Published August 16, 2024 • 5 Min Read

Recent Census data reveals that there is a significant amount of unused living space in homes across Canada–at a time when many Canadians are struggling to find a home they can afford.

TLDR

-

As a result of zoning bylaw changes, you may be able to add rental units to your property

-

Depending on your municipality, you could convert your home to multiple rental units or add new housing to your existing land

-

Rental income from tenant(s) can contribute to your cash flow, help you pay off your mortgage faster, and/or take advantage of tax credits for landlords

-

It is important to consider the responsibilities of being a landlord and the costs of construction before getting started

Homeownership costs have reached new heights in recent years. In fact, the average household needed to spend 63.5% of its income to cover the costs of owning an average home at market price in 2023. And for those who don’t own a home, getting into the market can feel more difficult than ever. This environment results in a need for more housing and solutions that can help homeowners carry the cost of ownership.

So, let’s talk about what solutions could look like. By converting your property into multiple units, you could put money in your pocket over the long-term, build home equity, and help others access housing. It maybe something worth exploring.

How to add housing units to your property

Recent changes in zoning laws across Canadian municipalities have made it simpler for homeowners to convert the property they live in into multiple residential units. While there are many variables, and different rules in each community, homeowners are being presented with unique opportunities for their properties.

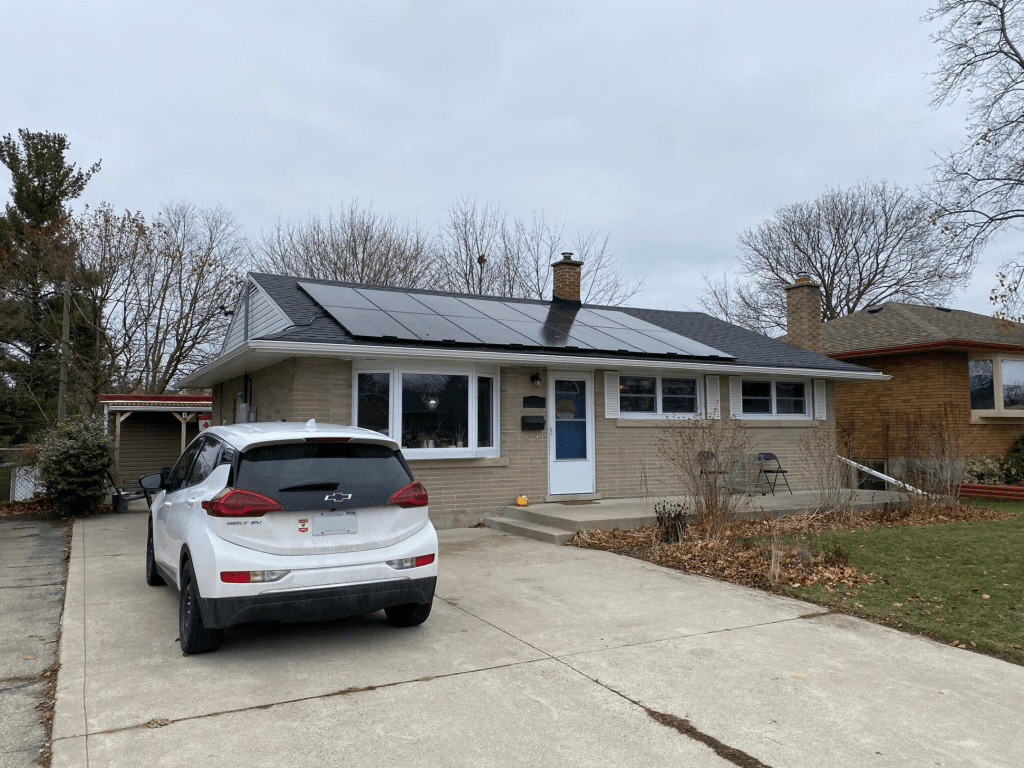

If you live in a municipality where you can add new units by redeveloping your land or your existing property, there are a few ways you can go about it. One option is to convert or retrofit your existing home into multiple units, otherwise known as a duplex, triplex, or multiplex.

Take these examples: Have your children left home, and you have some empty rooms? You could split up your property to create new separate spaces that could be rented out for additional income. Have a basement that doesn’t get much use? Consider turning it into an apartment suite and put that space to work.

Another option, which is gaining popularity in some Canadian cities, is to build an external structure that sits on your property. Such a structure can be attached or fully detached from your main home.

For example, if you have a detached garage, you may be able to convert it into a laneway home. Have unused space in your backyard? You may be able to add a garden suite.

Advantages and opportunities for homeowners

Adding new housing units to your property has the potential to make a valuable difference to your household by helping you:

-

Improve your cash flow for yourself and your family

-

Use rental income to pay off your mortgage

-

Take advantage of tax deductions that come with being a landlord

What’s more, by converting your existing home into a rental unit, you’re steps away from your tenants. This proximity allows you to take care of potential issues, keep an eye on maintenance needs and maintain property value versus managing tenants from afar (or paying for a maintenance company to do it for you).

Things to consider before you get started

While there is significant upside to adding rental units to your property, there are some important factors to consider.

Being a landlord, for one, isn’t for everyone. You’re on call 24/7 and if there’s an issue with the unit, you’re responsible for taking care of it. Keep in mind, if you’re adding multiple units, you could hire a property management company who could do the heavy lifting for you – from maintenance to repairs to finding tenants.

Another factor to think about is that if you’re living on-site, you’re sharing some of your previously private space with others. If you’re used to the privacy your single-family home has provided, this may something to get used to. Keep in mind too that there’s always the risk that the additional unit(s) will be unoccupied for a time in between tenants – so if you’re budgeting for extra cash flow, it’s best to prepare for occasional vacancy.

Perhaps the most important consideration is the cost to retrofitting, converting and/or adding units to your property. If this is something you’re seriously thinking about, be sure to create a budget, speak to an advisor, crunch the numbers and get some reliable quotes for work so you’re comfortable with how the financials play out.

An RBC Construction Mortgage can help Canadian homeowners add up to a total of 6 new housing units to their property – whether by building new units or retrofitting their existing home. Plus, with an in-depth knowledge of construction mortgages, RBC Mortgage Specialists can give you the support you need to guide you through the budgeting, mortgage and development process of re-engineering your existing home.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article