Published April 20, 2023 • 3 Min Read

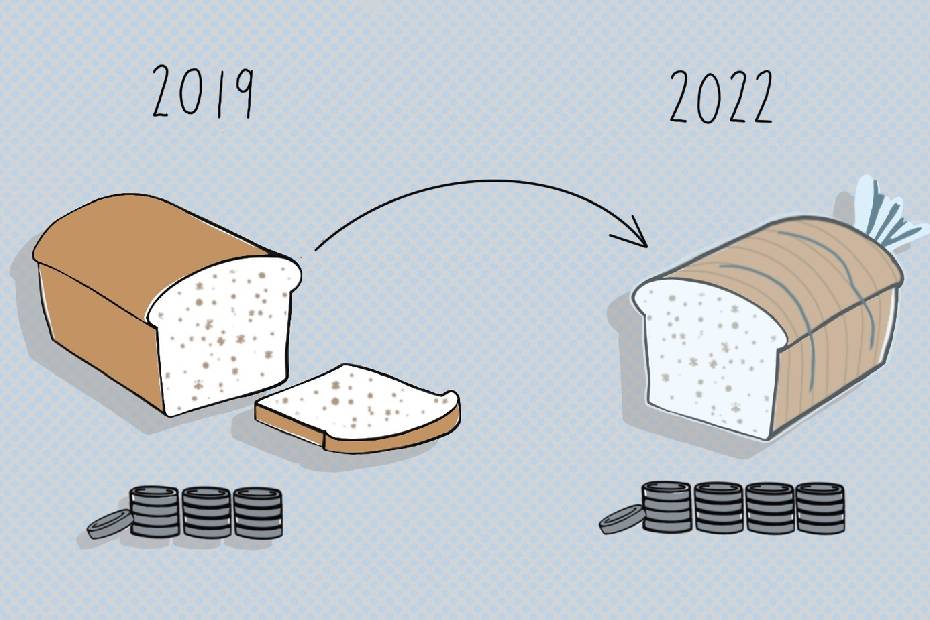

If you bought a loaf of bread for $3.50 in 2021, the same loaf might set you back $4.10 in 2022. That 17.1 per cent jump is what’s known as inflation.

Inflation reduces your purchasing power. That’s because a dollar buys you less today than it did in the past.

The shopping basket: Measuring inflation

Inflation is commonly measured by the Consumer Price Index (CPI). According to Statistics Canada, CPI “is an indicator of changes in consumer prices experienced by Canadians. It is obtained by comparing, over time, the cost of a fixed basket of goods and services purchased by consumers.”

Given that the CPI includes over 700 goods and services, this means those categories, and their assigned weights (what percentage of household spending goes toward said product) are refreshed on an annual basis to keep up with changes in consumption.

Keep an eye on the heat: Monitoring inflation

The responsibility of fighting inflation falls primarily on the Bank of Canada.

When inflation is high, the central bank often increases interest rates to subdue demand. Higher mortgage payments, for example, mean households have to tighten their belts and spend less on other items, decreasing demand and prices.

Think of it like this. When you’re poaching an egg, you want the water to be hot enough to simmer at a gentle boil but not so hot that it’s bubbling over. That’s sort of like the monetary policy. When inflation runs hot, the Bank of Canada “turns down the heat” by jacking up the interest rates.

Similarly, when the economy slows, the Bank of Canada can “turn up the heat” by cutting interest rates to spur economic growth. A perfectly poached egg in economic terms involves an economy operating at near full employment with inflation at the target range between 1 to 2 per cent.

What causes inflation?

Inflation can be hard on a bank account. It eats up purchasing power, pushing the cost of living higher.

When production costs rise, inflation can jump in tandem. When Russia invaded Ukraine in 2022, wheat supplies were disrupted, and the price of bread shot up around the world. Meanwhile, if increased demand suddenly eclipses supply, inflation will likely rise as well.

Inflation, in simple economic parlance, happens when too much money is chasing too few goods.

Did you know?

When price swings go haywire, you get hyperinflation, usually defined as a price increase of more than 50 per cent a month.

Some consider tulipmania during the 17th century one of the earliest examples of hyperinflation. The Dutch purchased tulips at unprecedented rates, causing prices to spike. When the price peaked, a single tulip then was many times the average person’s annual salary.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article