Published August 26, 2024 • 5 Min Read

TLDR

-

Young people looking to buy or rent a home are finding the housing environment in Canada challenging.

-

Aging Canadians need housing solutions that address changing mobility needs.

-

Loosening zoning laws allow homeowners to convert their properties to multiple units or add new housing to existing land.

-

You may have an opportunity to create a home for the younger or older generations of your family. Connect with a professional contractor to assess your living space.

Canada’s housing crisis is a hot topic and consistently grabbing headlines. If you have adult children looking to live on their own, or aging parents looking to downsize, housing availability is likely a major issue that’s affecting your family.

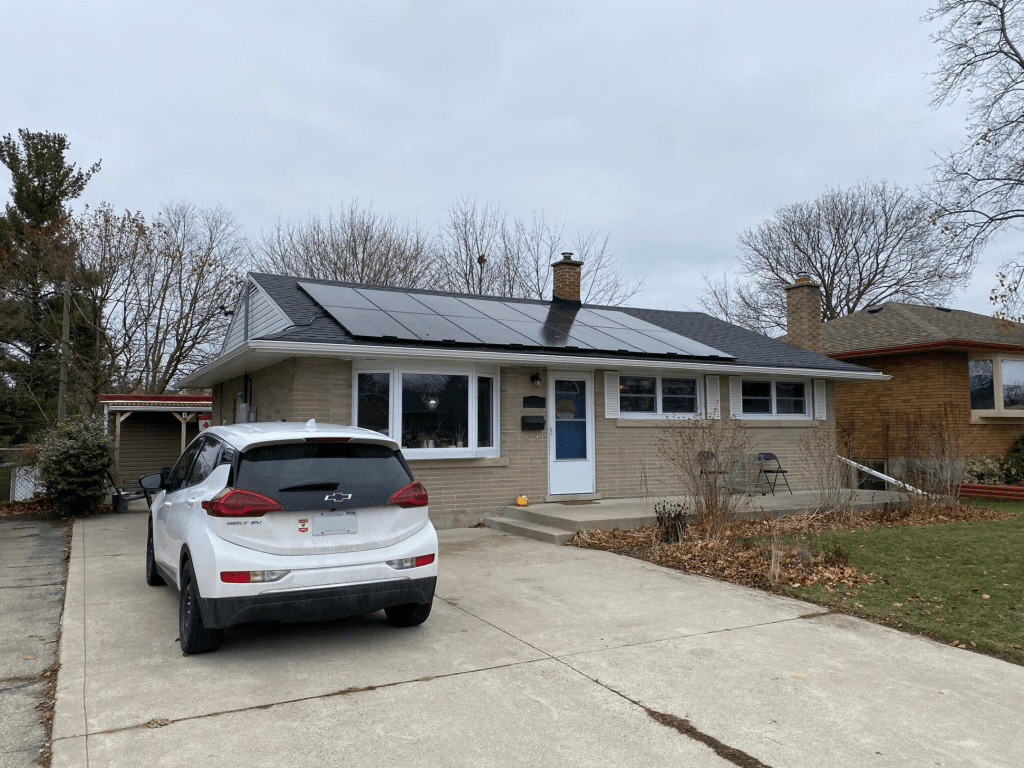

Looking for a way to help out? You may want to consider your existing home or land. It could be suitable to add new units by creating a multi-plex or a separate residential unit for family members to live. RBC offers financing to add a variety of new units on your property, such as laneway homes, garden suites, modular units, and other auxiliary dwelling units (ADUs), or to redevelop your home into a multi-unit property.

How to add housing units to your current property

Zoning laws in many municipalities across Canada have started to ease to allow homeowners to increase the number of units on their property. There are several ways you can go about adding units to yours, providing your local bylaws allow.

One is by converting or redeveloping your existing home (or your second home) into multiple units – such as adding a basement apartment, converting a second floor into a separate unit, or converting the space over your garage into a self-contained living space.

Another option is to build or otherwise add an external structure that sits on your property. In many parts of the country, garden suites are popping up in backyards of Canadian homeowners. These can be built from scratch, or come as prefabricated modular units that be placed, almost finished, on a property and completed on-site.

And if you have a property with a laneway, you can add a laneway home or convert an existing laneway garage into a residential unit.

Advantages

There are a few potential benefits to adding units to your property. Perhaps most notably, you can custom-create a space for your adult children that gives each of you privacy and suits their specific needs. Depending on how you structure the financial side of things (i.e., if you charge rent), you can nurture some financial independence as your kids are starting out on their own.

If you’re adding units for aging parents, you can create a space with current or future mobility needs in mind. Take a look at these home renovation tips for building a comfortable place to live for adults entering their older years.

Whatever generation you’re looking out for, the option of adding space to your property is considerably better for them compared to finding a rental with an external property company or landlord who can change rates and rules. More than a place to live, you can provide certainty and peace of mind.

And should your situation change, you can always rent to someone else to create rental income and boost your cash flow.

Considerations

While there are clear advantages to adding units to your property, it requires some careful planning and consideration. Here are some tips to keep in mind:

-

Create an agreement that sets ground rules, rent (if charging) and expectations. For instance, who is responsible for cutting the lawn, paying for utilities, and otherwise maintaining the space? When dealing with family, it is especially important to articulate these conditions so that everyone is on the same page and relationships stay healthy.

-

Understand the bylaws and zoning rules in your municipality. As different towns and cities in Canada have different regulations, it is important to be clear on what is allowed in your community.

-

Get familiar with building and fire codes. To create a legal apartment, it must meet several specific standards. Understanding what those are in your municipality will be key before you start construction. Engaging an experienced and local contractor who is well-versed in the codes and regulations of your area is a worthwhile early step.

-

There is a cost to converting and adding living space. Before you get started, be sure to create a budget and crunch the numbers so you’re comfortable with how the financials play out.

-

Connect with experts who can advise you. Find a general contractor your comfortable working with and engage a mortgage specialist early to get your finances options mapped out.

Whether you have adult children getting ready to leave home or you’re helping your aging parents find suitable housing for a changing lifestyle, you’re likely seeing the housing challenges first-hand. But with new zoning laws in place, the solution to these challenges could very well be in your own backyard.

The RBC Construction Mortgage program provides unique financing opportunities to help Canadian homeowners add new housing units to their property, up to a total of six units, whether through redeveloping an existing home into multiple units or building new residential structures.

And, with an in-depth knowledge of construction mortgages, RBC Mortgage Specialists can give you the support you need to guide you through the process of redeveloping your existing home or building something new.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article