RBC Small Business Poll Finds Millennials and Gen Z Canadians are Leading a Micro-Entrepreneur Economy

Published September 27, 2022 • 2 Min Read

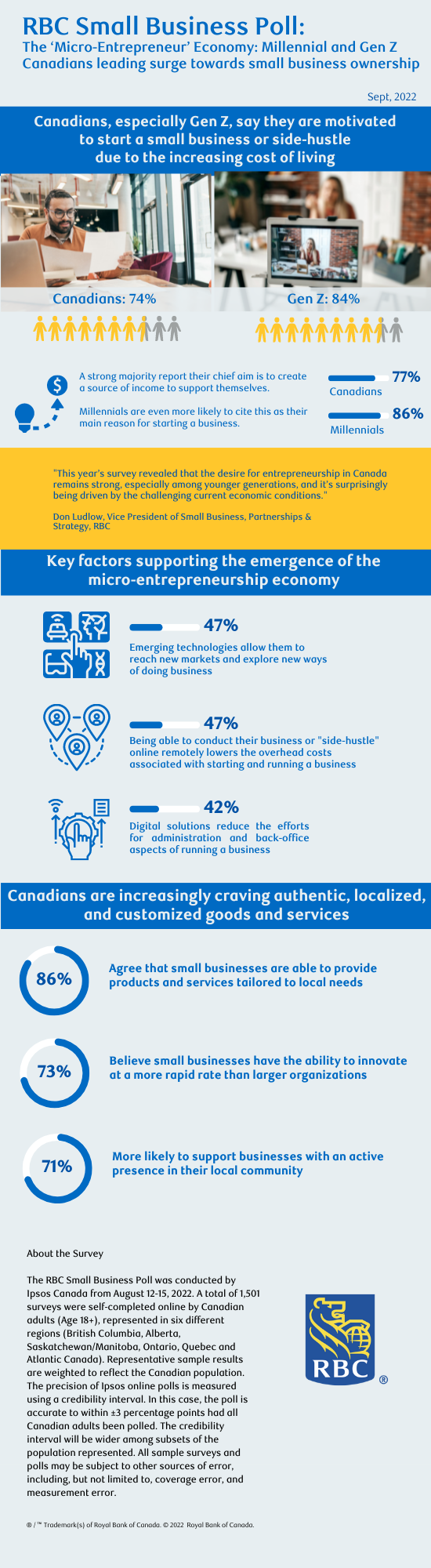

A recent RBC Small Business survey reveals that 74 per cent of Canadian small business owners and aspiring entrepreneurs are motivated to start a small business or side hustle as a result of the increased costs of living — a number that rises to 84 per cent among Generation Z participants.

For the majority of respondents (77 per cent), creating a source of income to support themselves is reported as the primary reason for starting a business. Millennials are even more likely to cite this as a reason, with 86 per cent sharing this as their primary motivation behind entrepreneurship.

“This year’s survey revealed that the desire for entrepreneurship in Canada remains strong, especially among younger generations, and it’s surprisingly being driven by the challenging current economic conditions,” says Don Ludlow, Vice-President of Small Business, Partnerships & Strategy, RBC. “Many Canadians see entrepreneurship as a golden opportunity to meet emerging consumer needs in a rapidly evolving marketplace, and take control of their financial future in these economically uncertain times.”

Fortunately, the barriers to entry to entrepreneurship are lower than ever, as new technologies and digital solutions are making it easier for Canadians to start small businesses.

The demand for such businesses also remains at an all-time high, as Canadians continue to crave authentic localized and customized goods and services that small businesses are uniquely poised to provide. In fact, the rising preference and willingness among Canadians to shop local have contributed to entrepreneurs’ overall desire to become an entrepreneur, with 39 per cent of those surveyed stating that this shift has motivated and made it easier for them to start a business.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. Information available on the RBC Direct Investing website is intended for access by residents of Canada only, and should not be accessed from any jurisdiction outside Canada.

Share This Article