TLDR

-

The U.S. has paused imposing 25% tariffs on a wide swath of Canadian exports and 10% tariffs on energy exports. Canada has also paused its proposed tariffs in response.

-

Canadian business owners have demonstrated resilience in the past. Drawing from tried-and-true tools and strategies can help weather upcoming uncertainty.

-

Business scenario planning – also known as ‘what if’ planning – can help you prepare for a range of situations in times of change.

-

Your 2025 business plan can help you stay focused and agile. Bringing it up to date is an important step.

Canadian business owners are no strangers to disruption. From pandemic shutdowns to supply chain issues, talent shortages to inflation, they’ve weathered it all. Now, with the reality setting in of possible 25% tariffs on Canadian exports to the US., businesses are bracing for more turbulence.

Will things get choppy? Likely. But you’ve got this. As a business owner, you’ve adapted, pivoted and developed resilience that has pulled you through tough times before. Weathering this next storm comes down to applying lessons learned, preparing your business for change and creating a Plan B (and maybe a Plan C) to navigate through the uncertainty ahead.

The situation: Story developing (last updated Feb 4, 2025)

On February 1st, the U.S. announced 25% tariffs on Canadian goods and 10% tariffs on Canadian energy exports imported into the U.S. In response, the Canadian government announced 25% tariffs on $155B worth of goods imported from the U.S. As of February 3rd, a day before the tariffs were due to take effect, the U.S. and Canadian governments reached an agreement that put the tariffs on hold for 30 days. Visit the Government of Canada website for a rundown of the U.S. tariffs and Canada’s response.

The RBC Economics team has released its key insights on the situation. Read A U.S.-Canada trade shock now in play: first economic takeaways for their outlook.

How can tariffs affect Canadian businesses?

As goods enter a country, they are classified by customs. Some goods have a government-mandated tariff added to the cost that the buyer must pay, essentially a sales tax, before the goods are released at point-of-entry (for example a retailer buying inventory or manufacturer securing parts to make their products). The impact of these tariffs on the Canadian economy and Canadian businesses will depend largely on how long the tariffs remain in place and what, if any, escalation occurs as a result of counter-tariffs.

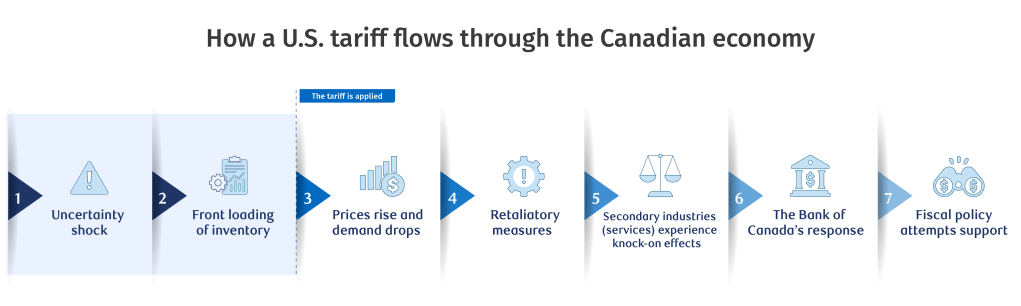

This article from RBC Economics outlines the potential impacts to Canada, the factors that influence that impact and the ways a U.S. tariff would likely flow through the economy.

Canadian businesses of all sizes will feel the impact of tariffs – not just big business. While 56% of Canadian goods exported to the U.S. come from larger businesses, 43% of exports are from small and medium-sized businesses, according to Statista.

As businesses face the uncertainty of what might come next, there are ways to prepare for the fallout.

Five things to do now to prepare your business for U.S. tariffs

1. Evaluate the risks within your industry

As the RBC Economics report outlines, trade-sensitive industries are the most vulnerable to tariffs. If your industry trades a lot relative to your production, it will be more exposed to the impact of tariffs. The automotive industry has been highlighted as the most vulnerable, with primary metal and chemical manufacturing, construction and agriculture as others high on the list.

Keep in mind, some industries may contend with indirect impact – restaurants in towns reliant on automotive manufacturing, for instance, may see fewer customers if there are layoffs or even extended uncertainty.

If your business relies on goods imported from the U.S., it’s worth reviewing the list of items covered by tariffs imposed by the Government of Canada. It appears the government is keen to give Canadian businesses time to find alternate suppliers. This last-minute reprieve also provides an opportunity to find ways to protect your business – some of the strategies outlined below can be a great starting point.

2. Examine your inventory, supply chain and customer base

Decades of free trade have led to integrated supply chains across Canadian and U.S. borders. This means goods travel back and forth throughout production lifecycles – a product may be manufactured in Canada but require parts from the U.S. – or vice versa – and may be shipped back and forth before it’s completed.

In other circumstances, companies might import supplies from China or Mexico, which may transit through the U.S. Businesses that rely on transitioning goods – even if those goods aren’t destined for the U.S. – could be affected.

How might tariffs affect your business?

If you export to the U.S.

Your products will become more expensive for your U.S. customers. This could mean they become less competitive in the U.S. market:

-

Demand may soften – especially if Americans can find a similar product for less

-

Profit margins may need to be cut

-

Cost cutting measures may be necessary

If you import from the U.S.

Retaliation tariffs will likely occur. As the prices you pay for U.S. goods rise, your margins may take a hit:

-

Owners may be forced to substitute U.S. goods and inputs

-

Profit margins may tighten if businesses absorb price increases

-

Goods imported from China or Mexico that transit through the U.S. may need to be reevaluated

3. Run business scenarios based on changing consumer demand

Scenario planning is one of the best ways to prepare your business for periods of uncertainty. Often defined as “what if” planning, business scenario planning involves making assumptions about what the future will bring to understand how different situations may affect your business.

Since there is considerable uncertainty around the tariffs, there are plenty of “what ifs” to consider.

Catch webinar re-cap: RBC Small Business Talks: Incorporating Scenario Planning into your Business Plan [Webinar Recap]

What if sales slowed? If the U.S. is one of your primary markets, you may face softer demand – especially if American consumers can find an alternative to your product for less.

Possible solutions:

-

Initiate new marketing programs to reach new client groups

-

Adjust product features to appeal to a new audience

-

Explore alternate markets

What if profits take a hit? If the cost of your inputs increases, your bottom line may be affected.

Possible solutions:

-

Revisit your market analysis and consider raising your prices

-

Look for alternate suppliers that aren’t subject to tariffs

-

Find ways to reduce your fixed and operating costs

What if there is fluctuation with the Canadian dollar? The Loonie has already dropped and further fluctuation isn’t out of the question. How do you prepare for economic circumstances beyond your control?

Possible solutions:

-

Consider raising your prices to offset the impact of a lower CAD

-

Renegotiate supplier contracts where possible

-

Look for domestic suppliers to mitigate foreign currency concerns

What if you need to take on more debt? If you need to turn to credit to shore up your cash flow, can your business absorb the repayments?

Possible solutions:

-

Look for lower-interest-rate debt, especially for longer term needs

-

Renegotiate terms with lenders, if possible

-

Meet with an advisor to discuss your options

Buy Canadian

If you’re purchasing parts, inventory, materials or other goods, consider supporting your fellow Canadian business owners whenever possible.

4. Research new revenue streams

While it may be impossible to replace the U.S. as a customer, consider ways into other markets that can help you diversify your sales.

RBC offers tools and support to help you identify potential markets, global trading partners and new supplier networks.

While you’re doing your research, consider, too, new ways to deepen your existing local customer base. Is there a different demographic set you can reach with new marketing tactics or product features? Are there new sales channels you can tap into? As you evaluate your products and your markets, it’s also a good opportunity to brainstorm ways to further innovate or differentiate your offering. This may be the time to get creative!

5 min read: Turning Point: Real Entrepreneurs Share Their Marketing Secrets for Growing a Customer Base

5. Streamline your business operations

As you potentially deal with higher input prices, softer demand and/or tighter profit margins, it’s worth looking for ways to reduce your operating costs. Can you lean into technology to automate time-consuming and expensive manual processes? Can you outsource labour? Does it make sense to downsize your office or warehouse space so rent and utilities costs go down? Read our Five Tips to Help Find Hidden Savings and Offset Rising Business Costs for more ideas.

It’s important to remember that Canada is a major market for the U.S. – in fact, this country is the #1 market for 34 U.S. states and cross-border trade sustains millions of jobs and businesses on both sides of the border. So, as a Canadian business owner, you do have some negotiating power when working with U.S. customers and suppliers. Staying informed and being positioned for change can help prepare your business for what comes next.

Read RBC CEO Dave McKay’s message on Linkedin

If you haven’t refreshed or created your 2025 business plan, this it the time to get moving! Our Business Plan Builder is a great place to start.