What’s the impact of digital technologies on business today? The latest RBC Poll reveals Canadians’ perspectives.

Published April 12, 2023 • 4 Min Read

According to the recent RBC Small Business Poll, most Canadians believe digital technologies have made it easier than ever to start a business.

-

69% agree on the important role of technology in launching a venture

-

72% also feel technology helps reduce the cost of day-to-day operations, therefore facilitating growth

While nearly two-thirds feel technology can also lead to increased competition, the survey reveals that consumers and business owners alike see the benefit of ongoing digital adoption.

“Even as Canadian consumers and business owners react to recent volatility in the digital economy, they foresee a future where e-commerce and technology remain firmly embedded in the way we live, shop, and do business,” says Don Ludlow, Vice-President of Small Business, Partnerships & Strategy, RBC. “For small business owners, a steady approach to digital transformation and investing in their business can support success over the long-term, providing momentum to sustain and grow beyond the cycle.”

The survey also reveals other important metrics that signal a business’ long-term viability, including establishing a loyal customer base, the ability to innovate, consistent positive cash flow and achieving sales and growth targets.

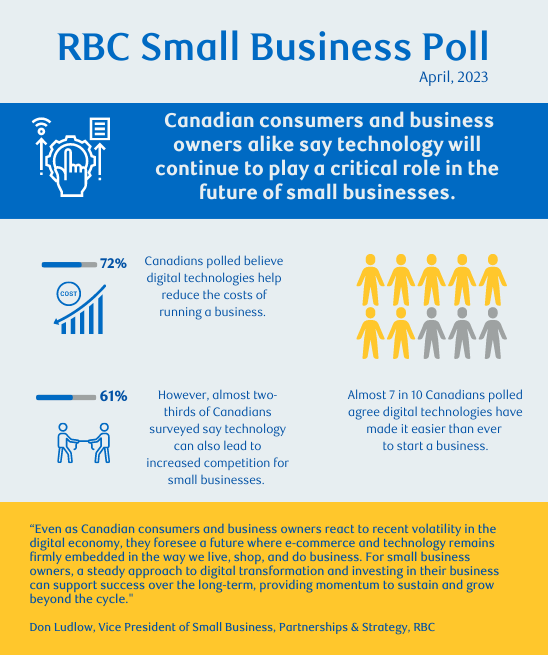

RBC Small Business Poll: April 2023

Canadian consumers and business owners alike say technology will continue to play a critical role in the future of small businesses.

72% of Canadians polled believe digital technologies help reduce the costs of running a business.

However, almost two-thirds (61%) of Canadians surveyed say technology can also increase competition for small businesses.

Almost 7 in 10 Canadians polled agree digital technologies have made it easier than ever to start a business.

“Even as Canadian consumers and business owners react to recent volatility in the digital economy, they foresee a future where e-commerce and technology remain firmly embedded in the way we live, shop, and do business. For small business owners, a steady approach to digital transformation and investing in their business can support success over the long-term, providing momentum to sustain and grow beyond the cycle.”

Don Ludlow, Vice President of Small Business, Partnerships & Strategy, RBC

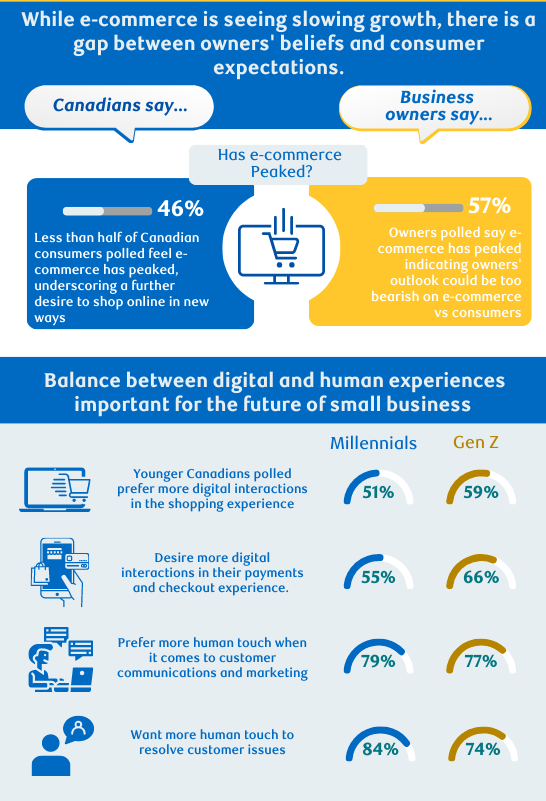

While ecommerce is seeing slowing growth, there is a gap between owners’ beliefs and consumer expectations.

Canadians say…

Less than half of Canadian consumers polled feel ecommerce has peaked, underscoring a further desire to shop online in new ways

Business owners say…

Owners polled say ecommerce has peaked indicating owners’ outlook could be too bearish on ecommerce vs consumers

Balance between digital and human experiences important for the future of small business

Younger Canadians polled prefer more digital interactions in the shopping experience:

-

Millennials 51%

-

Gen Z 59%

Desire more digital interactions in their payments and checkout experience:

-

Millennials 55%

-

Gen Z 66%

Prefer more human touch when it comes to customer communications and marketing:

-

Millennials 79%

-

Gen Z 77%

Want more human touch to resolve customer issues

-

Millennials 84%

-

Gen Z 74%

Business owners reveal critical milestones that signal long-term viability

While continuing to create digital touchpoints to deepen relationships with consumers is key to success, small business owners polled reported other critical milestones and metrics that indicate a venture is not only surviving but thriving in today’s turbulence:

-

Establishing a base of repeat/loyal customers: 63%

-

Ability to innovate/create new opportunities: 51%

-

Having funds to invest/grow your team: 48%

-

Hitting sales/growth targets for 2 con. quarters: 47%

-

Cashflow positive for 2 con. quarters: 49%

-

Ability to secure external growth funding: 42%

About the Survey

The RBC Small Business Poll was conducted by Ipsos Canada from February 17-22, 2023. A total of 1,505 surveys were self-completed online by Canadian adults (Age 18+), represented in six different regions (British Columbia, Alberta, Saskatchewan/Manitoba, Ontario, Quebec and Atlantic Canada). Representative sample results are weighted to reflect the Canadian population. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within ±3 percentage points had all Canadian adults been polled. The credibility interval will be wider among subsets of the population represented. All sample surveys and polls may be subject to other sources of error, including, but not limited to, coverage error, and measurement error.

® / ™ Trademark(s) of Royal Bank of Canada. © 2023 Royal Bank of Canada.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. Information available on the RBC Direct Investing website is intended for access by residents of Canada only, and should not be accessed from any jurisdiction outside Canada.

Share This Article