RBC Small Business Poll reveals Canadians are turning to entrepreneurship for financial security and career autonomy

Published September 26, 2023 • 4 Min Read

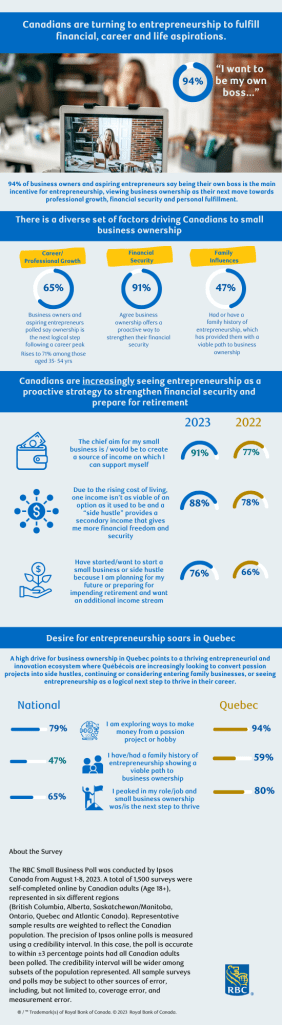

According to the recent RBC Small Business Poll, there is a diverse set of factors driving Canadians to small business ownership. 65% of business owners and aspiring entrepreneurs shared that ownership is the next logical step following a peak in their career, while 91% of them feel that business ownership offers a proactive way to strengthen their financial security and prepare for retirement. Over a third of business owners, meanwhile, indicated that starting a business mid-career is an ideal time to pursue a side venture and pursue a passion or hobby.

“The survey reveals a strong sentiment among Canadians regarding small business ownership. It’s not just about embarking on a new path; it signifies a forward-thinking approach to securing one’s financial future while advancing professionally,” says Don Ludlow, Vice President of Small Business, Partnerships & Strategy, RBC.

While Canadians are turning to entrepreneurship for various reasons, it’s clear that mid-career transitions to business ownership are becoming increasingly attractive, as the concept of being your own boss offers professional, financial and personal benefits.

Canadians are turning to entrepreneurship to fulfill financial, career and life aspirations.

94% of business owners and aspiring entrepreneurs say being their own boss is the main incentive for entrepreneurship, viewing business ownership as their next move towards professional growth, financial security and personal fulfillment.

There is a diverse set of factors driving Canadians to small business ownership

-

Career/Professional Growth

-

63% of Canadians business owners and aspiring entrepreneurs polled say ownership is the next logical step following a career peak

-

Rises to 71% in respondents among those aged 35- 54 yrs

-

-

Financial Security

-

92% agree business ownership offers a proactive way to strengthen their financial security and prepare for retirement

-

-

Family Influences

-

47% had or have a family history of entrepreneurship, which has provided them with a viable path to business ownership

-

Canadians are increasingly seeing entrepreneurship as a proactive strategy to strengthen financial security and prepare for retirement

The chief aim for my small business is / would be to create a source of income on which I can support myself:

-

2023: 91%

-

2022: 77%

Due to the rising cost of living, one income isn’t as viable of an option as it used to be and a “side hustle” provides a secondary income that gives me more financial freedom and security:

-

2023: 88%

-

2022: 78%

Have started/want to start a small business or side hustle because I am planning for my future or preparing for impending retirement and want an additional income stream

-

2023: 76%

-

2022: 56%

Desire for entrepreneurship soars in Quebec

A high drive for business ownership in Quebec points to a thriving entrepreneurial and innovation ecosystem where Québécois are increasingly looking to convert passion projects into side hustles, continuing or considering entering family businesses, or seeing entrepreneurship as a logical next step to thrive in their career.

I am exploring ways to make money from a passion project or hobby

-

National: 79%

-

Quebec: 94%

I have/had a family history of entrepreneurship showing a viable path to business ownership

-

National: 47%

-

Quebec: 59%

I peaked in my role/job and small business ownership was/is the next step to thrive

-

National: 65%

-

Quebec: 80%

About the survey

The RBC Small Business Poll was conducted by Ipsos Canada from August 1-8, 2023. A total of 1,500 surveys were self-completed online by Canadian adults (Age 18+), represented in six different regions (British Columbia, Alberta, Saskatchewan/Manitoba, Ontario, Quebec and Atlantic Canada). Representative sample results are weighted to reflect the Canadian population. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within ±3 percentage points had all Canadian adults been polled. The credibility interval will be wider among subsets of the population represented. All sample surveys and polls may be subject to other sources of error, including, but not limited to, coverage error, and measurement error.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article