Key Banking Benefits for Canadians

For 17 years, RBC has been providing secure and easy U.S. banking to over 400,000 Canadians.

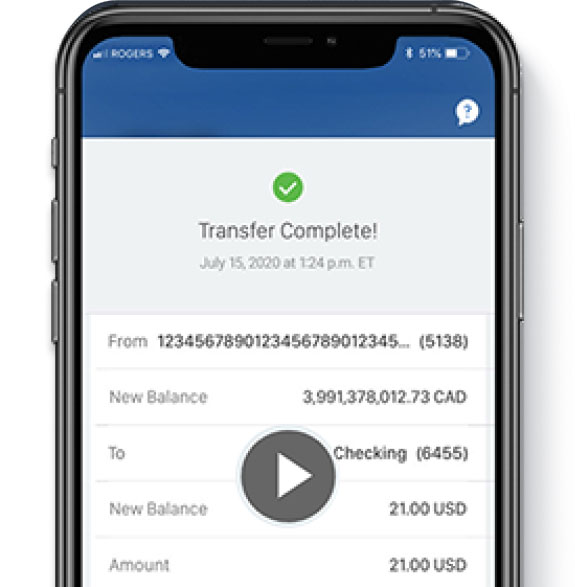

No worrying about drafts and wires. Enjoy free transfers between your RBC Royal Bank and your RBC Bank U.S. accounts - 24/7 with no delay†.

While there is no Interac e-Transfer in the States, there are several ways to send money between U.S. accounts through third party apps like Venmo, PayPal, Apple Cash and Cash App11 with a U.S. cell number. You can also transfer funds to other U.S. accounts in Online Banking.

Visit our no-fee3 ATM locator to find one near you. Use your RBC Bank Visa debit card.

Cross-Border Banking Bundle

Cross-Border Banking Bundle

U.S. Bank Account

U.S. Bank AccountDirect Checking

Make unlimited instant online exchanges and transfers† between the U.S. and Canada

Annual Fee: $0 for the first year*

- 10 debits/month; $1 per additional debit9

- Pay your U.S. credit card and other bills and deposit U.S. checks online

- $0 minimum balance; $50 deposit required to open

- Link your RBC Bank and RBC Royal Bank accounts with a single sign-in and transfer funds back and forth across the border.

- FDIC insured up to $250,000 per ownership category10.

U.S. Credit Card

U.S. Credit CardVisa Signature Black

Pay no annual fee1, earn rewards and use your Canadian credit history to qualify

Annual Fee: $01

Introductory APR: 0% for 6 months

- Avoid currency fluctuations for U.S. dollar transactions

- Roadside assistance

- Emergency cash and card replacement

- Enjoy travel perks such as signature concierge services to scheduled events and access to tickets.

- You’re covered by Visa’s Zero Liability Policy8 protecting you against unauthorized use.

Partners & Perks

Apply Online In Just 5 Minutes

It’s easy and quick.

Apply Online with Your Canadian Address

You don’t need to be a U.S. resident or have a U.S. address

Legal Disclaimer

RBC Bank, Equal Housing Lender  Member FDIC.

Member FDIC.

Legal Disclaimer

RBC Bank is RBC Bank (Georgia), National Association (“RBC Bank”), a wholly owned U.S. banking subsidiary of Royal Bank of Canada. RBC Bank is a member of the U.S. Federal Deposit Insurance Corporation (“FDIC”). U.S. deposit accounts are insured by the FDIC up to the maximum amount permissible by law. U.S. deposit accounts are not insured by the Canada Deposit Insurance Corporation (“CDIC”). U.S. banking products and services are offered and provided by RBC Bank. Canadian banking products and services are offered and provided by Royal Bank of Canada. All deposit accounts, loans and lines of credit are approved by RBC Bank. RBC Bank - 8081 Arco Corporate Dr, Suite 400. Raleigh, NC 27617. www.rbcbank.com

Legal Disclaimer*

Offer period is January 1, 2024 through October 31, 2026 (“Offer Period”). The Investment Advantage offer is available for new and existing RBC Investment Advantage (“IA”) clients. To qualify, IA client must be a new RBC Bank client, defined as an individual who has not been a primary or secondary accountholder on any RBC Bank U.S. personal checking account for the 18 months prior to the new account open date (“Eligible Personal Client”). Eligible Personal Client must open a new RBC Bank personal checking account and apply for an RBC Bank Visa Signature Black credit card on the same business day and both accounts must be opened in the name of the Eligible Personal Client before the end of the Offer Period. For eligible clients, RBC Bank will waive the personal checking monthly or annual fee for 1 year (“Offer”). Promo code IAA2019 to be entered on account application for IA clients. All other terms and conditions continue to apply on all RBC Bank products, including funding requirements and other applicable fees. Offer cannot be combined with any other RBC Bank checking offer. Employees of Royal Bank of Canada and their affiliates do not qualify for this offer. Offer is available only during the Offer Period. Offer can be changed or withdrawn at any time. Only one offer per Eligible Personal Client.

Legal Disclaimer†

Standard account charges may apply. Maximum transaction limits may apply and are subject to change. Availability of the money will depend on the time when it is sent from Royal Bank of Canada or RBC Bank. Transaction may not appear on your RBC Bank account transaction history until the following day but will reflect the date of transfer.

Legal Disclaimer1

All loans and lines of credit are subject to approval. Additional credit card transaction fees will apply as follows: Balance Transfers - Either $10 or 3% of the amount of each transfer, whichever is greater (after the end of the introductory period, the maximum fee is $99). The Balance Transfer fee has no maximum during the introductory period (first 6 monthly billing cycles); thereafter, this fee will be a maximum of $99 per Balance Transfer. Cash Advances - Either $5 or 3.5% of the amount of each Cash Advance, whichever is greater. Foreign Transaction Fee - 1.5% of the U.S. Dollar amount of the foreign transaction if the transaction is conducted in foreign currency. Platinum: 3% of the U.S. dollar amount of the transaction if the transaction is conducted in a foreign currency. Late Payment Fee - up to $35. Returned Payment Fee - up to $35. Annual Fee Visa Signature Black Plus - $75. Annual Percentage Rate is Prime Rate plus a margin between 9.99% and 16.74% for Visa Platinum and Visa Signature Accounts based on your credit worthiness. This APR will vary with the market based on the Prime Rate. Prime Rate: As published in The Wall Street Journal; current rate is 6.75% as of December 11, 2025.

Legal Disclaimer2

While there are no foreign transaction fees for purchases in the U.S. or in USD, there are foreign transaction fees for purchases conducted in foreign currency. RBC Bank Foreign Transactions: Signature: 1.5% of the U.S. dollar amount of the transaction if the transaction is conducted in a foreign currency. Platinum: 3% of the U.S. dollar amount of the transaction if the transaction is conducted in a foreign currency.

Legal Disclaimer3

There is no fee associated with accessing these ATMs but standard account charges and transaction limitations will apply. If you access ATMs other than those identified in our ATM locator (www.rbcbank.com/atms) fees may apply. During the process, you will be notified of the fee and will be required to accept the fee if you desire to complete the transaction. For fee information, refer to the Personal Schedule of Fees for details.

Legal Disclaimer4

Refer to the Avion Rewards Program Rules provided with your card for details. Avion points are not earned on balance transfers and cash advances.

Legal Disclaimer5

1.00% cash back from the RBC Bank Visa Signature Black/Visa Platinum Rewards credit cards and 1.25% cash back from the RBC Bank Visa Signature Black Plus credit card can only be redeemed with Avion points.

Legal Disclaimer6

Prime Rate: As published in The Wall Street Journal; current rate is 6.75% as of December 11, 2025.

Legal Disclaimer7

All insurance is subject to limitations and exclusions. Insurance products are offered by Visa and are not insured by the FDIC or any federal government agency and are not a deposit or other obligation of, or guaranteed by, any bank or bank affiliate.

Legal Disclaimer8

Visa's Zero Liability Policy covers U.S. issued cards only and does not apply to commercial credit cards, ATM transactions, or PIN transactions not processed by Visa. Cardholder must notify card issuer promptly of any unauthorized use. Consult issuer for additional details or visit www.rbc.com/security .

Legal Disclaimer9

Debit transaction charges do not include service charges and online fund transfers such as a transfer to a deposit account, a credit card payment and north and south transfers from an RBC Royal Bank account and RBC Bank account in the same name.

Legal Disclaimer10

Subject to the maximum extent permitted by law. Amount of coverage is based on the account balance and account ownership. For details visit www.fdic.gov.

Legal Disclaimer11

You must enroll as an RBC Bank (U.S.) client to take advantage of these exclusive offers. These offers are subject to their respective terms and conditions which can be accessed upon enrollment. Offers are subject to change and can be withdrawn at any time. Cross-Border Offers & Perks – RBC Bank . These companies are not affiliated with RBC Bank and RBC Bank is not responsible for the offers provided by each company or their respective terms and conditions.