Mobile Banking

You are on: Tabbed 1 page for Primary tabs

Bank from anywhere, anytime. The RBC® Caribbean app is available on Android‡ for all personal and business NetBank clients in St. Lucia, Antigua, Nevis and St. Vincent. The RBC Caribbean app for iOS‡ is coming soon.

Get Started now:

![]() NetBank clients: no new password to remember!

NetBank clients: no new password to remember!

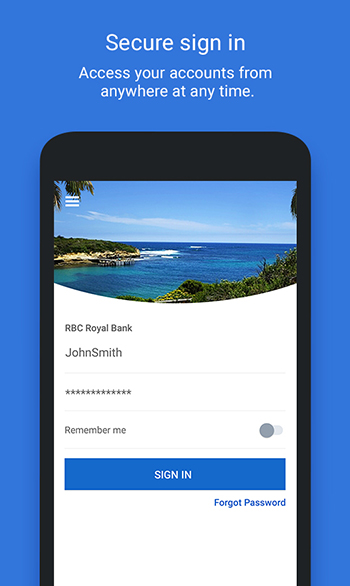

Once you get enrolled in Netbank, you will automatically have access to Mobile Banking. Please use your existing User ID and Password to sign in to the RBC Caribbean Mobile Banking app.

![]() Forgotten your NetBank Password or User ID?

Forgotten your NetBank Password or User ID?

If you have enrolled for NetBank but can't remember your Password, click on the "Forgot your password" option on the NetBank log-in page. If you have forgotten your User ID, please call our Client Contact Centre.

![]() Not an existing NetBank client?

Not an existing NetBank client?

To use the RBC Caribbean Mobile Banking app, you will first need to enroll for Online Banking. Enrol now!

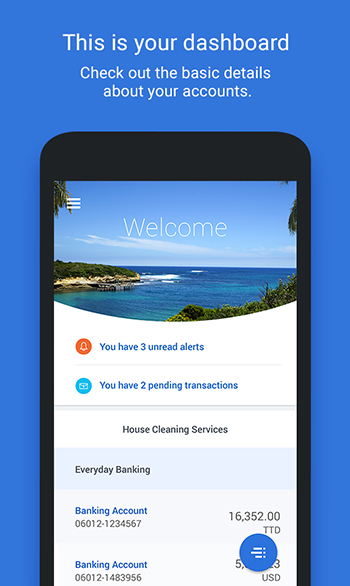

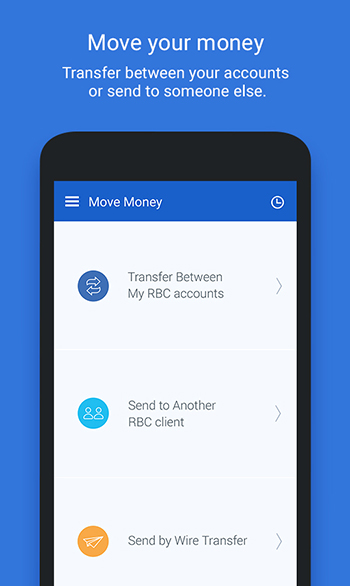

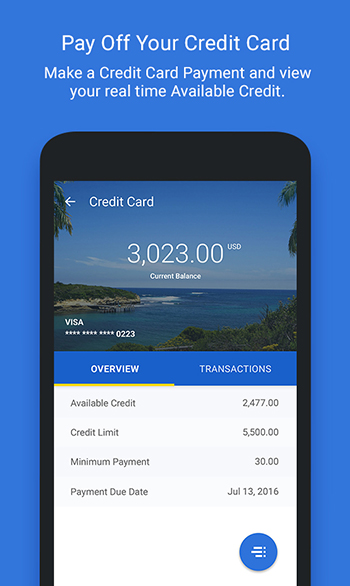

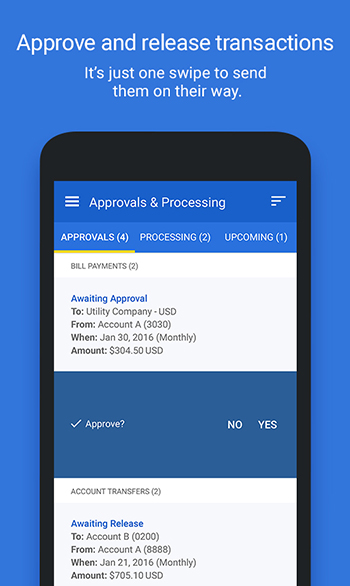

Simplicity and Convenience

Banking shouldn't be a chore. With the RBC Caribbean app, banking is easy. Want to check up on your accounts? Just sign in and see your transactions in real time. Need to pay off your Credit Card? It only takes a few seconds. You get the idea. Do what you need to do — quickly — and get on with your day.

Robust Security

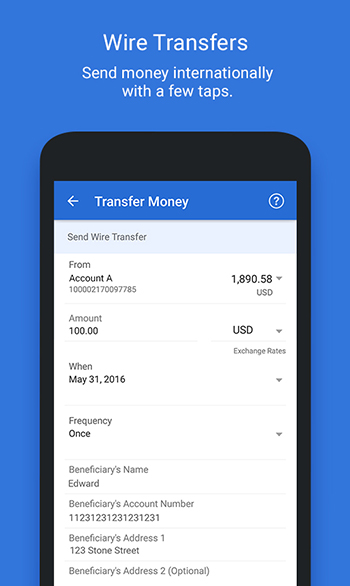

The RBC Caribbean app uses state-of-the-art encryption and never stores your personal or financial information on your device. Additionally, you’re protected by the RBC Security Guarantee for Online and Mobile Banking. So whether you’re moving money between your own accounts or sending money internationally, you can rest easy knowing that both your money and financial information are protected.

Download the app now on Google Play‡. Standard data rates may apply.

With the RBC Caribbean app you can:

|

Features |

|---|

|

|

|

|

|

|

|

|

|

|

You are on: Tabbed 2 page for Primary tabs

When you use mobile banking, your money is protected. All transactions are processed behind our firewalls and we use encryption to securely send data between your device and our servers. Additionally, your personal and financial information is never stored on your device.

It's always a good idea to follow safe mobile practices:

- Don't share your online or mobile banking passwords — or Personal Verification Questions/Answers—with anyone. And never write any of that information down.

- It's a good idea to protect your mobile device with a lock screen.

- If your device is lost or stolen, your information is still safe. But as a precaution, give us a call and let us know. And you might also want to call your mobile carrier.

- Only download the RBC® Caribbean app from the official Google Play‡ store.

- Install an antivirus app to protect your device from viruses and malware.

- Don't respond to internet pop-ups, emails or SMS requests that ask you to provide personal or banking information. We'll never ask you for this kind of information.

- Avoid using public Wi-Fi services for mobile banking. Stick to your wireless data connection.

- Review your statements regularly and report any errors within the time periods set in your account agreement.

- Always sign out of your profile when you're done using mobile banking and don't leave your device unattended.

- Contact us right away if you notice any suspicious activity.

Do you have mobile security questions?

Our mobile banking is safe, secure and helps you monitor your own accounts by giving you access to your accounts and transaction information anywhere, anytime you need to know. If you have any questions, please call our client contact centre.

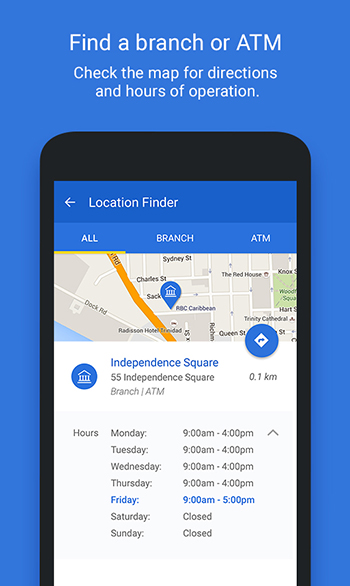

Android app permissions

Mobile banking apps interact with your device's core functions (such as its phone and GPS locator) to provide various services. When you download the RBC Caribbean app, you’ll be asked to accept permissions.

|

Permission |

Why the RBC Caribbean app needs access |

|---|---|

|

Location – Approximate location (network-based), precise location (GPS and network-based) |

Used for the Find Us (find a branch or ATM location) service |

|

Storage – Modify or delete the contents of your USB storage, read the contents of your USB storage |

Used by Maps to cache map data |

You are on: Tabbed 3 page for Primary tabs

FAQs

![]() 1. What is the RBC Caribbean mobile app?

1. What is the RBC Caribbean mobile app?

![]() 2. What do I need to use the RBC Caribbean app?

2. What do I need to use the RBC Caribbean app?

![]() 3. How do I get started with mobile banking?

3. How do I get started with mobile banking?

![]() 4. How much does the RBC Caribbean app cost?

4. How much does the RBC Caribbean app cost?

![]() 5. What language options are available?

5. What language options are available?

![]() 6. Which accounts can I access in mobile banking?

6. Which accounts can I access in mobile banking?

![]() 7. How do I reset my Password Verification Questions?

7. How do I reset my Password Verification Questions?

![]() 8. Can I store multiple usernames?

8. Can I store multiple usernames?

![]() 9. Where can I find my pending transactions?

9. Where can I find my pending transactions?

![]() 10. How do I switch between companies?

10. How do I switch between companies?

![]() 11. How do I view my joint accounts?

11. How do I view my joint accounts?

![]() 12. Do permissions carry over from NetBank?

12. Do permissions carry over from NetBank?

![]() 13. Why are some transactions in the RBC Caribbean app and not in NetBank?

13. Why are some transactions in the RBC Caribbean app and not in NetBank?

![]() 14. Can I make credit card payments?

14. Can I make credit card payments?

![]() 15. How do I send a Wire Transfer in mobile banking?

15. How do I send a Wire Transfer in mobile banking?

![]() 16. Do I need to release transfers in mobile banking?

16. Do I need to release transfers in mobile banking?

![]() 18. Why did I get signed out of mobile banking?

18. Why did I get signed out of mobile banking?

![]() 19. Why did I get locked out of mobile banking?

19. Why did I get locked out of mobile banking?

![]() 20. What happens if I get a new phone?

20. What happens if I get a new phone?

![]() 21. Who do I contact for help with mobile banking?

21. Who do I contact for help with mobile banking?

![]() 22. Can I modify a post-dated transaction?

22. Can I modify a post-dated transaction?

![]() 23. What permissions does the app need?

23. What permissions does the app need?

![]() 24. How do I uninstall the RBC Caribbean app?

24. How do I uninstall the RBC Caribbean app?

![]() 25. Is mobile synced with my online accounts?

25. Is mobile synced with my online accounts?

![]() 27. How do I sign out of mobile banking?

27. How do I sign out of mobile banking?

![]() 28. Is my password saved on the device?

28. Is my password saved on the device?

![]() 29. What happens if I lose my device?

29. What happens if I lose my device?

![]() 30. Are transactions made with mobile banking secure?

30. Are transactions made with mobile banking secure?

![]() 31. Why was I warned about using mobile banking on a rooted device?

31. Why was I warned about using mobile banking on a rooted device?

You are on: Tabbed 4 page for Primary tabs

You are on: Tabbed page 1

You are on: Tabbed page 2

You are on: Tabbed page 3

You are on: Tabbed page 4

You are on: Tabbed page 5

You are on: Tabbed page 6

You are on: Tabbed page 7

You are on: Tabbed page 8

|