Published August 13, 2024 • 5 Min Read

TLDR

-

Many municipalities across Canada have loosened zoning bylaws, allowing for multiple housing units to be added to a residential property

-

You may be able to convert your existing home or add a new housing unit to your land

-

Housing units may include a garden suite, laneway home, basement apartment or above-garage suite

-

The costs, requirements and number of units you can build will depend on your specific location

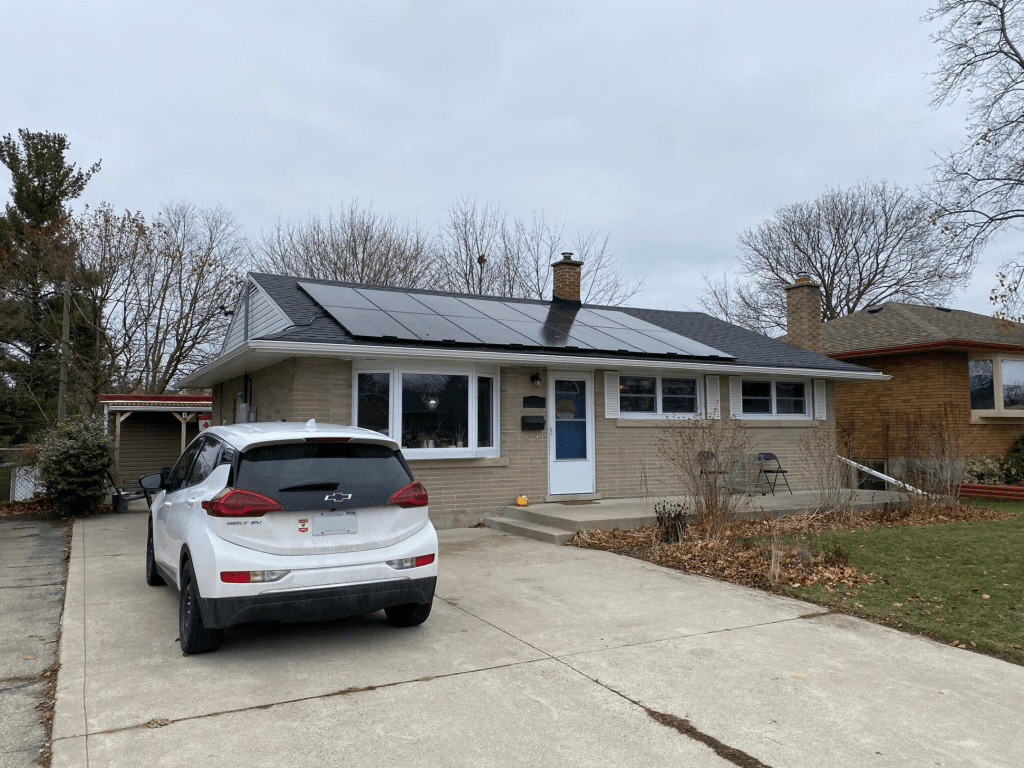

Whether you’re looking for a supplementary source of income or ways to help out family or friends who are searching for a place to live, you may want to consider redeveloping your home and/or adding new residential units to your property.

Zoning restrictions in some municipalities across Canada have started to ease, allowing for the prospect of adding units to your property, in addition to the home where you or your immediate family will continue to live.

RBC offers existing homeowners financing specifically for the purpose of adding new units to your property, such as building a laneway home, garden suite, factory constructed modular unit or other Accessory Dwelling Unit, commonly referred to as an ADU (an ADU is essentially a self-contained residential unit within the same property as a single-family home). Or, by redeveloping your current home into multiple units (think basement apartment or studio over the garage).

Of course, there are several things to consider when adding units to your property. If you’re thinking of taking advantage of the building opportunities and the financing options available but have some questions, we have answers.

6 questions answered about converting and building multiple units:

What building permits or zoning restrictions do I have to consider?

While National and Provincial legislators have encouraged the building of ADUs and eased regulations, there are still various legal and regulatory requirements that you’ll have to navigate. The zoning laws, building codes and bylaws you’ll need to abide by vary by municipality, so it’s important to understand the specific rules and regulations that are unique to where you live.

Unit size, occupancy, parking requirements, ceiling height and fire prevention measures will all be provisions to consider. Working with an experienced contractor and getting the advice of a real estate lawyer can help you navigate this process and ensure you do things right from the start.

How much does it cost to convert or build new units?

The cost to add units to your property will depend on a number of factors – most notably, whether you’re building a new structure or converting part of your home into an additional unit.

Here are some rough estimates based on industry averages – however these estimates are examples only. It is vital to obtain your own quote as costs will vary greatly by area, timing, and complexity of your project.

-

Custom garden suite

-

Single storey (645 sf) – $575-625/sf

-

Two storey (1,290 sf) – $400 $450/sf

-

Two storey + basement (2,250 sf) – $300-350/sf

-

-

Prefab garden suite (500-1,000 sf)

-

$150,000 – $200,000

-

-

Basement apartment conversion

-

$50,000 – $75,000

-

Note: 500 – 1,000 sf spaces are typically designed as one-bedroom units, most appropriate for a couple or single occupant. Two- and three-bedroom units are typically 1,000 sf or larger, offering more space for families.

Other costs to consider include:

-

Building permit fees

-

Professional fees – such as architect and engineer

-

Landscaping

-

Adding or upgrading your main services for utilities such as water and electricity

-

Interior finishes and fixtures

-

Inspections

How many units can I build on one property?

Most municipalities allow for up to three or four units on a single residential lot. However, municipalities and regions may have amended their zoning bylaws only recently, so be sure to check the updated rules for your area. The RBC Construction Mortgage program is flexible enough to assist with the financing of up to a total of six housing units on your property.

Can I build/ convert on my vacation property too, or is this only allowed on my principal residence?

Yes, you can build on the lot or redevelop your second home to allow additional housing units as well, so long as zoning bylaws of the municipality permit.

How much of a construction mortgage can I qualify for?

The amount of construction mortgage you will qualify for will depend on factors similar to those that influenced your eligibility for your primary residence mortgage – including your income, credit score and personal monthly expenses.

Under their Construction Mortgage program RBC will consider adding the projected market rent you expect to earn from the unit(s) as eligible supplementary income, which in turn can help support obtaining more of a mortgage. Speak to your RBC Mortgage Specialist to assess your personal needs.

What kinds of units can I build?

The units you can build will depend on the specific zoning bylaws of your municipality. Under the RBC Construction Mortgage Multi Units program, the following will qualify:

-

Conversion of your existing home to multiple units (i.e., a basement apartment, second floor suite, studio above the garage)

-

Standalone buildings on your property such as laneway homes or garden suites

-

Factory Constructed Mobile/Chattel Homes that are not permanently fixed to the ground but located on the land you own

-

Modular Homes that are permanently fixed to your property

If you live in a Canadian municipality that allows for the conversion or construction of additional units, there is a lot to navigate. With an in-depth knowledge of construction mortgages, RBC Mortgage Specialists can give you the support you need to guide you through the process of adding new housing units to your property, and the RBC Construction Mortgage program could be the finance solution you need to bring your ideas to life.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. Information available on the RBC Direct Investing website is intended for access by residents of Canada only, and should not be accessed from any jurisdiction outside Canada.

Share This Article