Published May 27, 2022 • 9 Min Read

This article was originally published by RBC Global Asset Management.

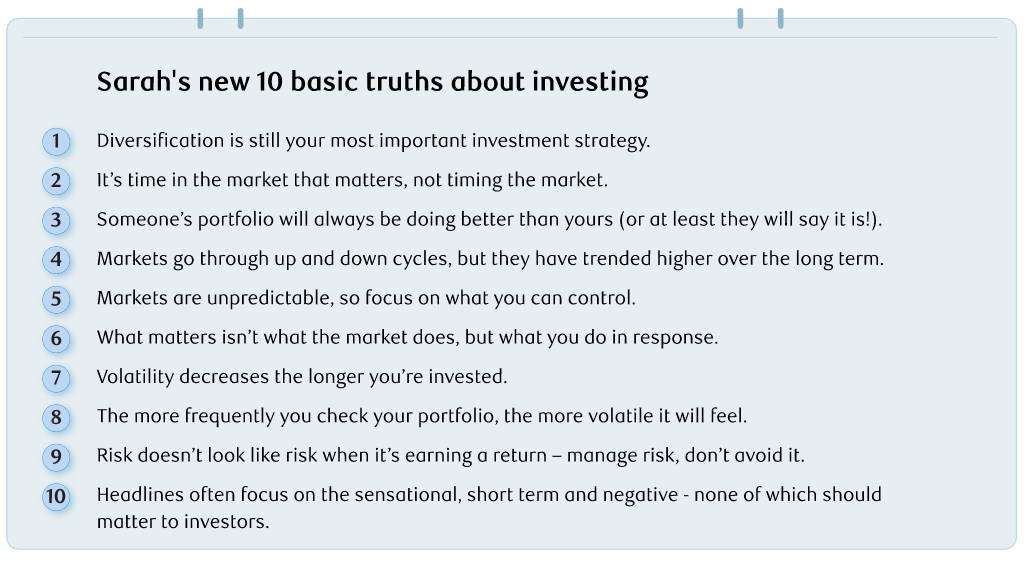

The first few months of 2022 have been tough for investors. I have been through a number of periods like this in my career and am often asked by investors for advice on what they should be doing in response. In fact, I have received this question so often in the past that I wrote an article in early 2020 about the 10 basic truths of investing that I have learned in my time as a professional investor. These touched on the importance of diversification, maintaining a long-term perspective and that time in the market is more important than timing the market.

With the recent increase in market volatility, I was discussing these investing truths again with my team. We decided that it might be time to refresh the list. While my original list still stands, I think some new truths have moved into the top 10 in the past few years.

1. Diversification is still your most important investment strategy.

This one was and still is at the top of my list! If recent history has shown us anything, it’s that diversification remains one of the best ways to manage volatility in your portfolio. Different asset classes and markets go up and down at different times, so combining them into a well-diversified portfolio will smooth out investment returns over time. This can help you manage through volatile markets like the one we have experienced so far in 2022. It will also help you stick to your long-term investment plan.

2. It’s time in the market that matters, not timing the market.

One thing I have learned is that it is extremely difficult to successfully time the market. It involves making two decisions – when to get out and when to get back in. Even if you manage to find the right time to get out of the market, it’s highly unlikely that you’ll be able to get back in at the right time. As difficult as the market drawdown was in March 2020, sitting on the sidelines meant you likely missed out on some pretty impressive gains that followed shortly after the low. Missing even a few of the strongest days in the market can have a significant impact on your overall investment returns.

3. Someone’s portfolio will always be doing better than yours (or at least they will say it is!).

People will always tell stories of a hot stock or investment tip that made them money. Meme stocks, bitcoin and NFTs all come to mind. But no discussion of investment returns or performance is meaningful without also considering the level of risk involved. To earn higher returns, you need to accept more risk or volatility. So those who are bragging about their investing success could have a very different risk tolerance or time horizon than you, or they may simply be exaggerating their results. Either way, you should not take this as an indication that your investment portfolio is inferior or that you are missing out on something.

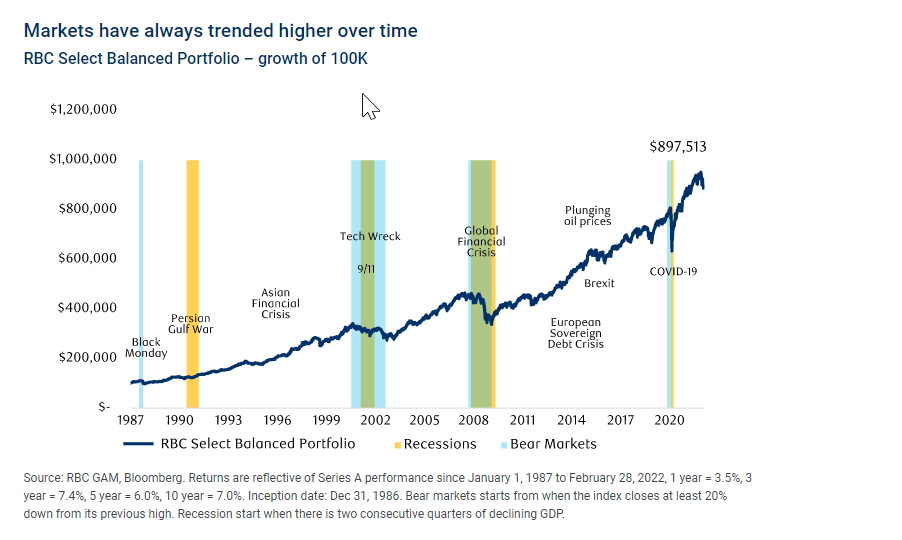

4. Markets go through up and down cycles, but they have trended higher over the long term.

Markets do not simply go up in a straight line. They experience many ups and downs, driven by a host of different factors. Some of these are fairly small and are resolved quickly; others are larger and can take longer for markets to digest. What is important to remember is that downturns have happened before, and will happen again, but they are not a reason to panic. In the past, markets have always recovered and trended higher over the long term.

5. Markets are unpredictable, so focus on what you can control.

Market downturns can be painful, especially when they follow a period of strong gains and relatively low volatility like we saw in 2021. But you have no influence over what the market is doing, so in periods like these it’s important to focus on what you can control. This includes keeping your emotions in check, staying invested and focusing on your financial goals. Over the long term, investing success has less to do with the ups and downs of markets and more to do with how you react to that volatility.

| What you can’t control | What you can control |

|---|---|

| The stock market | Your financial goals |

| Inflation | Your risk tolerance |

| Geopolitical Events | Your time horizon |

| Interest rates | How much you invest/save |

| What people say on twitter | Your emotions (sometimes) |

6. What matters isn’t what the market does, but what you do in response.

This one is an extension of #5, but it’s worth reinforcing. Being aware of how your emotions can impact your investment decisions during volatile periods can help you avoid making poorly timed changes to your portfolio (see #2). This is easier said than done, even for professional investors. Ignoring the short-term noise in markets is key. So is sticking to the solid financial plan that you put together with your advisor. It’s what you do – or rather what you don’t do – during these volatile times that can make all the difference.

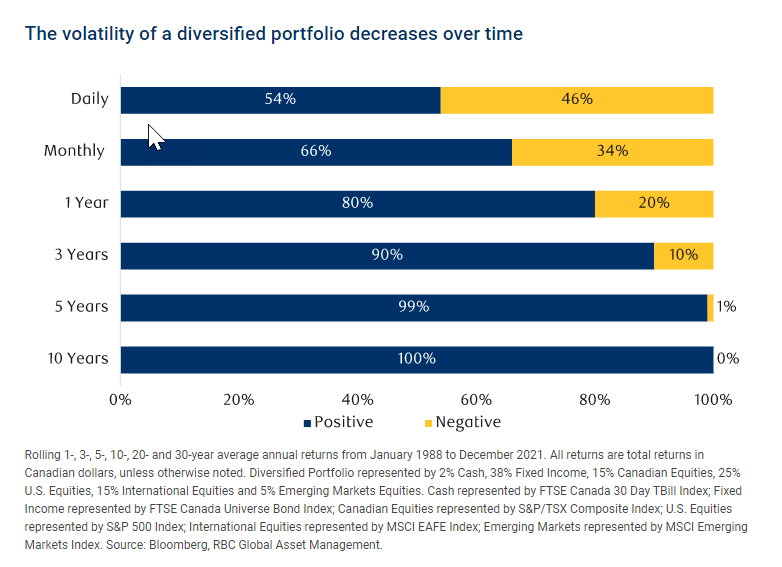

7. Volatility decreases the longer you’re invested.

All investments carry some degree of risk. If you want to earn a higher return on your investment, you have to be willing to accept more risk or volatility. If your tolerance for risk is low, then you will have to give up some return to achieve that. Understanding this relationship is a fundamental part of investing. That said, the volatility that comes from taking on more risk in your portfolio tends to decrease over time… especially if you are invested in a well-diversified portfolio (see #1).

8. The more frequently you check your portfolio, the more volatile it will feel.

It has never been easier to get up-to-date information on the status of your portfolio. But you must also remember that the more often you check it, the more volatile it will feel. That is because on a day-to-day basis, there is a 50-50 chance that it will have a positive or negative return. So watching your portfolio every day can lead you to think your investments are riskier than they really are. Instead, stay focused on your long-term investing goals and review your portfolio less frequently. This approach can help as the likelihood of seeing a positive return increases over time. It reminds me of an old TV ad: “Just set it, and forget it”!

9. Risk doesn’t look like risk when it’s earning a return — manage risk, don’t avoid it.

It’s easy to say that you are comfortable with a higher level of risk when the markets are going up. But some people quickly abandon that sentiment when markets are volatile. That’s because the fear of loss can far outweigh the anticipation of gains. Markets are unpredictable, we can’t change that fact. But you can manage the risk by diversifying your portfolio (see #1 again) and by focusing on what you can control (see #5).

10. Headlines often focus on the sensational, short term and negative — none of which should matter to investors.

There are always a variety of economic, financial or political events that can give you a reason to not invest. This year is no different. But headlines are designed to grab your attention and shouldn’t be cause for alarm or a reason to make sudden changes to your portfolio. Looking beyond the headlines and keeping the previous nine points in mind can provide you with a solid foundation for navigating markets in good times and in bad. In the end, staying on track and achieving your financial goals should be the only thing that matters.

Please consult your advisor and read the prospectus or Fund Facts document before investing. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Funds, BlueBay Funds and PH&N Funds are offered by RBC Global Asset Management Inc. and distributed through authorized dealers in Canada.

This has been provided by RBC Global Asset Management Inc. (RBC GAM) and is for informational purposes, as of the date noted only. It is not intended to provide legal, accounting, tax, investment, financial or other advice and such information should not be relied upon for providing such advice. RBC GAM takes reasonable steps to provide up-todate, accurate and reliable information, and believes the information to be so when provided. Past performance is no guarantee of future results. Interest rates, market conditions, tax rulings and other investment factors are subject to rapid change which may materially impact analysis that is included in this document. You should consult with your advisor before taking any action based upon the information contained in this document.

Information obtained from third parties is believed to be reliable but RBC GAM and its affiliates assume no responsibility for any errors or omissions or for any loss or damage suffered. RBC GAM reserves the right at any time and without notice to change, amend or cease publication of the information.

This document may contain forward-looking statements about a fund or general economic factors which are not guarantees of future performance. Forward-looking statements involve inherent risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. We caution you not to place undue reliance on these statements as a number of important factors could cause actual events or results to differ materially from those expressed or implied in any forward-looking statement. All opinions in forward-looking statements are subject to change without notice and are provided in good faith but without legal responsibility. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article