graph does not reflect transaction costs, investment management fees or taxes. If such costs and fees were reflected, returns would be lower. Past performance is not a guarantee of future results. An investment cannot be made directly into an index.

Key takeaways for investors

-

If your income is increasing more than your expenses, investing the extra savings can add to your wealth over time.

-

During this period there were many challenging times in the market, including, for example, geopolitical concerns, the global financial crisis of 2008 and interest-rate shifts. Yet, in the end consistency pays off – especially for investor # 1.

-

While all these investors invested regularly, it’s also important to increase your savings whenever possible to continue building your asset base.

Even though the results varied in the examples above, they all stuck to their investment plan. This consistency is one of the keys to success. While unexpected life events are inevitable and financial plans may have to shift at times to meet changing needs, sticking to a schedule and boosting your contributions incrementally over time increases your chance of meeting your long-term retirement goals.

As Warren Buffet once said, “Someone’s sitting in the shade today because someone planted a tree a long time ago.”

Investment advice is provided by Royal Mutual Funds Inc. (RMFI). RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. Information available on the RBC Direct Investing website is intended for access by residents of Canada only, and should not be accessed from any jurisdiction outside Canada.

Share This Article