A recent RBC poll finds one in five grandparents today are helping to support an adult child with everyday needs like clothing and groceries. If you’re approaching retirement age amid this cost-of-living crunch, you’ll want to consider these three steps to stay on top of your finances.

Retirement years are fast approaching for the one in five people in Canada between the ages of 55 and 64 who haven’t yet stepped away from the working world. This milestone can bring a sense of achievement, excitement—and potentially, concern. That’s because lately, the high cost of living is taking a toll on would-be retiree’s finances.

For those approaching or already in retirement who have children and grandchildren, there’s an additional twist: they’re finding themselves supporting these younger family members who are struggling to keep up with their bills. A recent RBC poll that surveyed grandparents aged 55 plus found one in five (21 per cent) are currently supporting at least one adult child aged 25 plus and three in ten (30 per cent) have gifted money to their grandchildren.

In addition, seven-in-ten (70%) of these grandparents reported their adult children expect them to help cover necessary costs – such as food and clothing – and more than half (54%) are providing this money at least monthly. For the money these grandparents have given to grandchildren, support for everyday living costs (30%) is second only to education expenses (39%). Over half (54%) are providing more money due to rising costs and three in ten (29%) are worried they will need to increase the financial support they provide this year.

“As costs continue to increase, grandparents are helping out with everyday needs like rent, clothing, groceries and utility bills,” says Craig Bannon, director, Financial Planning Centre of Expertise, RBC. “It’s becoming more and more important that the money they are providing to younger family members becomes part of their financial plans.”

If you’re one of these grandparents, here are three steps to help you stay on top of your finances:

Review your finances

It’s crucial to sit down with an advisor—something too many people skip, according to Bannon. In the recent grandparent survey, only just under two in five (37 per cent) respondents said that they have reviewed their finances to see how much financial support for younger family members they could afford to provide.

An advisor can review your investments and portfolio and help you explore your options.

“Only once you have that knowledge can you really think about what strategies you might be able to put into place now or in the future to help ensure you’re on the right track, or to put yourself into a better situation,” Bannon adds.

For example, if you’re not yet retired but not managing to save enough, you could consider delaying your retirement, continuing to work part-time or scaling back on the retirement lifestyle you’ve pictured. While no one wants to hear they’re approaching a budget shortfall, it’s better than the alternative—not knowing until it’s too late.

If you’re already retired and supporting adult children and/or grandchildren, Bannon recommends you have open conversations with these family members, early and often. And include talking with an advisor. Frank conversations can help to set expectations and ensure your existing or upcoming financial support doesn’t overstrain your own resources.

Refine your decision-making skills

You can help yourself to stay on track toward your financial goals by identifying any thoughts, emotions or habits that may be steering you off-track. This can be all too common when it comes to money.

While classical economics assumes people make rational choices, this isn’t always the case. There is a field of study that investigates the psychology behind economic decision-making, and how your feelings impact it: behavioural economics. This work sheds light on how people tend to base decisions on intuition and emotions rather than facts and analysis.

Maybe, for example, you’re considering downsizing—but then some friends of yours struggle to sell their home or don’t like their new life in a condo. Now, you’re more reluctant to list—even if those friends live in a different city altogether.

Here are some ways even experienced investors can get tripped up and make decisions that won’t benefit them in the long run:

-

Anchoring bias is the tendency to stick to first impressions, making a decision that relies more heavily on information received early on, even if it’s less reliable.

-

Present bias is the tendency to focus on the here and now and place more value on smaller, immediate rewards than a potentially greater, larger reward in the future. For example, a person with present bias might prefer to have $100 today instead of waiting a week to receive $150.

-

Status quo bias is the tendency to stick with your current situation rather than leap into the unknown.

-

Loss aversion is the inclination to feel the pain of losses as more powerful than the pleasure of similar gains. For example, it may feel better for some to avoid losing $10 than to find $10.

-

Regret aversion is similar in that regret-averse people want to avoid making a decision today they will regret in the future. Often, they imagine and prepare for a future full of worst-case scenarios.

Do some of those resonate with you? Making major financial decisions is rarely easy, but it can be easier. It starts with taking the emotion out of investing. Retirees can improve their financial literacy as well as getting professional and clear-headed advice from an advisor.

“When clients go through an advice-based conversation, such as through MyAdvisor, this can help them understand what’s driving their choices and may be steering them off course from achieving their financial goals,” Bannon says.

Make a multi-part plan

If you’re nearing retirement, you’ll want to put a plan in place to help you think about three upcoming time horizons: short, medium and long.

A common misconception is that, once retired, people don’t save up for things, but that’s not true. You may be planning a big trip or a home renovation. If you have grandchildren, you may be asked to support their dreams of post-secondary education.

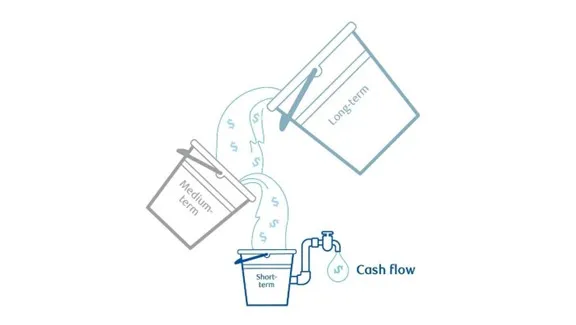

Try the “bucketing” strategy, which separates your portfolio/investments into three main time horizons or buckets:

-

The short-term or cash bucket is designed to provide you with the income you require to meet your immediate basic living and lifestyle needs, typically covering one to five years. It can be made up of savings, cash-like and short-term investments such as short-term GICs and money market funds. Your proposed projected income from these investments delivers monthly cash flow. Their conservative nature can help protect you from market fluctuations.

-

The medium-term bucket serves as a buffer between the short-term and long-term buckets, usually within a six to 10-year time frame. This is where you hold income-generating investments, which can include fixed income mutual funds that make quarterly distributions of earnings and equity mutual funds that pay regular dividends, for example. You can draw from the medium-term bucket to top up the short-term bucket or to deal with the unexpected.

-

The long-term bucket holds potentially higher-risk investments but offer higher potential for capital growth to sustain the portfolio for the years of retirement. With a 10-year-plus horizon it may cover more than a full economic cycle, giving the portfolio time to recover from most down markets or economic contractions.

The overall plan and the decisions about what types of investments to hold within each bucket are based on your income needs, life expectancy, risk tolerance and what your goals are in retirement.

Here are a few key questions to help you build the bucketing strategy that works for you:

-

How much annual income will you need from your retirement portfolio to meet your monthly cash flow needs? This will vary depending on your lifestyle and will change over the course of your retirement. For example, someone planning to travel the world the first five years of retirement will have different income needs than someone planning to stay close to home and spend time with family. Knowing your numbers is key—so keep track of your spending, including any support you give to your adult children and grandchildren.

-

How many years of cash flow do you want to have readily available? A good plan also has contingencies, such as an emergency fund for unexpected challenges. Planning for just-in-case scenarios puts a buffer in place to protect the income you require to meet your cash flow needs.

-

What are your goals in retirement and when do you want to achieve them? Revisit the bucketing strategy regularly to ensure it incorporates any changes that may have occurred in your life, your goals and the broader markets and economy. There are components that may need to be re-balanced throughout retirement. Sitting down annually with an advisor for a financial health checkup will help ensure your plan is delivering what you need.

If you’re approaching retirement in the next few years, you have a lot to look forward to—more quality time with your loved ones, discovering new passions or hobbies and embarking on exciting adventures in new or beloved places. You can best position yourself to enjoy this next phase of life through careful planning and decision-making, in partnership with an advisor.

You can book an appointment online

Mutual Funds are sold by Royal Mutual Funds Inc. (RMFI). There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Please read the Fund Facts/prospectus before investing. Mutual fund securities are not insured by the Canada Deposit Insurance Corporation. For funds other than money market funds, unit values change frequently. For money market funds, there can be no assurances that a fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in a fund will be returned to you. Past performance may not be repeated. RMFI is licensed as a financial services firm in the province of Quebec.

Financial planning services and investment advice are provided by Royal Mutual Funds Inc. (RMFI). RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.